PHOTO

Going by the May survey of purchasing managers across the MENA region, a rebound in corporate conditions is likely across Saudi Arabia, the UAE and Egypt.

Purchasing managers’ indices (PMIs) measure sequential shifts in activity; that is, corporations are asked whether their level of output is higher, the same or lower than the previous month (note that April was the peak lockdown period). While May surveys did demonstrate that output, new orders and employment improved modestly relative to April, they did nevertheless remain at low levels.

“Despite the phased easing in lockdown restrictions, the region is by no means out of the woods, but these economies have passed the nadir in economic contraction,” said Ehsan Khoman, Director and Head of MENA Research and Strategy at MUFG.

While for Saudi Arabia and Egypt, the non-oil private sector output fell again in May, according to IHS Markit PMI, the rate of decline eased since April. For UAE, the economy showed muted signs of recovery, and in Dubai, the economic downturn continued in May but at a slower place.

Saudi’s PMI was at 48.1 in May up from 44.4 in April, helped by slower declines in output, new work and employment since April.

Tim Moore, Economics Director at IHS Markit, which compiled the survey, said: "Business conditions in Saudi Arabia deteriorated again during May, but the speed of the downturn moderated from April's survey-record pace. New work continued to fall at a faster pace than at any time prior to the COVID-19 pandemic, with survey respondents commenting on rapid spending cutbacks among clients in response to concerns about the economic outlook."

"The change in curfew hours in May helped to lighten the impact on the UAE economy, PMI data suggests, with the headline index rising to 46.7 from a record low of 44.1 in April. However, this reading signalled that the market environment remained weak, particularly as new orders data showed another steep fall in demand," David Owen, Economist at IHS Markit said.

Input prices have been rising, prompting firms to make further cuts to staffing as sales revenues remain low. Though firms in across the region have been shedding jobs in May to minimse their losses, the fall in employment was the slowest since February.

"The Egypt PMI rose 11 points to 40.7 in May which, while signaling that the worst of the economic hit from the COVID-19 crisis may have passed, still pointed to weaker business conditions since April," Owen said.

The conversation has begun to shift towards what the next “normal” might entail and how different it will be.

In its MENA economic weekly report, MUFG said that whilst recent data and the continual rise in oil prices are certainly encouraging, the sheer velocity of the oil and virus shocks signals that the region is still in recession, though the risks are gradually subsiding.

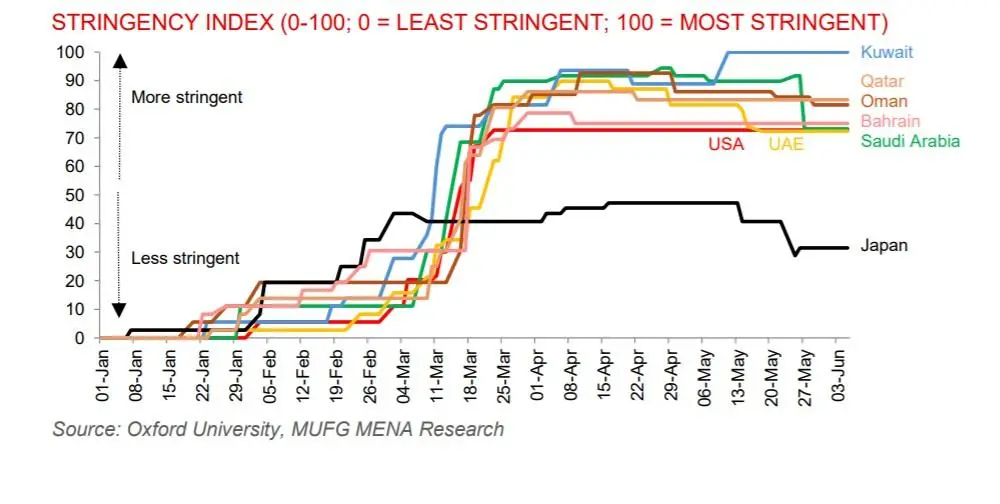

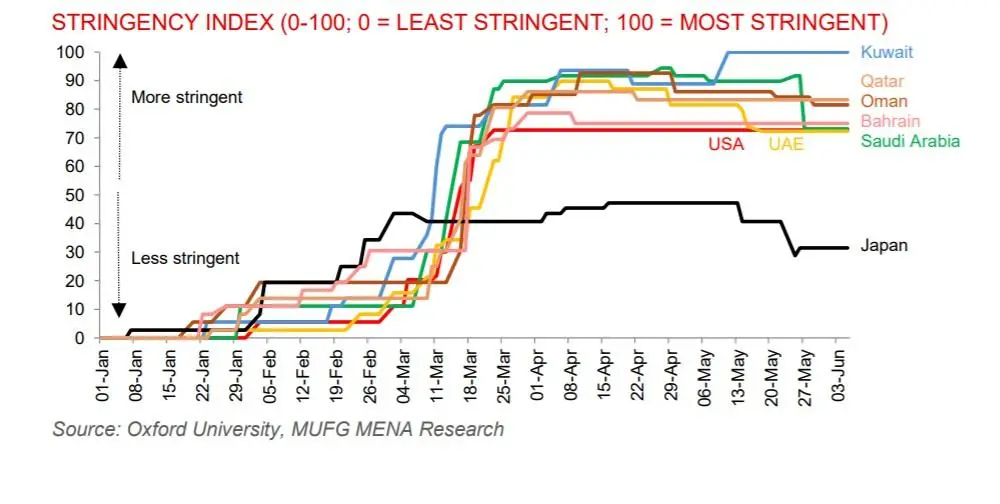

Stringency Index Source: Oxford University, MUFG.

Credit growth

As the pandemic started cratering businesses across the region, the initial policy response across was led by Central Banks, focusing creating liquidity in the financial system and support corporates to minimise the economic fallout.

According to MUFG, the regional central banks’ financial system liquidity and corporate support schemes is showing up in credit growth data.

“The UAE's $70 billion Targeted Economic Support Scheme (TESS) alongside the $26 billion stimulus provided by SAMA to the banking sector to facilitate financing both demonstrate that such actions have channelled through into a sharp rise in lending growth,” Khoman said.

The Saudi Arabian Monetary Authority (SAMA) introduced a 50 billion riyals package to support the banking sector, financial institutions and SMEs.

With massive relief measures lined up, Fitch expects pressure on banks' profitability.

According to the global ratings agency, if economic disruptions caused by the coronavirus and lower oil prices remain for longer, asset-quality problems and lower profitability will put pressure on currently adequate capital buffers. Liquidity is less of a risk as the government has already taken measures, including debt issuance, to inject deposits in the banking system.

"Whilst the precise composition and magnitude of new lending provided under these packages is unclear, the surge in credit growth suggests that the authorities' efforts to offset the economic fallout of the oil-virus shocks are bearing fruit," MUFG's Khoman noted.

(Reporting by Seban Scaria, editing by Daniel Luiz)

#PMI #MENA #ECONOMY #UAE #SAUDI

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here

© ZAWYA 2020