PHOTO

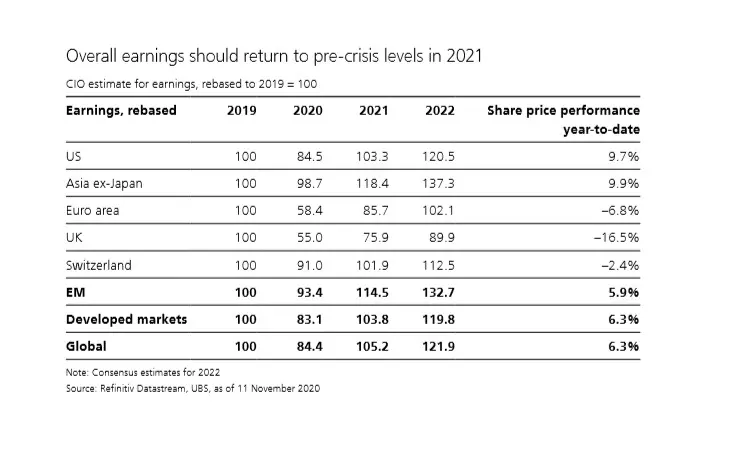

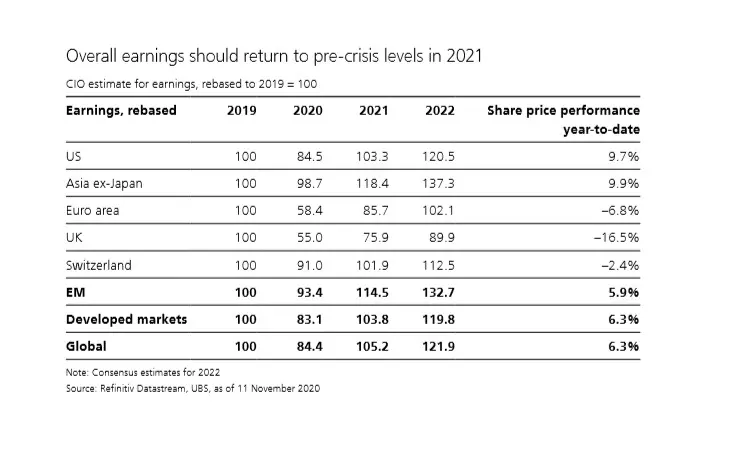

After an unprecedented year, UBS, the world’s largest wealth manager, expects economic output and corporate earnings to rebound to pre-pandemic levels in 2021, enabling economically sensitive markets and sectors to outperform.

Following encouraging early vaccine efficacy data, UBS is confident that vaccines will be widely available by the second quarter of 2021. This should help put Europe and the US on the path to a sustained recovery.

“We think the approval and rollout of a coronavirus vaccine by the second quarter, fiscal policymaking, and US voters choosing legislative gridlock will enable corporate earnings in most regions to recover to pre-pandemic levels by the end of the year,” Mark Haefele Chief Investment Officer, Global Wealth Management at UBS said.

“We expect the more economically sensitive markets and sectors, many of which underperformed in 2020, to outperform in 2021. Our preferred areas include small- and mid-caps, select financial and energy names, and the industrial and consumer discretionary sectors,” he added.

The pandemic has made our world both more digital and more local, and not all companies and individuals will be able to adapt.

“So while we think that in the short term investors can profit by investing in companies exposed to a cyclical recovery, this needs to be combined with exposure to the disruptors set to drive technological transformation over the decade ahead, including 5G, fintech, healthtech, and greentech," UBS noted in its report, Year Ahead 2021.

Diversify for the next leg

Profits underlying major equity indexes have proven surprisingly resilient through the pandemic when compared with the broader economy. This is because listed companies have a high exposure to digital, multinationals, and goods relative to services.

"Looking ahead, monetary and fiscal stimulus should continue to provide a tailwind for stocks, and we anticipate significant earnings growth as the global economy recovers. Low interest rates also continue to make equity valuations look attractive relative to bonds and cash," the report noted.

According to UBS, in 2021, investors should diversify for the next leg higher in equities by thinking global, looking for catch-up potential, and seeking long-term winners.

“Amid relatively high valuations and after outperforming global stocks in 10 of the past 11 years, US stocks will start to underperform other markets at some stage in the coming year, in our view,” the report said.

According to the UBS, the post-pandemic recovery in corporate earnings will be stronger in the more cyclically exposed Eurozone and UK markets, while valuations are more favorable in emerging markets, and Asia retains a combination of reasonable valuations, robust earnings, and secular growth.

“Investors should prepare for the year ahead by ensuring they are not overexposed to US stocks, and we recommend considering implementing hedges to US equity exposure and diversifying into markets and sectors that have potential to catch up,” it said.

Investors can retain exposure to secular growth by seeking out companies outside of the US, especially in Asia, which are exposed to key long-term trends, the report added.

Laggards to become outperformers

As economic normality starts to return, UBS expects some of the relative laggards in 2020 to become outperformers in 2021.

"Areas with the most catch-up potential, in our view, are US midcaps, EMU small- and mid-caps, select financial and energy stocks, and the industrial and consumer discretionary sectors. By contrast, we expect the earnings growth and performance of global consumer staples companies to lag in 2021, while some of the primary stay-at-home beneficiaries could also begin to underperform as conditions normalize," it said.

Too late to buy?

UBS suggests that the world economy and corporate earnings will return to pre-pandemic levels in 2021. With many broad market indexes already surpassing pre-pandemic highs in 2020, many investors are thinking whether it’s too late to buy.

“Tactically, we still think there is plenty of opportunity both in catch-up plays, and in structural winners that can continue reaching new highs. But strategically, investors should pay less attention to market timing and more to the long-term picture. So, in times of uncertainty, investors should take advantage of volatility to enter markets,” UBS said.

Assuming 6 percent annual earnings growth, earnings can be expected to be 5.7x higher over a 30-year horizon; market valuations may change over time, but rarely change by a factor of more than 5x.

According to the wealth manager, given the choice between investing immediately or waiting for stocks to get cheaper, putting money to work for the long term is usually the best choice.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020