PHOTO

- Company sees robust growth across portfolio, ending first full year of executing transformation plan

- Company proposes a 43% capital increase to SAR 3.0 billion through bonus shares by primarily utilizing share premium that arose from the investment in Thakher in 2016

Riyadh: Al Tayyar Travel Group (the “Company”) (Tadawul: 1810), the Middle East’s leading technology-powered travel and tourism company, announced today its financial results for the full year ended December 31, 2018.

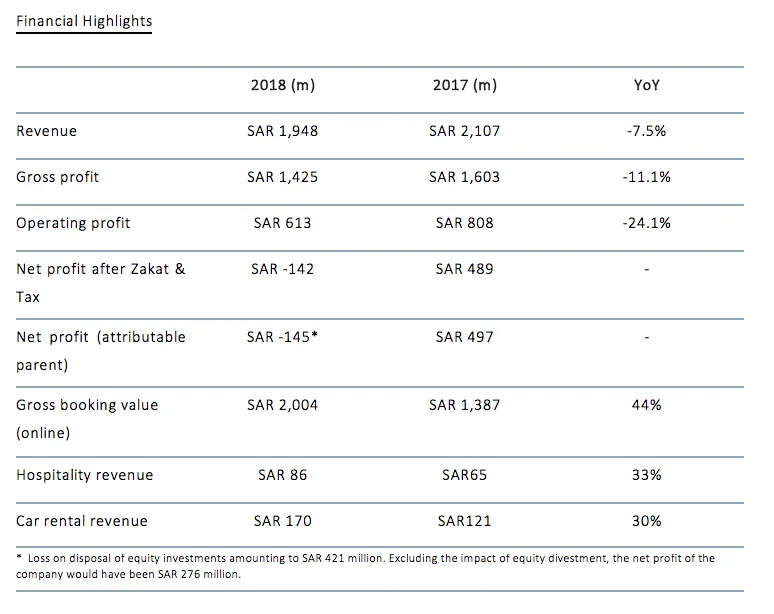

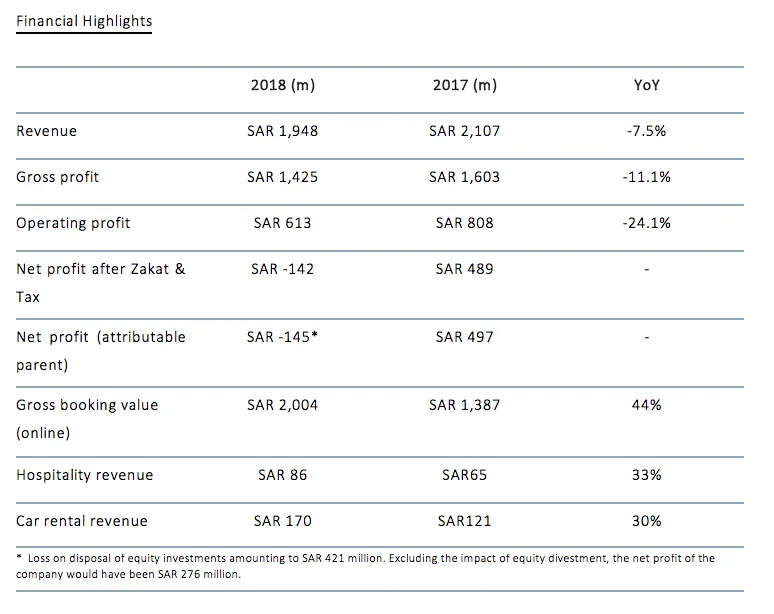

Financial Highlights

* Loss on disposal of equity investments amounting to SAR 421 million. Excluding the impact of equity divestment, the net profit of the company would have been SAR 276 million.

General Highlights

- Company is operationally profitable with a healthy cash balance to finance growth

- Revamped portfolio generating more diverse revenue streams and reducing enterprise risk

- Delivering on transformation; significant progress made in online travel, hospitality and car rental, all posting double digit growth

- Continuing to invest in big data infrastructure, product optimization, price and marketing activities, all of which are enhancing customer value

- Increasing capital to SAR 3.0 billion via 3-for-7 bonus share, per Board recommendation

Abdullah Aldawood, CEO at Al Tayyar Travel Group said:

“2018, the first full year of implementing our corporate transformation, was a period of intense activity for Al Tayyar Travel Group. Our revamped portfolio, prudent cost management and continued focus on operational excellence has enabled us to steer the business away from a dependency on specific contracts and towards increased commercial sustainability. We were operationally profitable with a solid cash flow performance and, excluding the one-off non-cash loss from a non-core equity divestment, the net profit of the company would have been SAR 276 million. Considering the significant company-wide advances we are implementing, we are pleased with the results, which are evidence that we are on the right track.

“Our core travel brand portfolio continued to deliver excellent results. Our consumer travel reached 1.8 million customers, 1 million of which were through our online platform, growing by 43% year-on-year. Our online gross booking value also grew by 44% surpassing our annual target of SAR 2 billion, and our recently launched Hajj & Umrah service has already registered commitments for 21,000 packages in 2019. This year we leveraged our technology and scale to deliver a unique, omni-channel travel and holiday solution for our online and retail consumer segment. We also integrated our operations into a scalable, flexible, user-friendly technology platform which further strengthens our customer experience. As a testament to our efforts, Almosafer is now the number 1 online travel agency in Saudi Arabia

“Looking ahead, we are committed to delivering on our transformation strategy and we anticipate making significant progress in 2019 with continued growth across all our business units, including travel, hospitality, car rental and corporate ventures. This will be complemented by an accelerated expansion of our core travel segments - consumer, government and corporate, and Hajj & Umrah - and an increasingly positive impact on our top and bottom line.”

Financial Performance

The Company posted full year revenue of SAR 1,948 million, compared to SAR 2,107 million in 2017. Revenue has become more diversified, driven by the Company’s strategic transformation efforts. Consumer travel, hospitality and car rental all posted higher year-on-year revenue, partially offsetting the significant decline in revenue from Government accounts, stemming from the conclusion of the Ministry of Higher Education contract. The Company's online gross booking value through its online platform increased by 44% to SAR 2,004 million, compared to SAR 1,387 million in 2017. This segment enjoyed rapid growth in line with the Group's strategy to focus on omni-channel travel solutions. Also, the Hospitality division recorded a strong year, with revenue up 33%, while revenue from Car Rental increased by 30%.

Gross profit was SAR 1,425 million in 2018 as compared to SAR 1,603 million in 2017. Operating profit was SAR 613 million, down 24% from 2017. The reasons for the decline were the change in product mix and increased contribution from online sales and travel services in the United Kingdom, business lines which have lower margins as compared to other segments of the Company. Additionally, the Company reported a reversal of impairment loss on trade receivables of SAR 70 million, chiefly from Government accounts.

The Company’s total operating expense in 2018 was SAR 1,418 million, representing a slight increase compared to 2017. Selling and marketing expenses increased by 12% to promote the Company’s new activities.

Net profit, excluding the non-cash loss on the divestment of the Thakher Investment and Real Estate Company of SAR 421 million, would have been SAR 276 million. Including the non-cash loss from the divestment, the Company reported net loss, attributable to the parent of the Company, of SAR 145 million in 2018, compared to a net profit of SAR 497 million in 2017. Other elements that weighed down on profit include, an impairment loss of SAR 129 million on goodwill, equity investments and other receivables and a provision recorded for Zakat of SAR 84 million, primarily to cover previous years’ reassessment.

Trade receivables were worth SAR 1.25 billion in 2018 down 28% from SAR 1.75 billion in 2017. All receivables from the Ministry of Higher Education were repaid.

The Company’s total operating expense in 2018 was SAR 776 million, representing an 8.2% decrease from 2017. Operating expenses as a percentage of revenue is 40%, which is below the international peer average.

Travel

The online division met its gross bookings target of SAR 2 billion, a year-on-year increase of 44%, and the Company is on track to reach SAR 3,750 million in gross bookings by 2020. The surge in gross bookings was powered by Almosafer, which doubled its gross bookings in 2018, and Tajawal, which continued its strong growth in the UAE. As a revenue stream, Government accounts remain an important long-term customer base, but as a percentage of gross bookings, dropped from half in 2017 to a third in 2018. Today’s group revenue is more diversified than ever before, with significantly rising contributions from consumer travel, hospitality and car rental.

In 2018, the Company strengthened its Travel offerings by signing strategic partnerships with key vendors, including an alliance with Marriott International and a promotional partnership with Dubai Tourism. The Company doubled its partnership funding in 2018 and has over 30 partnerships including tourism boards (Visit Britain and Dubai Tourism); Banks (Al Rajhi) and Payment Gateways (Visa); and local companies (Careem and GEMS Education). The division invested significantly in data infrastructure, which is enabling substantial optimisation of products, price and marketing strategies. Almosafer is now the number 1 online travel agency in Saudi Arabia. The Company has also invested heavily in marketing and new technologies to enhance market share.

Hajj & Umrah

In September 2018, the Company leveraged its supplier network to launch a promising new strategic business unit focused exclusively on Hajj & Umrah pilgrims. This was carried out in part to provide travel solutions to pilgrims across its core markets, and the broader Muslim world, and to support the government’s ambitions of growing this sector to 15 million Hajj and Umrah visitors by 2020 and 30 million by 2030. At the end of 2018, the Company had recorded commitments of 21,000 packages for 2019.

Hospitality

The Hospitality segment made solid progress in 2018, recording 33% in annual revenue growth. By the end of 2017, the Company had five operating hotels with 1,880 rooms, including the Sheraton Makkah and Movenpick Jeddah. In 2018, it announced the development of seven mid-market hotels in Jeddah, Riyadh and Taif, adding another 1,000 plus rooms to its portfolio. Construction is underway and the hotels are due to be completed between 2020 and 2021. As per our exclusive master franchise agreement they will be operated under the Choice brand. The Company is capitalising on the high-demand for affordable, mid-market rooms and service by increasing its footprint in the sector. The division provides the Company with steady cash flow and has a book value of SAR 3.5 billion.

Car Rentals

The Company’s car rental business also made solid progress in 2018. The business unit recorded revenue growth of 30% to reach SAR 170 million. It also doubled its fleet to 7,000 vehicles in 2018 and operates currently across 14 cities and all major airports across the Kingdom.

Corporate Ventures

The Company sold its stake in Thakher Investment & Real Estate Development for a total cash value of SAR 377.4 million. The sale removes a significant long-term capital-intensive project from the Company’s book and allows the Company to focus on its core business. The Company is reinvesting the proceeds into the business, as part of a broader capital allocation programme. In the UK, Portman Group’s gross bookings exceeded SAR 2.5 billion in 2018. The Company’s investment unit continues to manage a portfolio of other ventures that carry significant upside potential. These investments include the leading MENA-based car-hailing app Careem.

-Ends-

Contact

Al Tayyar Group

Talal Al-Hathal,

Head of Investor Relations

t: +966 11 2909299

e: talal.alhathal@altayyargroup.com

Brunswick Group

Jade Mamarbachi / Jamil Fahmy

t: +971 50 6003829 / +971 56 9940847

e: altayyar@brunswickgroup.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.