PHOTO

Qatar appears to be coping well with the economic fallout from blockade imposed on it just over a year ago by a quartet of neighbouring countries including Bahrain, Egypt, Saudi Arabia and the United Arab Emirates. The quartet began the blockade in June last year accusing Qatar of sponsoring terrorism, a claim the state has denied.

On July 15, ratings agency Moody’s lifted its outlook on Qatar’s sovereign outlook to ‘stable’ from ‘negative’, citing the state’s ability to withstand the impact from the blockade “for an extended period of time without a material deterioration of the sovereign's credit profile”.

The country’s stockmarket has proved equally resilient. The Qatar Exchange All Share Index gained in value by 6.9 percent in the first half of the year, making it the region’s second-best performing market behind Saudi Arabia.

Akber Khan, a senior director of asset management within Doha-based Al Rayan Investment, said that it has been “business as usual for many parts of the economy” since the blockade was enforced.

“While there are certainly some companies suffering, many of these are not listed, such as contractors,” he told Zawya in a telephone interview.

Other elements of the economy can actually benefit from a shock to the system, he said, including many of the firms on the index.

“Of the top six companies in the QE Index, four are banks and one is Industries Qatar. So at least 60 percent of the index is set to benefit from a global macro tailwind of rising interest rates and Brent crude averaging more than $70 in the first half of 2018,” Khan said.

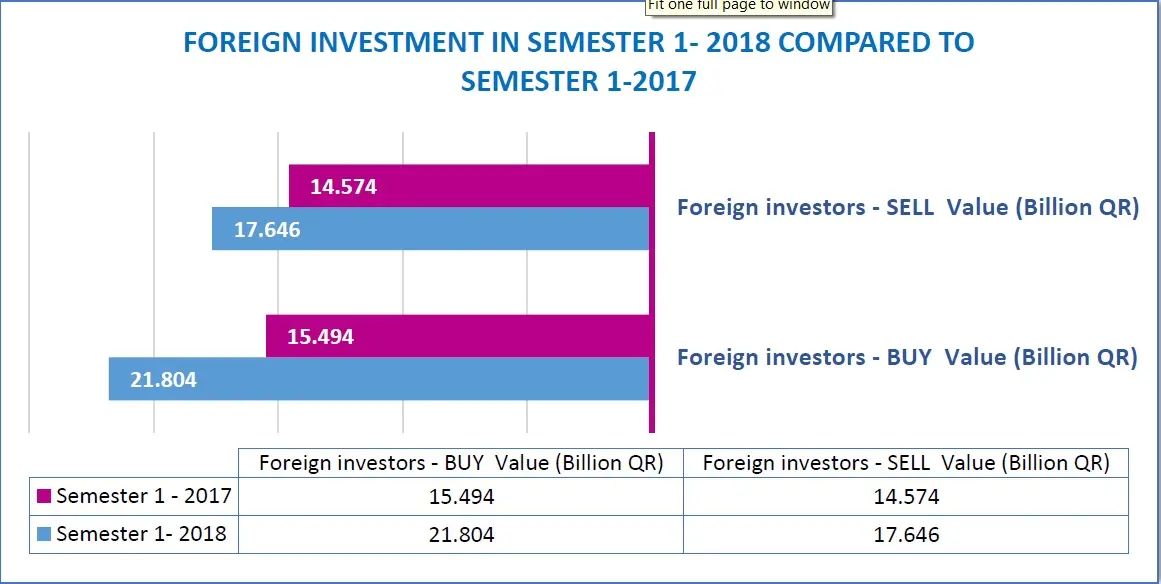

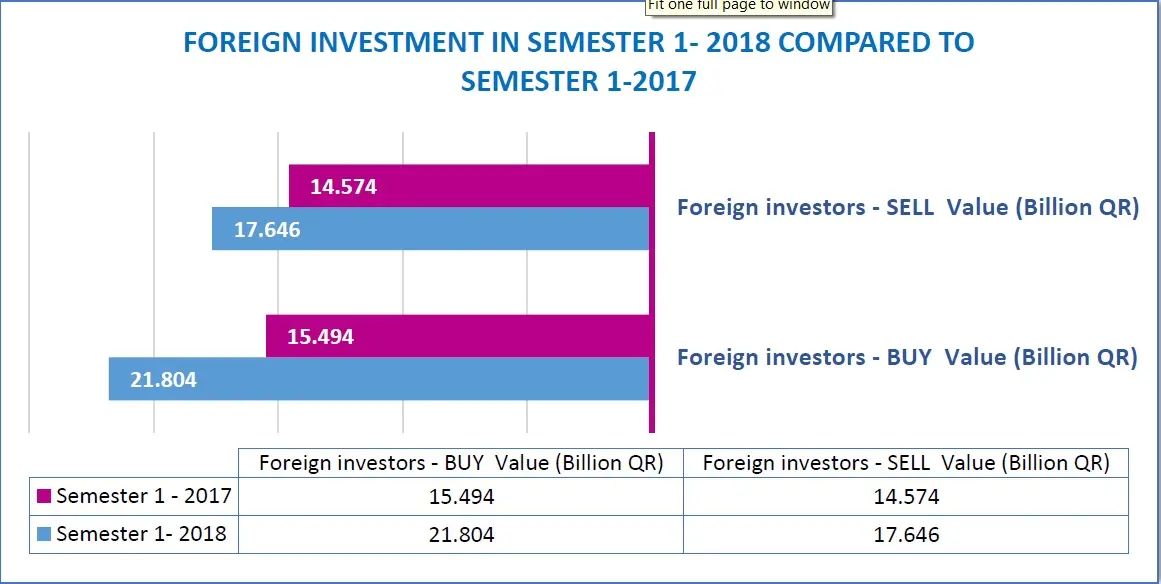

The other major factor behind the Qatar market’s growth in the first half of 2018 has been the decision to raise foreign ownership limits of many of the index’s largest firms, which has led to an inflow of investment of 4.16 billion Qatari riyals ($1.14 billion) during the first half, according to figures published by the Qatar Stock Exchange (QSE) earlier this month.

QSE’s statement also said that the average daily value of shares on the index increased by 2.5 percent year-on-year in the first six months, to 335.5 million Qatari riyals ($92.2 million) per day.

Source: Qatar Stock Exchange

“Qatar outperformed massively from 12 March until the end of May because of the foreign ownership limit increases we saw for QNB (Qatar National Bank), IQCD (IQCD), Qatar Electricity and Water, and Qatar Islamic Bank,” said Mohamed Al-Hajj, vice-president and head of MENA strategy at EFG Hermes, in a telephone interview.

Qatar National Bank and Qatar Islamic Bank were two of the three top gainers in the first half, increasing in value by 20.6 percent and 19.6 percent respectively. They were only topped by Commercial Bank Qatar (CBQ), which had an eventful six-month period which saw it end talks with Tabarak Investment to sell its stake in Sharjah-based United Arab Bank, raise $500 million through a five-year bond issue and by reporting a huge growth in first-quarter profits. On July 19, the firm reported that this momentum continued into the second quarter, with half-year net profit quadrupling to 855 million riyals, compared with 180 million riyals in the same period last year.

Khan said that he does not envisage the index giving back any of the gains it has made in the first half of the year.

“Many market observers outside Qatar have been very surprised by the market’s resilience following the increases in foreign ownership; many expected the market to correct 10 or 15 percent. That hasn’t happened, partly for two reasons. One, the scale of the index-related buying was so great, that it hasn’t finished yet. Secondly, the average emerging market investor has long been significantly underweight Qatar and this is now being partially corrected.”

He argued that “an obvious caveat” to this would be a global event, such as the escalation of trade disputes leading to a panic about global growth and investors selling off emerging market equities.

“But that would not be a Qatar-specific issue,” said Khan.

Gainers

1. QATAR COMMERCIAL BANK 32.39%

2. QATAR NATIONAL BANK 20.63%

3. QATAR ISLAMIC BANK 19.59%

Losers

3. QATARI INVESTORS GROUP -19.29%

2. OOREDOO -19.88%

1. QATAR FIRST BANK -20.62%

Click through the links below read how other GCC markets fared.

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018