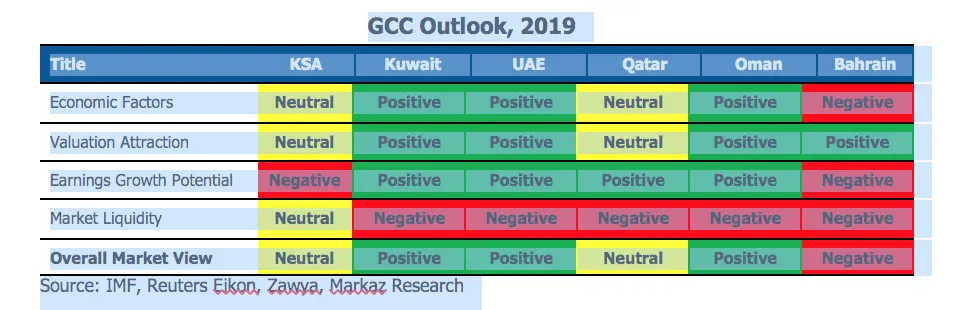

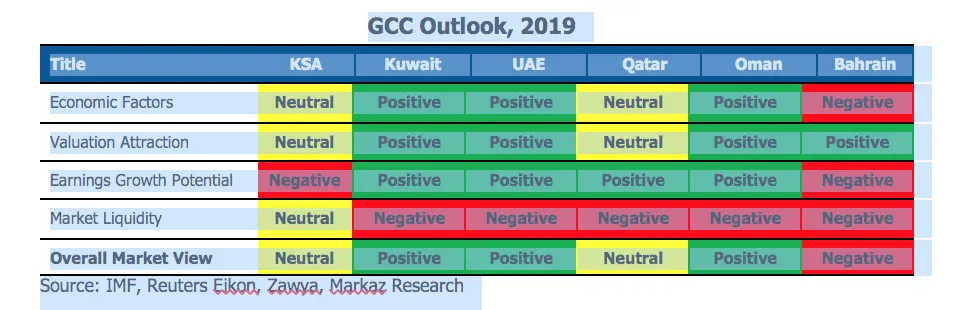

Kuwait: Kuwait Financial Centre “Markaz” recently released its outlook on GCC markets for the full year of 2019. In this research report, Markaz analyses the performance of GCC stock markets in 2018 and provides an outlook for 2019 based on a four-force framework that includes economic outlook, corporate earnings potential, valuation attraction, and market liquidity, for each individual country.

Amidst muted growth expectations in global markets, economic outlook for the GCC region as a whole remains positive, as the surge in oil revenues and fiscal reforms of past years will provide the necessary cushion for GCC countries to support economic growth through capital expenditure. Although the recovery in oil prices did not last the entirety of the year, GCC economies witnessed a sizeable increase in oil revenues. Their fiscal and external balances started to recover after three lacklustre years with only Bahrain and Oman running twin deficits in 2018. With the exception of Bahrain, where there is weakness in government finances, economic factors remain largely favourable for other GCC countries.

Kuwait – Positive

Kuwait continued to be a positive performer on the back of strong economic reforms and banking performance. Earlier in 2018, Boursa Kuwait announced that it has officially assumed responsibility for the management of all Kuwait Stock Exchange’s activities. The market has been subsequently divided into three segments designed to incentivize companies to improve liquidity and transparency. Moreover, it launched an over-the-counter trading platform, becoming the first Arabian Gulf exchange to offer stocks of unlisted companies. Due to the positive reforms undertaken by Boursa Kuwait, Kuwait was upgraded to emerging market status by FTSE Russell’s index in September, 2017. Investors are now eagerly waiting for the Annual Market Classification Review by global index provider MSCI, as it will consider reclassifying Kuwait from Frontier Market to Emerging Market status in 2019. The index inclusion is expected to create a fund inflow of close to USD 3-6 billion into the stock market. This has created a positive sentiment for the country among investors who have helped push the yearly gains of Kuwait to 7.8% for 2018 as it continues it momentum from 2017.

Corporate earnings have seen a growth of 8.5% in Q3 of 2018 when compared to the same period last year. The Banking index, which accounts for nearly 50% of the overall index composition, saw a growth of over 10% in 2018. Boubyan bank and National Bank of Kuwait were the top performing blue chips with price growths of 35% and 20% respectively. The rise in personal loan limits by the Central Bank of Kuwait, coupled with increasing the level of supervision on high values loans and putting a leash on speculative lending, would help boost the dwindling credit growth in the country and strengthen its financial health.

In terms of valuation, Kuwait is trading at a Price-to-Earnings (P/E) ratio of 16 which is the highest in the entire GCC region. The economy of Kuwait is expected to grow by 4.06 % in 2019 according to the World Economic Outlook Released by the International Monetary Fund. With the largest fiscal buffers among its GCC peers as well as a very low fiscal breakeven oil price, Kuwait has insulated itself from future uncertainties in the form of losses due to fall in oil.

Saudi Arabia – Neutral

2018 has been a volatile year for the Saudi stock market. The Tadawul index started 2018 on a strong note, as the largest market in the GCC region was upgraded to ‘Emerging Market’ status by both index providers, FTSE Russell and MSCI. However, the market soon lost ground as a sharp fall seen in oil prices coupled with the impact of political uncertainties significantly slowed down the pace of the rise in the stock market, which then had to settle with a yearly gain of 8.31%.

Growth in corporate earnings remained flat for the first nine months of 2018 when compared to the same period in the previous year. Media and entertainment sector led the way in earnings growth, with a rise of 38.3% (YoY) in Q3 2018 after the Saudi government lifted the ban on movie theatres. The banking and telecommunications sector followed suit, registering gains of 28.9% and 26.6%, respectively. Banking sector’s profitability was supported by a rise in their net interest income in the increasing interest rate environment. With the sharp fall in oil prices, many of the sectors such as retail, construction, hotels & tourism and transport sectors reported lower earnings in 2018. The weakest performing sectors were Real Estate and Utilities with falls of 30.1% and 24.9% respectively.

Saudi Arabia plans to increase state spending by 7 % next year in an effort to support economic growth that has been hurt by low oil prices. The mark-up in spending would delay the Saudi Government’s plan to eliminate its state budget deficit by the year 2023.

UAE – Positive

The Dubai financial market was the worst performing GCC market for the year 2018, with a YTD loss of 24.93%. All the sectors registered a negative performance with Consumer Staples and Investment and Financial Services being the worst of the lot with substantial losses of 62% and 44% respectively. Real Estate and Construction sector, which commands the highest weightage in the DFM General Index has seen a drop of 39% in 2018. The Abu Dhabi Securities Exchange on the other hand was the second best performer in the GCC market with a yearly gain of 11.75%, buoyed by healthy quarterly results of listed companies and stronger investor sentiment boosted by government-led stimulus measures. The Banking index, which accounts for 60% of the overall index composition, saw a rise of 27% for the year 2018.

For the nine months of 2018, UAE corporate earnings were up by 13.3% compared to the same period last year. According to the latest IMF estimates, UAE’s GDP growth is expected to be 3.7% higher in 2019. Given large fiscal buffers, ample spare capacity, and rising investment needs for Expo 2020, the government has appropriately switched to providing stimulus to the economy. The introduction of VAT in 2018 has been a historic milestone and is expected to substantially strengthen and diversify government revenues in the coming years.

UAE remained the major destination of FDI inflows at about USD 11 billion in 2017, accounting for 22% of total FDI to the Middle East and North Africa region. Dubai’s foreign direct investment flows soared 26% in the first half of 2018 to USD 4.84 billion compared to the same time period in 2017 as announced by the Dubai Investment Development Agency. The investment law, which seeks to allow more than 49% ownership to foreign investors in some specific business sectors, is in effect which could further boost the FDI flow into the country.

Qatar – Neutral

Registering the best performance among its GCC peers, Qatar Stock Index saw a growth of 20.83% in 2018. Most of the sectors had a positive year with Banks and Financial Services and Consumer Goods and Services registering the highest growth of 43% and 36% respectively.

Corporate profits rose 8.2% on a year-on-year basis. Qatar’s banking system remains healthy with ample liquidity, high asset quality and strong capitalization. Deposit growth of 6% and loan growth of 5% in 2018 should result in a further decline in the loan-to-deposit ratio. The real estate sector, which was under considerable pressure last year, has seen a healthy rebound in 2018 with the sector gaining 14.2% this year. Qatar’s real estate sector is expected to see further growth, due to positive legislative changes by the government on the ownership of properties by foreign investors, which is likely to encourage further investments in this sector. In December 2018, Qatar announced its withdrawal from OPEC on the basis of its long-term strategy of shifting focus towards gas and away from oil.

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 1.06 billion as of 30 September 2018 (USD 3.51 billion). Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Alrazi Y. Al-Budaiwi

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Tel: +965 2224 8000

Fax: +965 2246 7264

Email: abudaiwi@markaz.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.