PHOTO

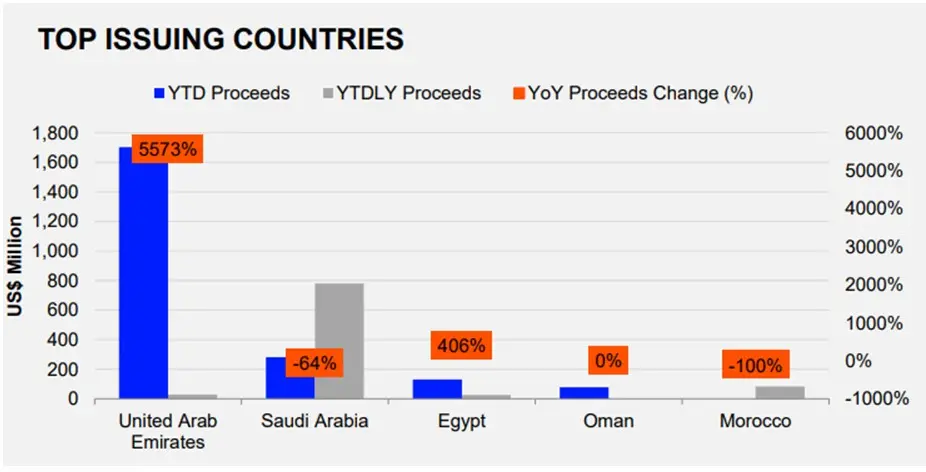

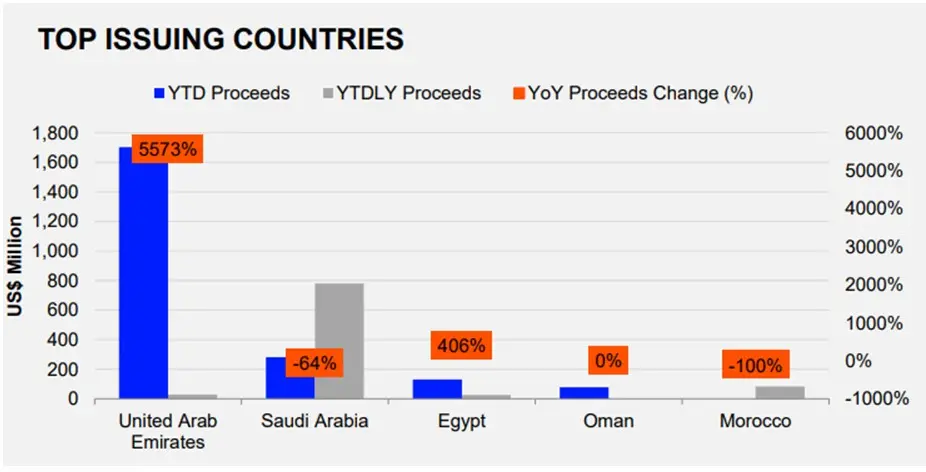

Equity and equity-related issuance in the MENA region totalled $2.1 billion during the first half of 2021 marking a 139 percent increase in proceeds and the highest total since 2018, according to Refinitiv data.

The UAE was the most active country in equity capital market (ECM) activity with $1.7 billion in proceeds raised. This compares with the just over $30 million equity and equity-related issuances in the year-ago period in the UAE.

Half of this total came from the largest equity offering of the year - the Abu Dhabi National Oil Company’s (ADNOC) convertible offering of $1.1 billion in May 2021.

ADNOC Distribution had also a follow-on private placement of 375 million shares for gross proceeds of $445 million.

Saudi Arabia saw a 64 percent year-on-year drop in issuances to nearly $800 million year to date. However, the kingdom had two initial public offerings during the period, the most by any country in the region.

One was Alkhorayef Water & Power Tech’s IPO in early March on the Saudi Arabia’s Tadawul Stock Exchange, raising $144 million.

The second was Theeb Rent-a-Car, which listed 30 percent of its shares in an IPO on Riyadh’s Tadawul exchange, raising $137.6 million.

The only other IPO in the region was by Egypt-based higher education management firm Taaleem Management Services, which raised $131 million.

The top issuing industry in MENA was energy and power, supported by the ADNOC issues. This was followed by consumer products and services.

Citibank topped the MENA Equity capital markets league table during the first half of 2021, advising on $1.4 billion in related proceeds, Refinitiv data showed.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021