Kuwait: Kuwait Financial Centre “Markaz” recently released its Monthly Markets Review report for the month of May 2021. Markaz report noted that Kuwait equity markets had another month of gains. Kuwait All Share index extended its good run and gained 1.8% for the month. Market liquidity in May, as indicated by the average daily traded value, stood at USD 241million, an increase of 41% compared to the earlier month.

Among Kuwait sectors, Oil & Gas was the top gainer, rising 7.1% followed by consumer services at 6.1%, while Technology and Basic Materials declined by 19.8% and 6.2% respectively for the month. Among blue chips, Agility Public Warehousing was again the top gainer rising 6.6% in May, extending its gains from last month. The stock has gained nearly 50% for the year. Kuwait’s largest company by market capitalization, Kuwait Finance House (KFH) gained 3% for the month and 21% for the year. KFH stock outperformance has enabled it to become the largest listed company in Kuwait.

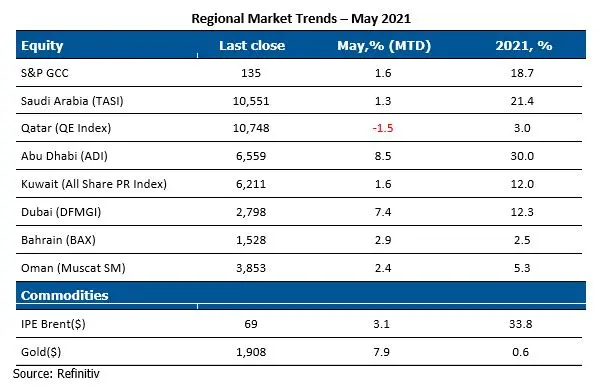

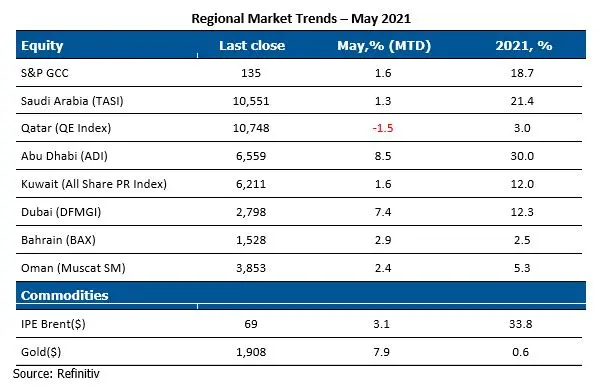

Regionally, S&P GCC index gained for the seventh consecutive month as oil prices continued to rise with Brent crude nearing the levels of USD 70/barrel. S&P GCC composite index ended the month 1.6% higher. Abu Dhabi and Dubai gained 8.5% and 7.4% respectively for the month, led by banking stocks. KSA, Bahrain and Oman gained 1.3%, 2.9% and 2.4%, respectively while Qatar was the only market to make losses for the month, falling by 1.5% as profit taking was seen in blue chip companies like Industries Qatar that had make strong gains earlier in the year.

Among the GCC blue chip companies, First Abu Dhabi Bank - UAE’s largest lender - was the biggest gainer, rising 18.4% for the month on expectations that an upcoming review by MSCI of its emerging markets index will increase the bank's index weighting and spur foreign fund flows into its shares. The bank also successfully completed the takeover of Bank Audi Egypt during the month. Dubai’s Emirates NBD Bank gained 10.8% for the month. The bank’s shares rose after it sold USD 750 million in Additional Tier 1 bonds after receiving more than USD 1.75 billion in orders.

The performance of global equity markets was positive, with the MSCI World Index closing 1.3% higher in May on hopes that the US Federal Reserve and other central banks would continue accommodative monetary policies despite a slight increase in inflation. The US White House also proposed the largest budget in history of USD 6.1 trillion dollars. U.S. market (S&P 500) made a small gain of 0.5% for the month while treasury yields fell slightly for the month following the Fed’s assurance that rise in inflation was expected to be ‘transitory’. U.K (FTSE 100) rose by 0.8% for the month.

Oil prices closed at USD 69.3 per barrel at the end of May, posting a monthly gain of 3.1%. Oil prices continue to remain range bound between USD 60-70/barrel as investors weighed OPEC+ production cuts with the possibility of increased supplies from Iran while the demand situation improved with the forthcoming US summer driving season expected to see increased demand for Oil.

-Ends-

About Kuwait Financial Centre “Markaz”

Established in 1974, Kuwait Financial Centre K.P.S.C “Markaz” is one of the leading asset management and investment banking institutions in the MENA region with total assets under management of over KD 988 million as of 31 March 2021. Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Sondos S. Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.