PHOTO

Majority of high net worth individuals (HNWIs) and business owners in the UAE are optimistic about the state of their economy and stock markets.

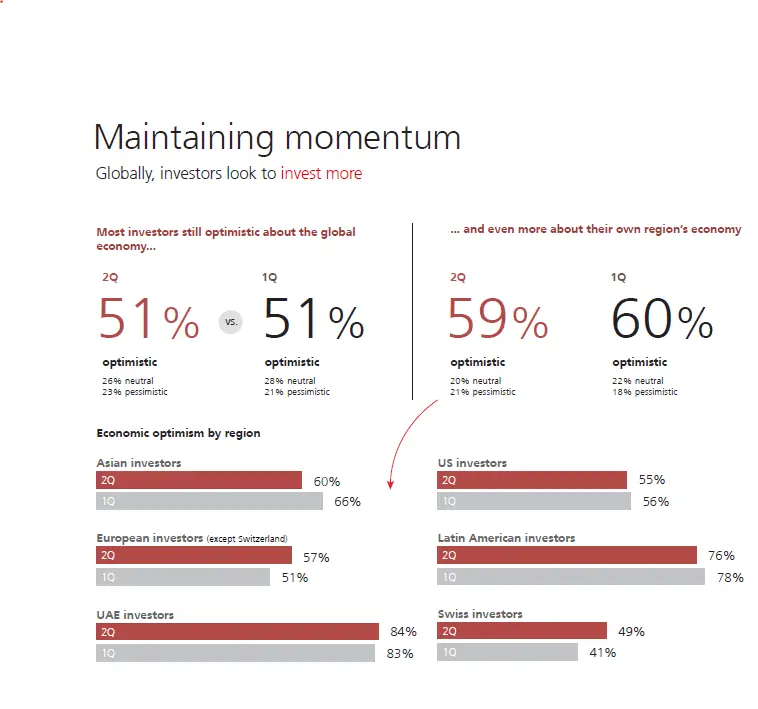

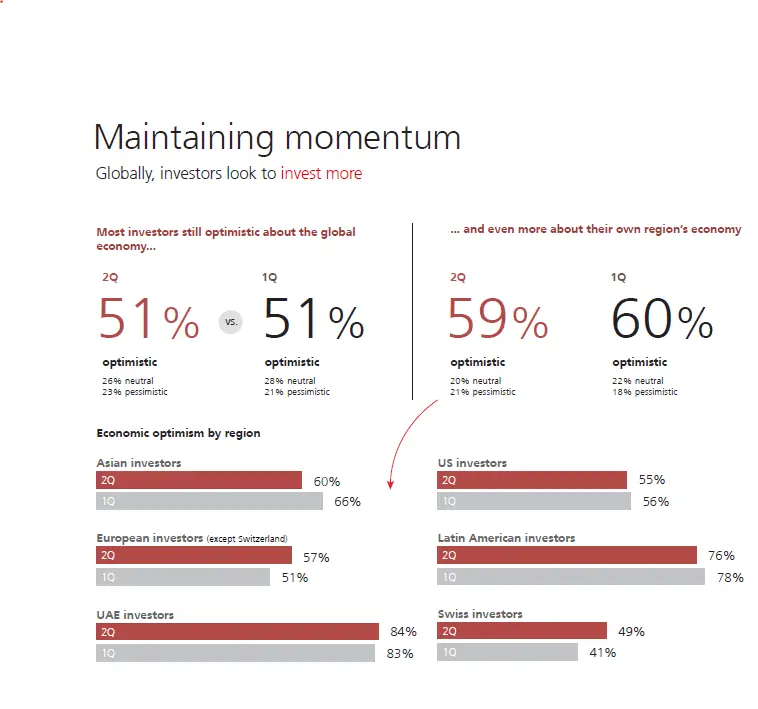

UBS Global Wealth Management's new quarterly Investor Sentiment survey notes that while 84 percent of UAE investors are positive about their economy and 81 percent are bullish on regional stocks, investors globally expressed much lower levels of optimism on their domestic economies and stock markets.

On average, 59 percent of surveyed participants are optimistic about their regional economy, while 55 percent are bullish on their regional stocks. Latin American investors were the second most bullish right after UAE investors.

Cedric Lizin, Head of UBS Wealth Management Dubai, said: "Our survey shows clearly that investors in the UAE are among the world's most optimistic when it comes to their local economy.”

“However, we believe it is now important to translate that optimism into actual market participation, as opposed to cash holdings," he added.

Despite the high optimism among UAE investors, the survey showed that their cash holdings are elevated, as nearly one-fifth of their assets (21 percent) are held in cash.

However, 48 percent of UAE investors are concerned about threats on cyber security, rising healthcare costs and terrorismin the region. .

Global investors rank their country’s politics and the global trade war as major concerns, as cited by 46 percent of the participants. While 43 percent of global investors chose cyber security as a top concern.

(Reporting by Gerard Aoun; Editing by Seban Scaria)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019