PHOTO

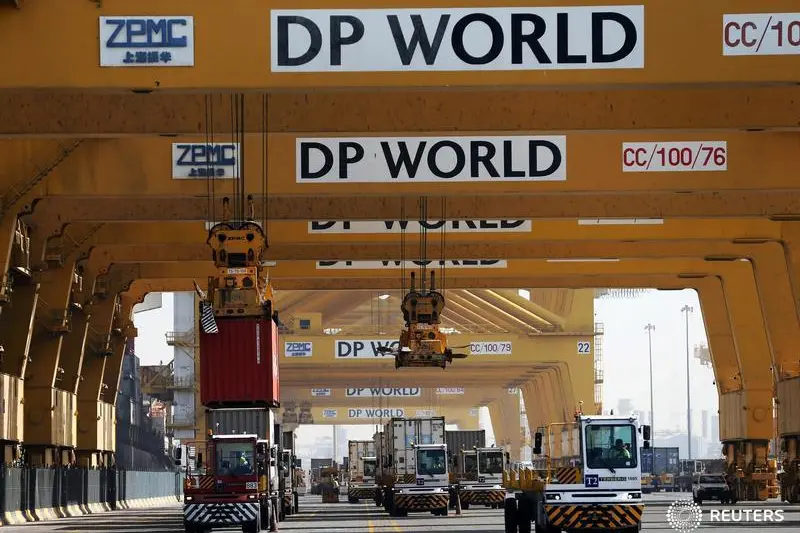

Driven by rebound in global trade, Dubai-based port operator DP World reported a 52 percent surge in net profit for the first six months of the year and said near-term outlook for the industry was positive.

Net profit for the period was $475 million compared with $313 million in the year-ago period. Revenue grew over 21 percent to $4.95 billion supported by acquisitions and strong growth in India, Australia, and UK, DP World said in a statement on Thursday.

Group chairman and CEO, Sultan Ahmed Bin Sulayem, said he was delighted with the strong set of first half results. He said the growth demonstrated “that we are in the right locations and a focus on origin and destination cargo will continue to deliver the right balance between growth and resilience,” he said.

"Overall, the near-term outlook remains positive, and while we are mindful that the Covid-19 pandemic and geopolitical uncertainty could once-again disrupt the global economic recovery, we remain positive on the medium to long-term fundamentals of the industry and DP World’s ability to continue to deliver sustainable returns.”

He said the company made progress on its capital recycling program, and this “combined with the strong operational performance, leaves us well positioned to deliver on our 2022 combined (DP World and PFZW) leverage target of less than 4x Net Debt to adjusted EBITDA (Pre IFRS16).”

Net debt to annualised adjusted EBITDA decreased to 3.5 times from 3.7 times at FY2020, the financial statement showed.

Cash from operations came in at $1.49 billion in 1H2021 compared to $1.12 billion in H1 2020.

Investment roadmap

The company plans to make further investments in key growth markets. Capital expenditure guidance for 2021 is for approximately $1.2 billion with investments planned into UAE, Canada, Jeddah (Saudi Arabia), Berbera (Somaliland), Sokhna (Egypt), Luanda (Angola), P&O Ferries, London Gateway (UK) and Callao (Peru).

For H1-2021, capex came to $687 million, invested across the existing portfolio.

Bin Sulayem said that by leveraging its infrastructure across inland logistics, ports & terminals, economic zones and marine logistics network, “DP World aims to lower inefficiencies and provide improved connectivity in fast growing trade lanes such as Asia, Middle East & Africa.”

DP World, which announced acquisitions of logistics firm Syncreon and Imperial Logistics during the first-half, said they bring value-added capabilities in fast growing markets and verticals, while also cementing long-term relationship with cargo owners.

The port operator, which reverted to being a state holding after delisting from Nasdaq Dubai stock exchange, has ports and economic zones, across the world. It reported a 29 percent fall in annual profit to $846 million in 2020.

(Writing by Brinda Darasha; editing by Seban Scaria)

This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021