PHOTO

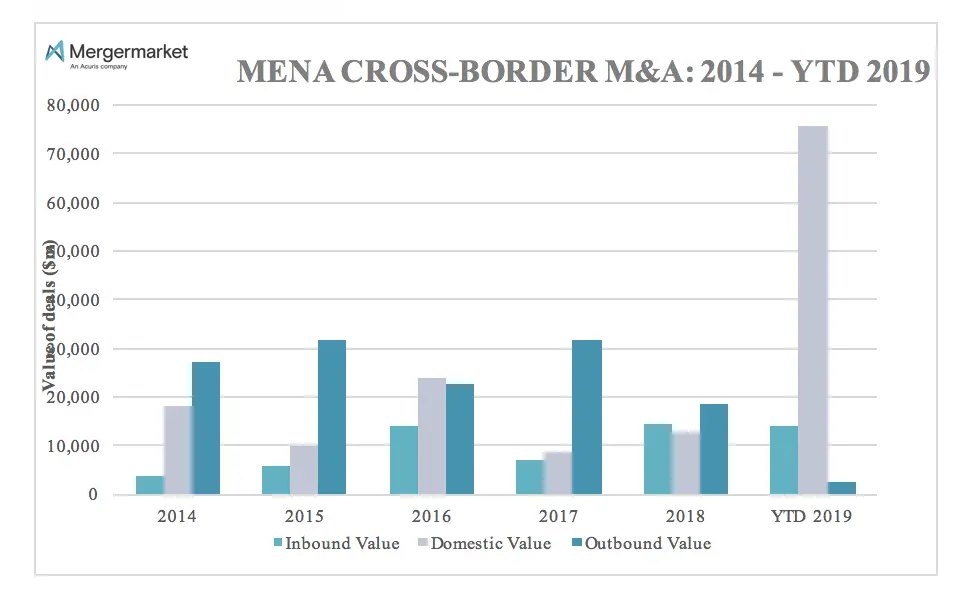

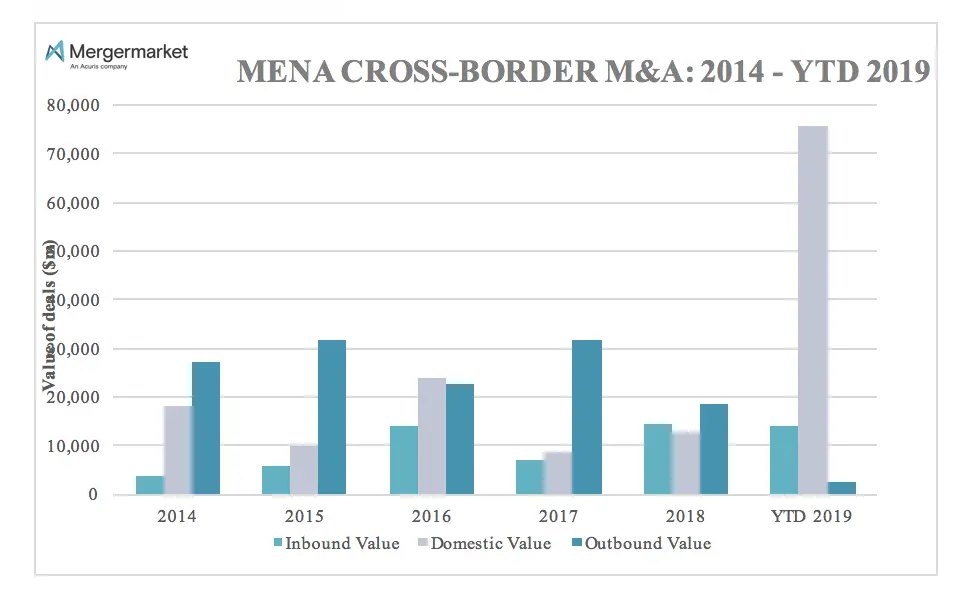

- Inbound and domestic M&A in Q1 2019 see the highest deal value on record

- Significant rise in private equity buyouts in the region in Q1, the highest on record

Dubai: Mergermarket, the leading provider of M&A data and intelligence, has released research showing that M&A targeting MENA in 2019 has already surpassed all annual totals following the USD 70.4bn Saudi Aramco-SABIC megamerger – the second largest M&A deal globally so far this year. Even excluding this deal, MENA M&A would have reached its second highest quarterly value on record. The data was announced at Mergermarket’s MENA Mergers 2019 held in Dubai on 10 April.

High-profile deals involving Abu Dhabi National Oil Company (ADNOC) have been key to the increase, including the sale of ADNOC Oil Pipelines to KKR and BlackRock for USD 4bn, marking the firm’s largest divestment on Mergermarket record. The region also saw the USD 4bn deal between Emirati banks Abu Dhabi Commercial Bank and Union National Bank. The move marks the second domestic banking merger in a matter of months, following the tie-up between Saudi British Bank and Alawwal Bank in October for USD 4.7bn.

With the region appearing to be sheltered away from macroeconomic issues elsewhere, foreign investment has seen a noticeable uptick, bucking the global trend. A total of 22 inbound deals worth USD 14bn were registered in Q1, the highest quarterly value since 4Q07, following deals such as Uber’s acquisition of rival Careem Networks. Domestic consolidation was also on the rise with a 21 domestic deals in Q1 – up from 14 in 4Q18. However, with increasing protectionist measures across much of the Western world outbound M&A figures for Q1 2019 paint a slightly different picture. While the value and volume (16 deals, USD 2.6bn) increased from the final quarter of 2018, the figures remain relatively low compared to recent years.

Anil Menon, MENA M&A and Equity Capital Markets Leader, EY, commented: “M&A activity in 2019 is off to a solid start. We expect 2019 to be a strong year for M&A activity due to (a) consolidation plays in select sectors, (b) strategic buying by sovereigns and national oil companies, and (c) increased capital allocation in the technology sector. This combined with a more balanced bid/ask spread in terms of deal valuations is propelling M&A activity.”

Asar Mashkoor, Managing Director at Emirates NBD commented: “The region has always had liquidity. What we are seeing now is that seller expectations of value are reasonable, and buyers are positioning themselves for an improvement in sentiment. At the same time, banks are keen to diversify away from traditional sectors and willing to help finance M&A transactions. We expect this trend to continue in the medium term

Omar Momany, Partner, Baker McKenzie, commented: “The significant uptick in M&A activity in the Middle East in the first quarter of this year has been largely due to a number of mega mergers and consolidations across key sectors driving economic growth, including financial services, technology and industrials. Despite the volatility of global markets in 2018, strong economic fundamentals, improvement in oil prices, and rising production growth continue to draw investors to the Middle East. With governments such as the UAE and Saudi Arabia taking steps to enhance their foreign direct investment regimes and diversify their economies, we expect a healthy level of M&A activity in the region for the rest of 2019."

“Early-stage M&A activity in MENA virtual data rooms increased by 23% year-over-year over the past two quarters, indicating that the MENA region is set for very healthy levels of announced M&A deal count growth throughout 2019," said Pete Frintzilas, Senior Vice President, SS&C Intralinks.

Elaine Green, Editor of Mergermarket Bureaus commented: “We are seeing a surge of interest from private equity in energy, consumer and education opportunities. Infrastructure and renewable deals continue to drive interest. The region increasingly looks to diversify out of an over-reliance on traditional energy sources and as its population becomes more westernized in habits we expect consumer, education and health sectors to see further growth”.

“While value is a key indicator of market health we also look at global deal count, which tends to be a more balanced measure of deal making. Early-stage M&A activity in MENA virtual data rooms increased by 23% year-over-year over the past two quarters, indicating that the MENA region is set for very healthy levels of announced M&A deal count growth throughout 2019," said Pete Frintzilas, Senior Vice President, SS&C Intralinks.

Gamal M. Abouali, Partner, Abu Dhabi, Cleary Gottlieb Steen & Hamilton LLP commented: “While deal volume in Middle Eastern private equity remains subdued, participation of GCC sovereign wealth funds in outbound private equity investments in Europe, North America, and Asia continues to be robust. GCC institutions are increasingly carrying out co-investments and direct investments, as opposed to passive fund stakes, which means the region will help shape private equity activity globally.”

-Ends-

Media Enquiries

Diana Estupinan

Instinctif Partners

E: diana.estupinan@instinctif.com

T: +971 (0) 4369 9353

Ioiana Pires Luncheon

PR Manager, EMEA

Acuris

E: ioiana.luncheon@acuris.com

T: +44 (0)20 3741 1391

About MENA Mergers 2019

MENA Mergers 2019 will include will focus on the main deal drivers in the MENA M&A market and look ahead to the key investment trends likely to be seen during the coming year. Panels, presentations and case studies will be given by representatives of the Middle East’s leading corporates, investment banks, private equity funds and financial and legal advisory firms. The event will be attended by corporate development and M&A teams, private equity professionals and business owners, investment bankers, financial advisors, lawyers and transaction services professionals. Mergermarket will host MENA Mergers at Jumeirah Emirates Towers, Dubai, on 10th April, in strategic partnership with EY, Baker McKenzie, Cleary Gottlieb, Intralinks and Instinctif Partners. The forum will be followed by Mergermarket’s third annual Middle East M&A Awards, celebrating excellence in M&A legal and financial advisory in the region. For more information: https://events.mergermarket.com/dubai

About Mergermarket:

M&A intelligence, data and research

In M&A, information is the most valuable currency. Mergermarket, an Acuris company, reports on deals 6-24 months before they become public knowledge, giving our subscribers a powerful competitive advantage. With the largest network of dedicated M&A journalists and analysts, Mergermarket offers the most comprehensive M&A intelligence service available today. Our reporters are based in 67 locations across the Americas, Europe, Asia-Pacific, the Middle East and Africa. Visit mergermarket.com.

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.