Hotel occupancy increases to 55% compared to 24% in H1 2017

H1 2018 EBITDA loss improves by 63%

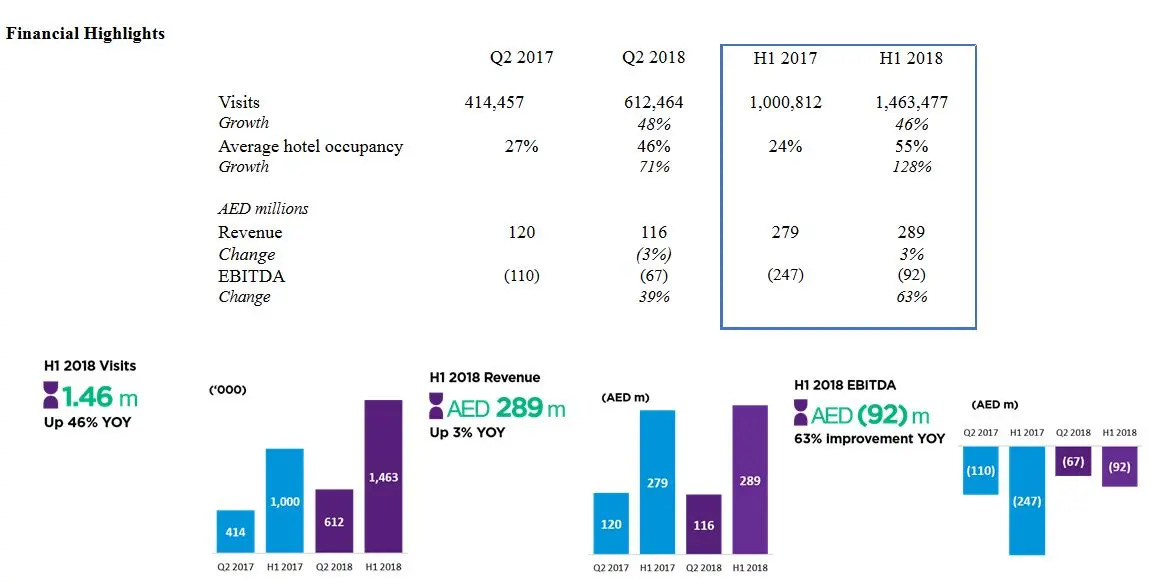

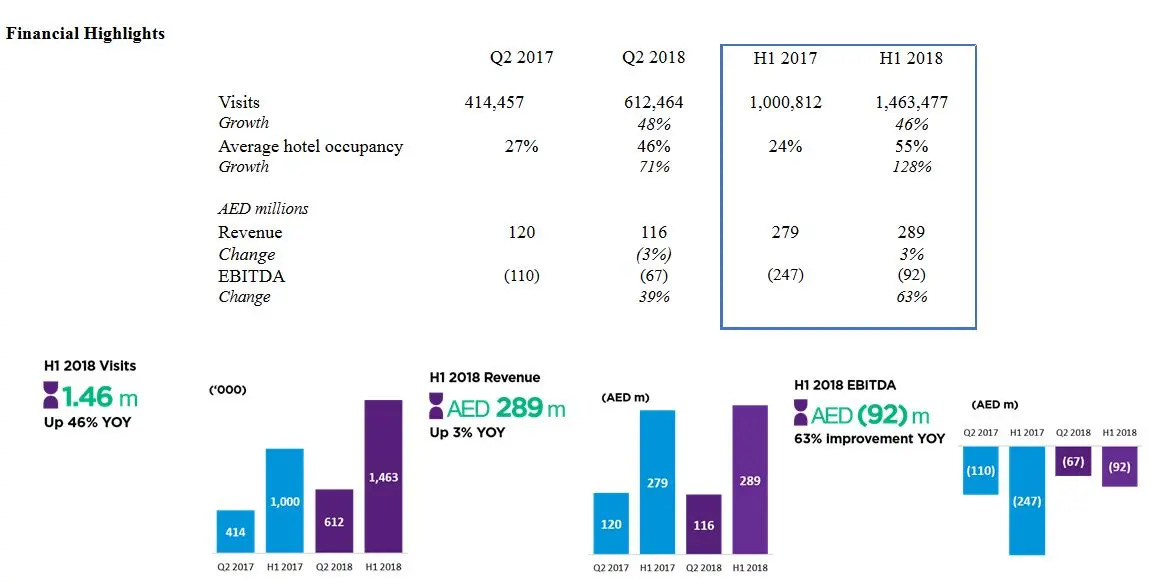

Q2 2018 Financial Highlights

- Q2 2018 visits reached 612,464, an increase of 48% compared to same period in the previous year; H1 2018 visits reached 1.46 million an increase of 46% compared to H1 2017.

- Q2 2018 revenue was AED 116 million, compared to AED 120 million in the same period in the previous year; H1 2018 revenue was AED 289 million, compared to AED 279 million H1 2017.

- Continued EBITDA loss improvement due to visitation growth and cost efficiencies. Q2 2018 EBITDA loss improved by 39% compared to Q2 2017. H1 2018 EBITDA loss improved by 63% compared to H1 2017.

- Lapita™ Hotel average occupancy rose to 46% in the second quarter of 2018, compared to 27% for the same period last year. H1 2018 average occupancy was 55%, compared to 24% in H1 2017.

Operational highlights

- During the quarter, the 2nd Annual ‘Big Day Out’ set a new record in daily visitation, with over 36,000 visits on the 20th of April 2018. Overall, April was another peak month, with the theme parks attracting over 300 thousand visits driven by the influx of tourists during the international school holiday season.

- DXBE announced a strategic partnership with Dubai Airports to promote Dubai Parks and Resorts at all DXB concourses with access to over 88 million passengers travelling through Dubai Airport annually.

- Post period, DXBE entered into a partnership with Emirates, the largest airline in the Middle East, to offer its customers special bundled offers, exclusively available for Emirates passengers.

- Post period, DXBE signed an agreement with RTA’s Dubai Taxi Corporation for branded family taxis, and an exclusive campaign targeting Dubai Airport arrival passengers.

Mohamed Almulla, CEO and Managing Director, DXB Entertainments PJSC, said: “The business is making good financial and operational progress under our clearly defined strategy. Our primary focus is on driving footfall, generating repeat visitation through a simplified pricing structure and increasing brand awareness through targeted marketing initiatives. We attracted 1.46 million visits in the first half of the year, an increase of 46% compared to the same period last year.

“EBITDA has continued to improve from a loss of AED 247 million in the first half of 2017, to a loss of AED 92 million this year; a 63% improvement. This demonstrates that we are getting closer to our target of reaching EBITDA break even.

“We are continually refining our offer to meet guest demand and are currently working on a Bollywood Parks™ Dubai enhancement strategy which includes increasing the number of smaller family friendly rides as well as enhancing the theming, performances and food options. Our goal is to make Bollywood Parks™ Dubai a truly unique experience with more family friendly options.”

Financial summary

For the three months ended June 2018, DXB Entertainments reported total revenues of AED 116 million, of which AED 80 million was generated through the theme parks, AED 5 million through retail and AED 17 million through hospitality.

Within the theme parks, 68% of revenue in Q2 2018 was driven through admissions and 27% through in-park spend.

In Q2 2018, 77% of retail revenue was driven through Riverland™ Dubai leasing revenue with 82% of the GLA leased. Overall retail revenue was lower in the second quarter of 2018 at AED 5 million, reflecting a newly implemented revenue share model, which will impact leasing revenue in the near term.

Hospitality revenue increased by 47% to AED 17 million in Q2 2018, compared to Q2 2017. Average occupancy was 46% and the average daily rate was AED 556 for the second quarter of 2018.

Close management of costs saw operating expenses continue to improve in the second quarter of the year, totalling AED 188 million, compared to AED 184 million in the previous quarter and 19% less when compared to the same period last year. Employee expenses account for the largest operational expense, comprising over 40% of total operating expenses. [1]

Operational summary

H1 2018 visits were up by 46% compared to the same period last year with Q2 2018 visits reaching 612,464, an increase of 48% compared to same period last year.

While the second quarter generally produces lower visitor numbers, reflecting the seasonal nature of the theme park business, April was another peak month, driven by international school holidays, resulting in over 300 thousand visits. Furthermore, the 2nd Annual ‘Big Day Out’ set a new record in daily visitation, with over 36,000 visits on the 20th of April 2018.

Of the 1.46 million visits to the parks during the first half of the year, 32% were multi-park tickets, 38% were single park tickets and 25% were annual pass visits. Tour and Travel operators contributed 19% of visits, and international visitors made up 38% of total visits with the largest contributors coming from the MENA, GCC and the Indian subcontinent.

Riverland™ Dubai is 82% leased, and the Company continues to work on its leasing strategy by closely monitoring the tenant mix and increasing the number of events and shows held by the river at Riverland™ Dubai to encourage repeat visits from the resident market.

As part of its strategy to increase international tourist visits to Dubai Parks and Resorts, DXBE announced a strategic partnership with Dubai Airports to promote Dubai Parks and Resorts at all DXB concourses with access to over 88 million passengers travelling through Dubai Airport annually. Additionally, the Company entered into a partnership with Emirates, the largest airline in the Middle East, to offer its customers special bundled offers, exclusively available to Emirates passengers. Finally, to complete the visitor journey, DXBE recently announced a partnership with RTA’s Dubai Taxi Corporation, for 100 Dubai Parks and Resorts branded airport family taxi’s which will promote the destination to passengers arriving at Dubai airport.

Strategy Update

On 18 July 2018 the Board of Directors passed a resolution for the enhancement of Bollywood Parks™ Dubai. The plan includes increasing the number of rides, with a special focus on smaller family friendly rides as well as enhancing the theming and entertainment within the park. This signals an exciting new phase in the evolution of the park. The enhancements will be operational in time to welcome visitors in the fourth quarter. The Company is also exploring a new ticketing model for Bollywood Parks™ Dubai which focuses on providing different price options for the consumer such as a pay-as-you-go model.

The Board also mandated management to evaluate DXB Entertainments’ future development plans and capital deployment to ensure value for shareholders through prudent financial management. The review will cover future plans and expansion zones including Six Flags Dubai, to determine scope and timelines. All feasible options will be presented to the Board later in the year for final discussion on the strategy going forward.

Outlook

Mohamed Almulla, CEO and Managing Director, DXB Entertainments PJSC, said:

“DXB Entertainments has made good progress in growing its brands in the region and beyond during the first half of 2018. We tapped into UAE’s fantastic tourism infrastructure through strategic partnerships with its world class entities such as Emirates Airlines and Dubai Airports. We believe that such partnerships will enable us to communicate the incredible experiences that we offer, while helping us grow new and repeat visitations to the parks.

“Looking ahead, we will continue to grow visitation from our key markets in the UAE, GCC and internationally, whilst also focusing on enhancing the visitor experience to deliver on DXB Entertainments’ long-term strategy.

“Theme parks are seasonal in nature and whilst we expect to deliver year-on-year growth compared to the year ended 31 December 2017, we anticipate the warmer third quarter to continue to reflect the effect of seasonality in line with our expectations.”

For further information, please contact:

Marwa Gouda, Head of Investor Relations, DXB Entertainments PJSC

+97148200820

IR@dxbentertainments.com

Jon Earl, Managing Director, FTI Consulting

+97144372104

jon.earl@fticonsulting.com

Anca Cighi, Director, FTI Consulting

+97144372111

anca.cighi@fticonsulting.com

DXB Entertainments PJSC

DXB Entertainments PJSC (previously Dubai Parks and Resorts PJSC) is a Dubai-based operator of leisure and entertainment destinations and experiences. The Company is traded on the Dubai Financial Market (DFM) under the trading symbol DXBE. We bring together a diverse portfolio of world-class brands to offer entertainment in the areas of theme parks, family entertainment centres and retail and hospitality.

DXB Entertainments is the owner of Dubai Parks and Resorts, the region’s largest integrated theme park destination, with five Theme Parks (Six Flags Dubai under development), two Hotels (LEGOLAND® Hotel under development), and one retail and dining facility all spread over 30.6 million sq.ft of land, with an estimated AED 13.2 billion in development costs.

DXB Entertainments also manages six Dubai-based mid-way attractions in addition to a chain of cinemas, all owned by Meraas.

With a diverse portfolio of 16 leisure and entertainment assets, DXB Entertainments is the largest leisure and entertainment company in the region.

For more information, go to: www.dxbentertainments.com

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.