PHOTO

(A correction was made to the stake size and the purchase price of Omantal's partial acquisition of Zain in the penultimate paragraph).

The Muscat Securities Index hit a nine-year low in the first half 0f 2018, as its benchmark index fell by 10 percent, making Oman’s stock market the second-worst performer in the region behind Dubai.

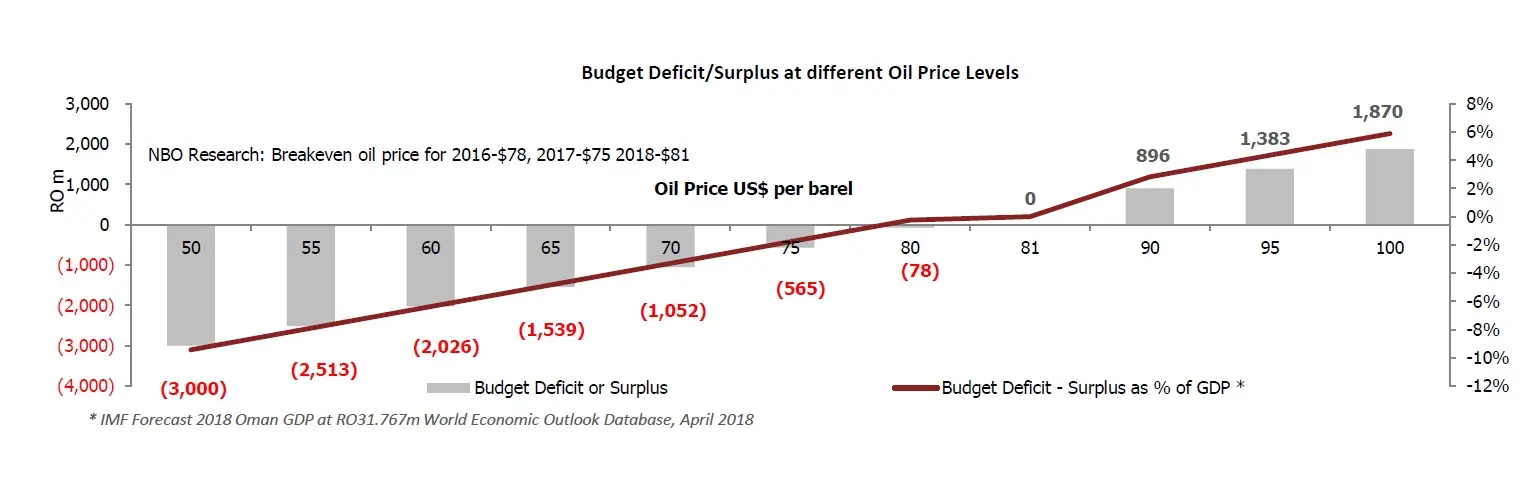

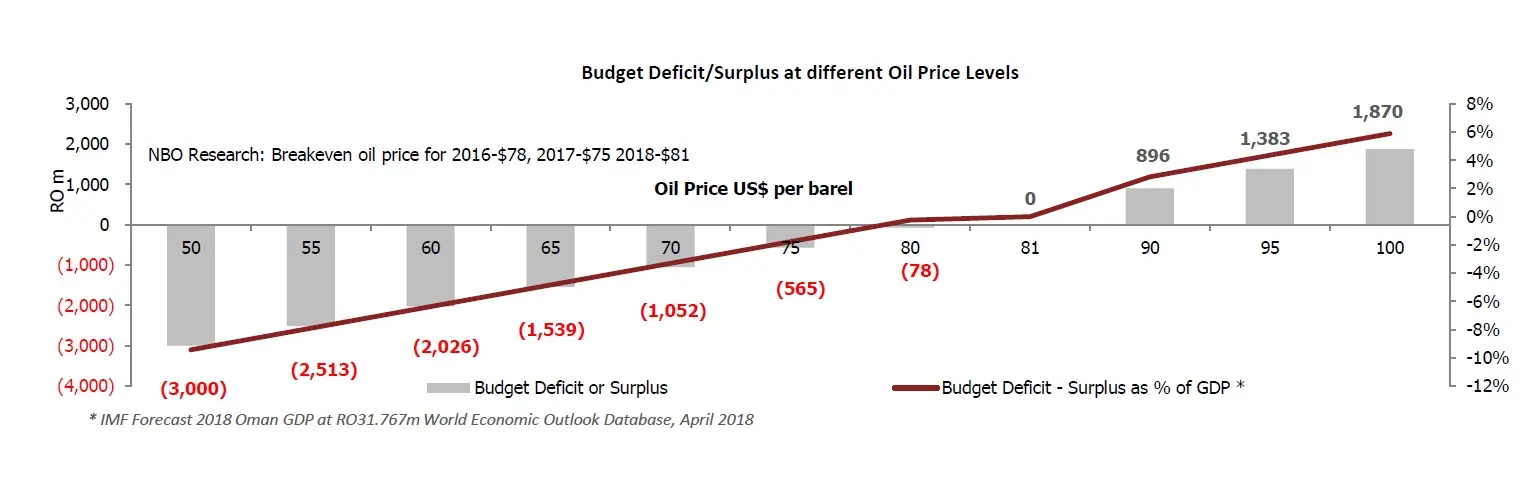

The sultanate has struggled to plug budget shortfalls in recent years as oil prices have slumped, with its sovereign debt being downgraded to ‘junk’ status last year by ratings agency S&P. Yet in April the International Monetary Fund praised Oman’s progress in bringing down its budget deficit to 12.8 percent of gross domestic product (GDP) last year, from 21 percent in 2016.

S&P also reaffirmed in a mid-year MENA Sovereign Ratings Trends note published on Tuesday, 17 July that after a 0.3 percent decline in GDP last year, it expects growth of 3 percent this year, and 4 percent in 2019, on the back of higher oil revenues.

While this should lead to further reductions in its deficit, BMI Research, a Fitch Group company, warned in a note earlier this month that the sultanate may instead divert extra revenues towards increased spending – “both on capital projects and recurrent expenditure”.

Hettish Karmani, the head of research at Muscat-based U-Capital, argued that there is “a good chance of market improvement” in the second half of the year, citing higher oil prices and improved economic prospects.

“Contracts and awards have become more steady and the banking sector is expected to do well in the light of Fed rate hikes and their subsequent follow-up in Oman because of (the dollar) peg,” he said in an emailed response to questions from Zawya.

Indeed, the top-performing stock on the Muscat market so far this year is Galfar Engineering & Contracting, which has picked up a couple of sizeable deals in its home market in the first half of the year, as well as posting an improved first quarter profit of 1.1 million Omani rials ($2.9 million), up from 272,000 rials in the same period last year.

Source: Oman Ministry of Finance, National Centre for Statistics and Information, National Bank of Oman.

Karmani explained that the 50 percent increase in its share price in the first half of 2018 was due partly to the fact that its stock had been sold down in the past couple of years as it suffered losses and receivables mounted.

However, he added that in recent months the “company was able to secure many contracts and received some payments from government and semi-government sources”, reducing its outstanding debt and improving its financial position.

The biggest faller in the market was Omantel, whose shares declined by 38 percent. Karmani said the company’s shares had been sold down by investors who felt the company had paid a “too high” price to acquire a 22 percent stake in Kuwait’s Zain for 846 million Omani rials $2.2 billion – a deal that was done in two transactions, which was completed in November last year.

In a note on the company issued last Sunday, 15 July, National Bank of Oman said that the sell-off caused by investors’ apprehension had presented “a good buying opportunity, especially in view of the 9.8 percent dividend yield”. It added that the company was in talks with the telecoms regulator about reducing the amount of royalty fees it pays for directing business traffic from 10 percent to 7 percent which, if successful, could lead to the company generating higher margins.

Gainers

1 GALFAR ENGINEERING & CONTRACTING 50.68%

2 RENAISSANCE SERVICES 46.21%

3 OMAN & EMIRATES HOLDING 45.57%

Losers

3 RAYSUT CEMENT -23.08%

2 OMAN FISHERIES -24.14%

1 OMANTEL -38.00%

Click through the links below read how other GCC markets fared.

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018