PHOTO

Arab Advisors Group’s new report answers the following questions:

- What is fixed voice regulatory framework in the MENA region?

- What are fixed voice penetration rates in the MENA region?

- What is fixed voice market share in terms of subscriptions and revenues?

- Which fixed voice operator tops the list in terms of revenues and subscribers in the MENA region?

- What are telecom groups’ revenues, EBITDA, and net profit in H1 2018 and 2017?

Over the past years, the telecom industry witnessed rapid changes. Cellular operators penetrated the industry and took over the fixed voice markets. Currently, those cellular operators managing fixed voice products seek to retain subscribers, fight churn and maintain, or if possible, grow revenues.

This new report “A Scorecard of Key Performance Indicators of Fixed Operators in the Arab World” was released to Arab Advisors Group’s Telecoms Strategic Research Service subscribers on March 19, 2019. This report can be purchased from Arab Advisors Group for US$ 2,250. The 27-page report, which has 24 detailed exhibits, provides a comprehensive analysis of the Key Performance Indicators (KPIs) of fixed voice operators in the Arab region. The report further provides an analysis of telecom groups’ performance in H1 2018 and 2017.

Please contact Arab Advisors Group for more details or to get a copy of the report's Table of Contents.

The purchase of this report will count towards an annual Strategic Research Service subscription.

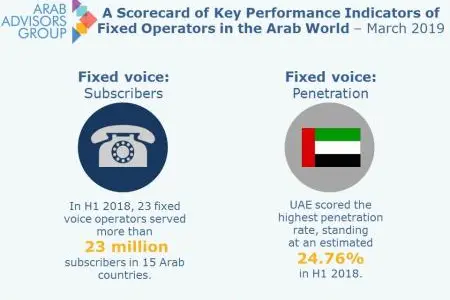

“Arab Advisors Group analyzed the performance of 23 fixed voice operators serving 15 Arab countries. By H1 2018, Telecom Egypt had the highest share of total fixed voice market among the examined operators. The report also covered the financial performance of nine telecommunications groups operating in the Arab World. Among the examined groups, Etisalat Group had the highest EBITDA and EBITDA margin by H1 2018.” Mrs. Dalia Haddad, Lead Research Analyst at Arab Advisors Group stated in the report.

“UAE’s fixed voice market is served by two Integrated Communications Providers (ICPs): Etisalat and du. According to Arab Advisors Group’s report, the UAE maintained the highest fixed voice penetration rate in H1 2018 and 2017. UAE’s fixed voice penetration rate stood at an estimated 24.76% by H1 2018.” Mrs. Haddad added.

Arab Advisors Group’s team of analysts in the region produced over 5,240 reports on the Arab World’s communications, media and financial markets. The reports can be purchased individually or received through an annual subscription to Arab Advisors Group’s (www.arabadvisors.com) Strategic Research Services (Media and Telecom).

To date, Arab Advisors Group served over 930 global and regional companies by providing reliable research analysis and forecasts of Arab communications markets to these clients. Some of our clients can be viewed on http://www.arabadvisors.com/clients/a

-Ends-

Arab Advisors Group provides reliable research, analysis and forecasts of Arab communications, media and technology markets.

Arab Advisors Group Strategic Research Services (Media and Telecoms) are annual subscriptions. The services cover nineteen countries in the Arab World: Lebanon, Syria, Jordan, Palestine, Iraq, Egypt, Sudan, Saudi Arabia, Yemen, UAE, Kuwait, Qatar, Bahrain, Oman, Libya, Tunisia, Algeria, Morocco and Mauritania.

For more information, please contact Arab Advisors Group offices. www.arabadvisors.com

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.