PHOTO

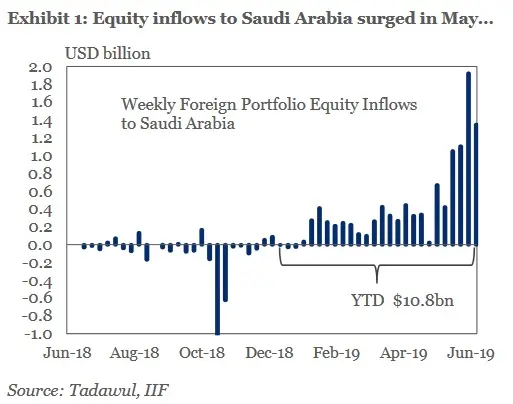

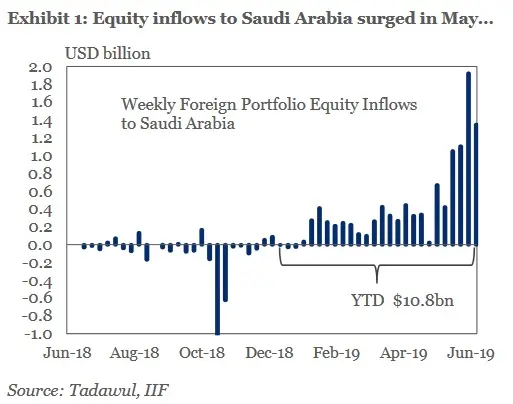

Saudi Arabia has attracted $10.8 billion worth of foreign equity investment as a result of upgrades to its stock market to emerging market status by index providers FTSE Russell and MSCI, according to a new paper.

The Institute of International Finance (IIF) said that its Capital Flows Tracker highlighted that "foreign investors have significantly increased their exposure to Saudi equities" ahead of MSCI's upgrade, which began late last month. It will take place in two tranches - in May and August. FTSE Russell's upgrade began in March and will be spread over five tranches. (Read more here).

The IIF said that May was generally a poor month for emerging market equities, with outflows of $14.7 billion experienced during the month - about half of this was money pulled from Chinese equities.

However, the Saudi market experienced $4.5 billion worth of inflows during the same month.

The IIF said that early positioning of foreign investors ahead emerging market inclusion by the big index providers had been "relatively slow" given that MSCI announced its proposed upgrade in June last year. It blamed already-high valuations, policy uncertainty and "reputational issues related to the Khashoggi incident" in October last year.

“Nonetheless, it seems that investors have shrugged off concerns in the past few months. Were it not for global trade conflict and regional security concerns, inflows to Saudi Arabia would have been even higher,” the IIF's paper said, adding that inflows into the Saudi market in the first half of 2019 have been similar to those experienced in Chinese and Indian equity markets.

“We expect Saudi Arabia to continue reaping the benefits of the capital markets reform and the inclusion in global indices,” the IIF said. It said the Saudi market will eventually be the eighth-largest component in MSCI's Emerging Markets index, with a total weighting of 2.7 percent. Given that $1.8 trillion worth of assets track the index, this suggests potential allocation of about $40 billion from investors in years to come, the paper said.

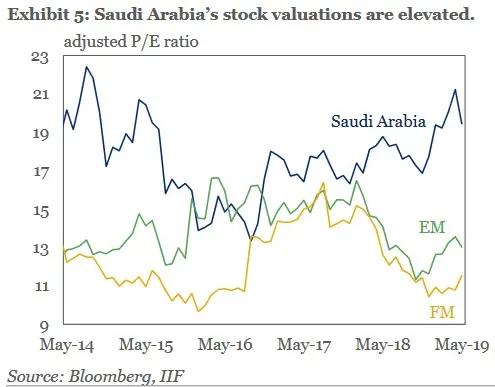

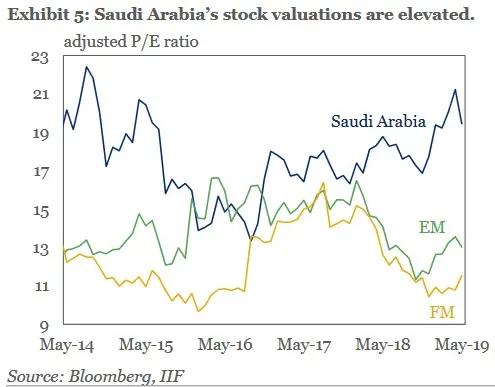

It added that valuations of Saudi stocks are currently “fair relative to historical levels, but they seem stretched on a P/E (price/earnings) basis” relative to other emerging markets. The Saudi market has increased in value by 11.66 percent so far this year, according to Eikon data, and closed at 8,739.16 on Sunday - down 1.5 percent.

A technical analysis of the market published by Kamco Research last week argued that “the current picture remains in favour of the bulls”, suggesting that break above 9,100 points could see the market move sharply higher, but warning that if it were to fall below 8,550 it could face further downward pressure.

(Writing by Michael Fahy; Editing by Mily Chakrabarty)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019