PHOTO

Contractor Arabtec is set to make a return to the Egyptian market as part of a renewed push beyond its core market of the United Arab Emirates.

The company’s chief executive Hamish Tyrwhitt told Zawya in an interview in Dubai last month that the contractor had already secured a deal with a “major international developer” from the UAE in Egypt, and was also targeting work in Saudi Arabia and in Bahrain, where it is part of a joint venture building the country’s new international airport.

Until recently, Arabtec had been focusing on its home market as it executed the first part of a three-year turnaround plan that included a recapitalisation of its business, backed by its biggest shareholder, Aabar Investments. Aabar, which is part of Abu Dhabi’s state-owned Mubadala Investment Company, holds a 37.68 percent stake in Arabtec.

“If you look at what we won last year, 100 percent was in the UAE, of which over 90 percent was in Dubai,” Tyrwhitt said.

However, the company is now tendering for projects in emirates other than Dubai and Abu Dhabi, Tyrwhitt said, adding that he had also recently returned from a meeting in Saudi Arabia with Saudi Aramco.

“We've just handed over 980 villas in one of the communities for Aramco, which is an amazing project and they're very happy with it, so we're back on their bid list and looking at work,” he said.

“We've just picked up our first work in Egypt, which is the first work we've won internationally in 12 months,” he added.

Although the company de-recognised a lossmaking joint venture in the kingdom with Saudi Binladin Group from its accounts in 2016 due to a ‘discontinuation of major operations’, Arabtec has continued to operate in Saudi Arabia directly through its three main operating companies – Arabtec Construction, Target Engineering, and Emirates Falcon Electromechanical Company (Efeco). Fit-out contractor Depa – in which Arabtec owns a 24 percent stake and which Tyrwhitt also runs –secured about half of its backlog from Saudi Arabia last year, he said.

Hamish Tyrhitt, CEO of Arabtec. Image supplied by Arabtec Holding.

Selective approach

“We are looking there (Saudi), but we're looking through our operating companies and we're being very selective in what we are doing, and starting from a very low base. Bahrain and Egypt are also there.

“If you look at what's similar about Bahrain and Egypt it’s that both of the projects that we are doing are actually UAE entities. Bahrain is for Abu Dhabi (the airport is being funded by the Abu Dhabi Fund for Development), and if you look at Egypt we're following one of the major international developers from the UAE to Egypt.”

The deal would be the company’s first significant deal in Egypt since former chief executive Hasan Ismaik signed an agreement with President (then General) Abdel Fattah el-Sisi four years ago, which was meant to lead to $40 billion worth of construction projects to deliver up to one million new affordable homes. However, no subsequent contract was ever announced and Tywrhitt told Zawya via email last week that this project was not part of the company’s backlog when he was appointed as chief executive in November 2016.

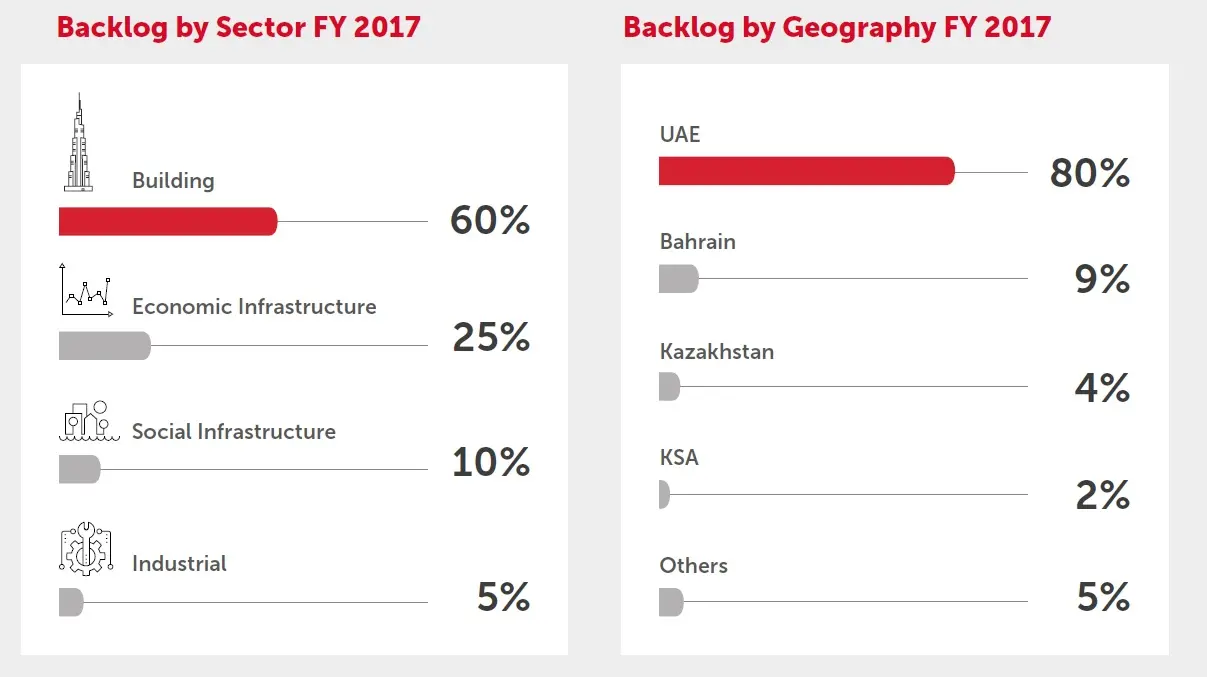

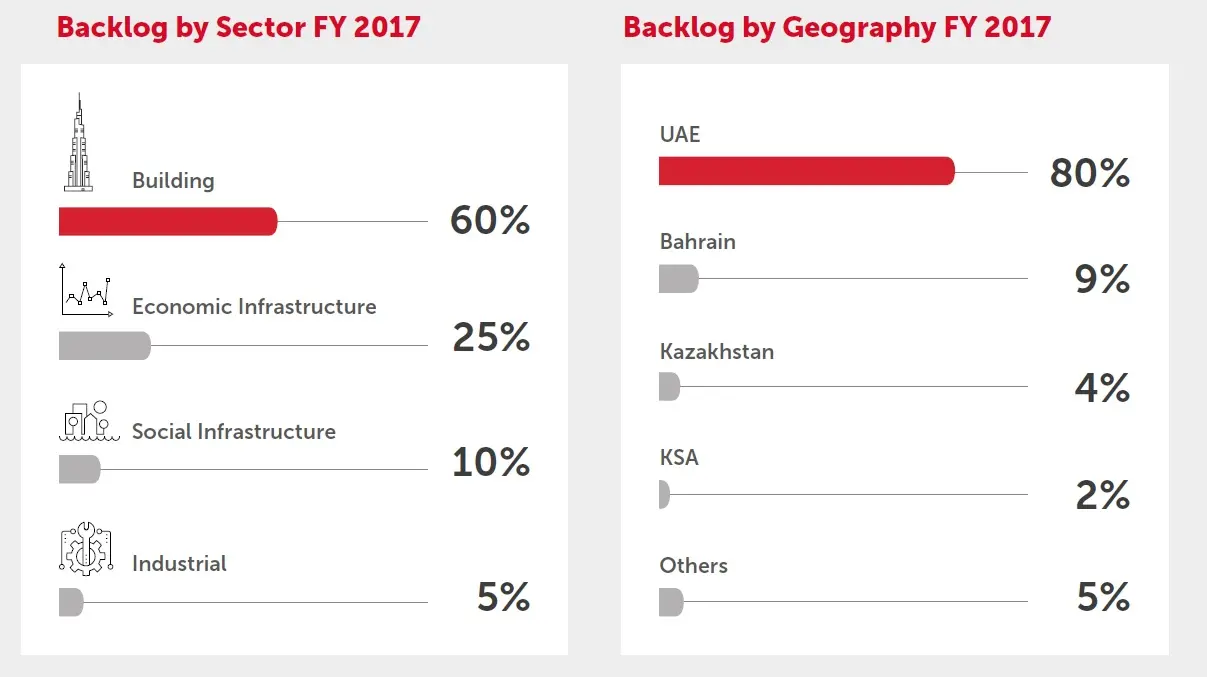

Source: Arabtec Holding Annual Report 2017

“I look at Egypt and Saudi, and both have large populations, both have resources and both have huge, historic interests and insights,” he said, arguing that each could benefit from increased tourism.

“I think Egypt is on most people's bucket list, and Saudi, with its religious and historic significance, is a mandatory trip for a huge percentage of the world's population.”

In a telephone interview with Zawya last month, Lina Hisham, an analyst with Egyptian brokerage Naeem Holding, said that only 5 percent of Arabtec’s backlog of 17.2 billion dirhams was currently generated in Egypt.

Hisham added that investment in Egypt was “soaring”, especially in real estate.

“I think they should consider it more,” she added.

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018