- BoD recommendation to distribute cash dividends of 25 fils per share or 25% of paid-up capital approved

- Earnings per share reached 48.5 fils for the year 2019 compared to 2018’s EPS of 14.5 fils

- Book value per share (BVPS) rose to 162 fils for 2019 compared to 2018, when it was 139 fils

Kuwait: Boursa Kuwait Securities Company (BKSC) held its E-Annual General Assembly (AGM) meeting for the year ended 31 December 2019 today, Tuesday, June 9, 2020. During the meeting, which was held virtually as part of the company’s commitment to ensuring the safety of its shareholders and in line with the preventive measures introduced by the Kuwaiti government to curb the spread of COVID-19, the Board of Directors’ (BoD) recommendation to distribute 25% of the paid-up capital, equivalent to 25 fils per share, as cash dividends was approved, with a total value of about KWD5.02 million (Five million, nineteen thousand, three hundred and ninety three Kuwaiti dinars and seven hundred and fifty fils).

The Board of Directors' report, the Auditor's report and the audited financial statements for the fiscal year ending on December 31, 2019 were all approved, as were the Corporate Governance and Audit Committee reports and the remunerations and benefits report for BOD members and Executive Management.

The AGM was chaired by Vice Chairman, Mr. Ahmed Hamad Al-Thunayan, who read the reports issued by the Kuwait Clearing Company’s electronic system regarding the quorum of attendance, the results of participation and voting included in the agenda, as well as a report of the shareholders' notes.

Shareholders agreed to grant the Board of Directors authorizarion to buy or sell the company's shares, provided they do not exceed 10%, in accordance with the provisions of Law No. 7 of 2010 and its executive regulations and amendments. Shareholders also discussed and approved the Related Parties’ Transaction Report for 2019 and the related parties’ transactions, which are proposed to be conducted during the upcoming 2020 financial year. Finally, the appointment of Mr. Badr Adel Salem Al-AbdulJader from Ernst & Young (Al-Aiban, Al-Osaimi & Partners) as the auditor for the fiscal year ending on December 31, 2020 was also approved.

Al-Thunayan said: "Boursa Kuwait recorded several achievements that contributed to its path of development and progress during 2019. Among the most prominent of these accomplishments was the completion of the stages of privatization of the company to become the first privatization project for a vital government facility, and thus becoming the first stock exchange owned by the private sector in the Middle East, with private investors owning 94% of the issued and paid-up capital of the company, thanks in no small part to its cooperation with the Capital Markets Authority.”

Al-Thunayyan also highlighted the exceptional and unprecedented performance achieved by Boursa Kuwait and hailed the commitment of the Board of Directors to support the company’s strategy, given its many achievements despite the challenges facing the market last year.

Al-Thunayan added: "Boursa Kuwait’s strategy aims to develop a strong financial market that enjoys high liquidity and credibility through the implementation of a host of developmental, structural and technical projects. The company has made great progress in its path to be a leading and prominent stock exchange in the Middle East, and a market ranked by the most prominent global indicators."

"Boursa Kuwait has fulfilled the promise it made to itself to continue to grow at an upward pace and to upgrade the country’s financial market system. As a result, the company recorded a significant jump in operating profits, while net profit increased by more than 307%.”

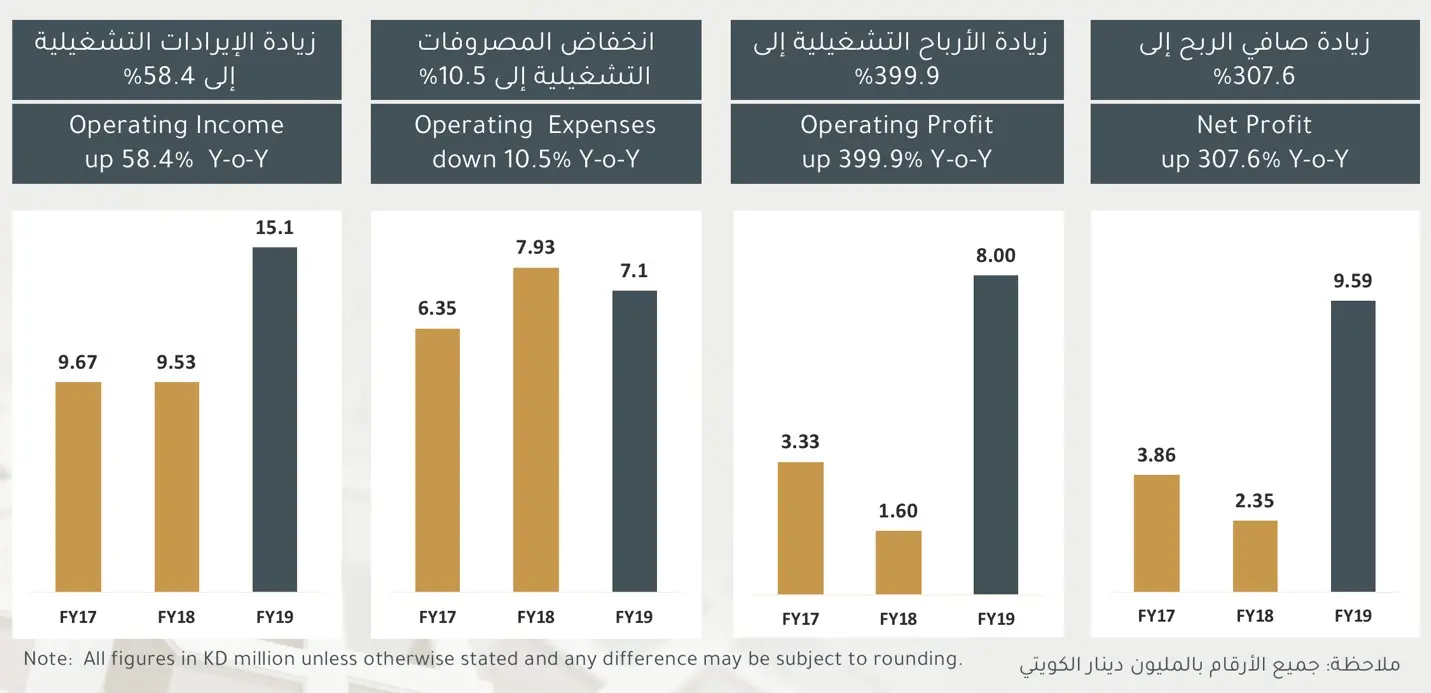

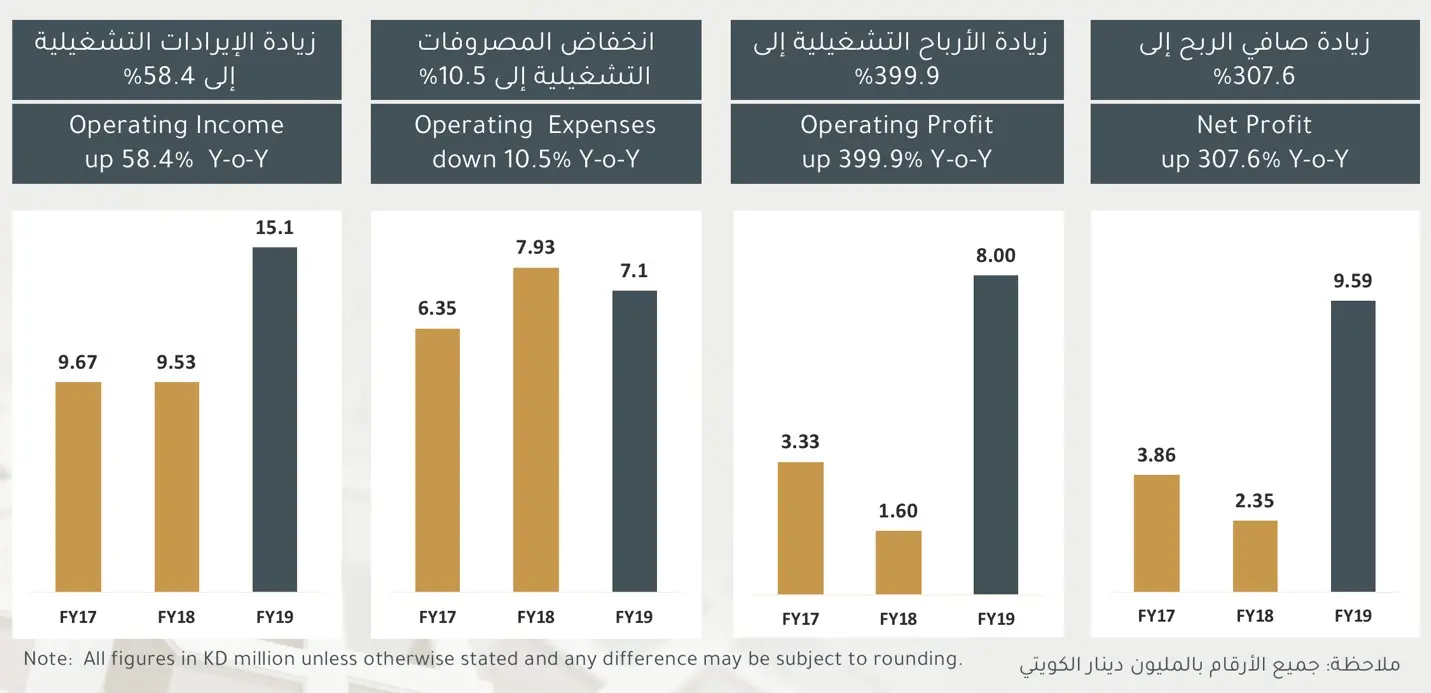

Summary of Boursa Kuwait's financial performance during the past three years:

Mr. Mohamed Saud Al-Osaimi, CEO of Boursa Kuwait, provided a detailed presentation on the company’s financial results and the performance of the stock exchange. He noted that operating income recorded an increase of 58.4% over the previous year, soaring to KWD 15.1 million from KWD 9.53 million. The change in the subscription fee structure from a capital-based basis to the average daily trading volume, the surge in trading volume due to the rise in foreign ownership in Kuwaiti banks, the annual review of Kuwaiti companies in the FTSE Russell Emerging Markets Index and the inclusion of Kuwaiti companies in the S&P index DJI for emerging markets were all major factors in this jump. In addition, the increase in trading commissions from KWD4.1 billion to KWD7.9 billion as a result of improved confidence of individual and institutional traders in the market also supported the upturn in operating income. Meanwhile, the net traded value of foreign investors reached KWD 565.442.571 .

Al-Osaimi added, “Executive Management has taken firm initiatives to control costs, which have led to positive results. Core operating expenses decreased by 10.5% from KWD7.93 million in 2018 to KWD7.1 million in 2019. Staff costs accounted for 59.5% of expenditures, with a marginal decrease of 4.4% over the previous year. The remaining major expenditures included IT maintenance, building expenditures, depreciation, and amortization, in addition to general and administrative expenses.

Al-Osaimi also indicated that the operating profit increased by 399.86% to KWD8,000,655 and the operating profit margin increased from 16.79% to 52.98%. Net profit witnessed an increase of 307.58%, to rise to KWD9.591,752 and net profit margin increased from 24.69% to 63.52%.

The auditor's report on financial results indicated that Boursa Kuwait recorded a positive financial performance supported by the company’s progress in implementing various initiatives within the framework of its Market Development plan and strict cost controls. Basic earnings per share reached 48.5 fils from the 2018 value of 14.5 fils, while the book value per share went up to 162 fils from 139 fils in 2018.

Mr. Mohamed Saud Al-Osaimi, Boursa Kuwait CEO, thanked the Board of Directors for their continuous support of the company’s strategy and operations, as well as to the members of the executive team and all the employees of Boursa Kuwait for their great efforts. He also thanked the Capital Markets Authority and the Kuwait Clearing Company for their support and continuous cooperation in developing the market.

He also reiterated the company's commitment towards growth and progress and the development of its infrastructure and work environment to international, best-in-class standards, and its effort to gain the confidence of investors, both loally and abroad by providing attractive investment opportunities.

-Ends-

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.