PHOTO

Global markets

Asian shares pulled back on Thursday after the United States Commerce Department said yesterday it would launch a national security investigation into car and truck imports, a move that could lead to tariffs like those imposed on steel and aluminium in March.

Increasing trade tensions between the U.S. and China have also weighed on stocks, with U.S. President Donald Trump on Wednesday calling for “a different structure” in any trade deal with China.

MSCI's broadest index of Asia-Pacific shares outside Japan was 0.1 percent higher, but Japan's Nikkei stock index .N225 fell 1.2 percent as auto shares slumped. South Korea's KOSPI lost 0.3 percent.

Middle East markets

On Wednesday, Abu Dhabi’s index rose 1.3 percent on a 4.3 percent jump by First Abu Dhabi Bank and a 2.2 percent increase by Abu Dhabi Commercial Bank.

Dubai’s index retreated after a two-day rally. The index closed 0.9 percent lower as Emaar Properties fell 1.5 percent and Emirates NBD lost 1.9 percent.

Saudi Arabia’s index edged down 0.1 percent, as real estate developer Jabal Omar dropped 3.7 percent and Al Rajhi Bank slipped 0.6 percent.

In Qatar, the index added 0.1 percent. Qatar Islamic Bank rose 1.5 percent and Industries Qatar added 0.2 percent.

Egypt’s index closed mainly flat to high, Kuwait’s index was down 0.7 percent, Bahrain’s index was up 0.1 percent and Oman’s index was down 0.5 percent.

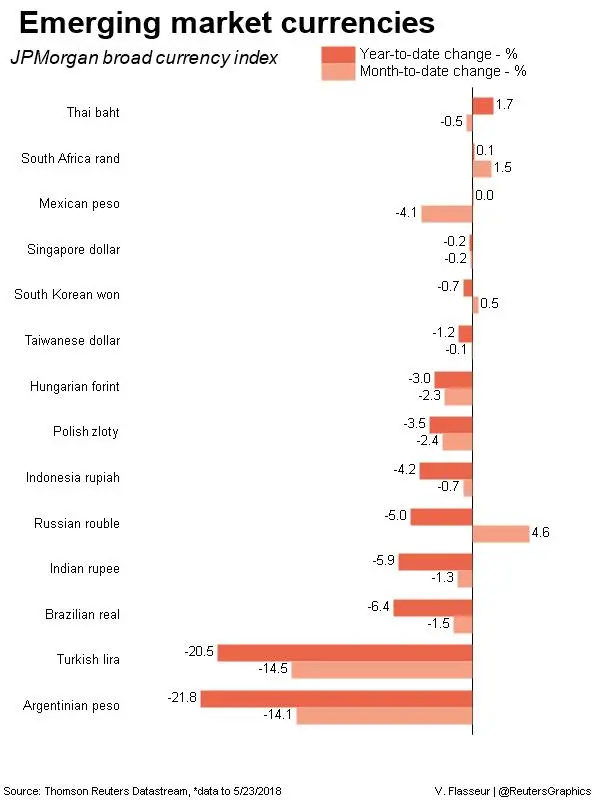

The Turkish currency drops more as Asian investors join the sell-off in the lira.

Turkey's central bank raised interest rates by 300 basis points on Wednesday in an emergency move to put a floor under the plunging lira currency.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Oil prices

Oil prices retreated early on Thursday as investors factored the possibility of higher OPEC output and as a surprise increase in crude oil inventories in the U.S. also weighed on prices.

International benchmark Brent futures were down 27 cents, or 0.34 percent, at $79.53 per barrel at 0300 GMT.

U.S. West Texas Intermediate (WTI) crude futures were down 17 cents, or 0.24 percent, at $71.67 a barrel.

“The chat is still that OPEC will do something at its June meeting in reaction to the looming prospect of a fall in crude production and exports from both Iran and Venezuela as the year progresses,” Greg McKenna, chief market strategist at CFD and FX provider AxiTrader, told Reuters.

Currencies

The dollar index, which tracks the greenback against a basket of six major rivals, was 0.2 percent lower at 93.839.

The dollar was down 0.6 percent against the yen to 109.44.

Precious metals

Gold prices edged higher on Thursday on a weaker dollar.

Spot gold was up 0.2 percent at $1,295.16 per ounce at 0359 GMT, after gaining nearly 0.2 percent in the previous session.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

For access to market moving insight, subscribe to the Trading Middle East newsletter by clicking here.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018