PHOTO

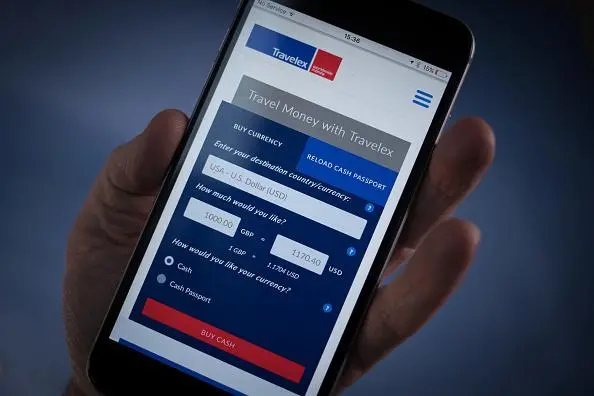

LONDON - There’s more to Finablr slashing the pricing of its initial public offering than volatile markets. The Travelex owner cut the price of its IPO by 17% on Tuesday, dampening billionaire owner B.R. Shetty’s payday. The last-minute bargain-basement pricing suggests investors might also have a problem with the $1.6 billion group’s actual business model.

Market volatility is a common catch-all excuse for an initial public offering not getting away. In Finablr’s case, market conditions have indeed not been ideal. The VIX index, which measures volatility, rose on trade tensions between the United States and China last week, while on Monday U.S. indices lost 2% to 4%. Shares in ride-hailing app Uber are down close to 20% since its long-awaited debut last week. Investors may also have been suffering from fintech fatigue following the listing of Network International and Nexi.

Yet broader market malaise can’t be the main culprit. Finablr already looked cheap relative to the sum of the parts, judging by listed peer comparators, and book-building was going badly before Uber tanked and equity markets lurched. Investors have bigger quibbles: Finablr’s annual growth rate of 7.2% since 2016 is weak compared to 13% for fellow UAE-based business Network International. Secondly, it’s still unclear why combining cross-border payments, currency exchanges and business-to-business platform infrastructure is a good thing. The company’s pitch is that there are synergies and cross-selling potential between the three. But the services they provide and the customers they serve tend to be very different.

The price cut means that Shetty will still get $200 million to reduce net debt, but the $347 million he and other minority shareholders were anticipating from selling their stakes down has shrunk to $198 million. They could potentially still get the original amount by delaying the IPO and splitting Finablr’s faster-growing, higher-margin payments business from the transfers business and holiday cash part. Pressing ahead carries a slight whiff of desperation.

CONTEXT NEWS

- Foreign exchange and payments company Finablr on Tuesday cut the price for its initial public offering to 1.75 pounds per share from a previously announced range of 2.10 to 2.60 pounds, having delayed the end of book-building by one day.

- The price cut represents a 17% reduction in the company’s market value.

- The new implied market value of the offer is 1.2 billion pounds ($1.6 billion) compared to 1.5 billion pounds ($1.9 billion) at the bottom of the range. The full deal size is comprised of primary proceeds of $200 million and $238 million secondary proceeds, including the greenshoe over-allotment option.

- A source told Reuters the closing of the book was extended because of market volatility.

(Editing by George Hay and Bob Cervi)

© Reuters News 2019