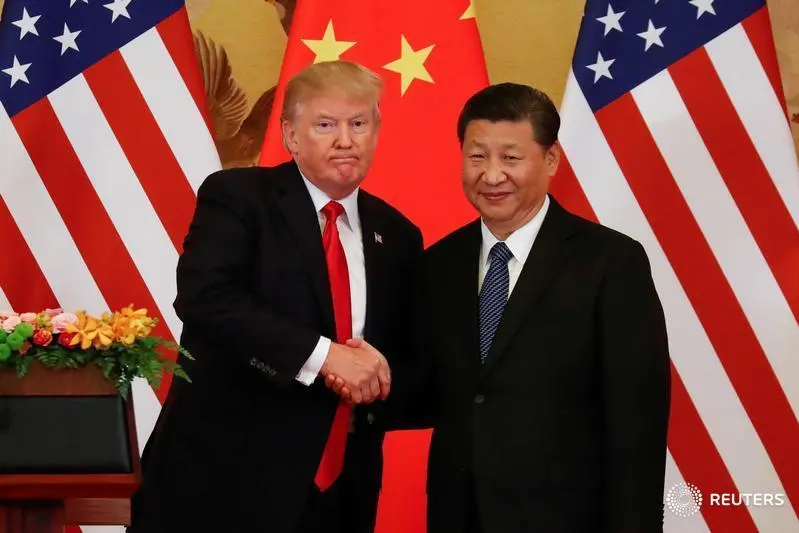

PHOTO

China warned on Friday it was fully prepared to respond with a "fierce counter strike" of fresh trade measures if the United States follows through on President Donald Trump's threat to slap tariffs on an additional $100 billion of Chinese goods.

China's Commerce Ministry spokesman, Gao Feng, called the U.S. action "extremely mistaken" and unjustified, Reuters reported. (Read the full report here).

Last Wednesday, China unveiled a list of 106 U.S. goods including soybeans, whiskey, frozen beef and aircraft targeted for tariffs, just hours after the Trump administration proposed duties on some 1,300 Chinese industrial, technology, transport and medical products.

Reuters outlined some of the companies and sectors likely to be the biggest losers as part of a trade war between the world’s two biggest economies:

ENERGY: Oil prices fell about 2 percent on Friday as news of the trade war escalated. (Read the full report here).

CAR COMPANIES: As its stock initially dropped 3 percent on news of the trade tit-for-tat, General Motors Co urged the two countries to engage in constructive dialog. Electric carmaker Tesla Inc, which depends on China for 17 percent of its revenue, dropped 2.5 percent on news of the war of words between the superpowers.

BOEING: Shares in the aircraft manufacturer was down 2.5 percent last week. Documents from China's Ministry of Commerce and the U.S. manufacturer showed the move would affect some older Boeing narrowbody models, Reuters reported. It was not immediately clear how much the tariffs would impact its newer aircraft.

Boeing said it was assessing the situation while analysts from JP Morgan said the proposals from China looked to have been calibrated carefully to avoid a major impact on the planemaker.

TECH MAJORS: The S&P 500 technology sector, which has the biggest revenue exposure to China among the benchmark's 11 major sectors, dipped 0.5 percent. Worst hit in the sector were chip stocks Intel Corp, Nvidia Corp and Broadcom Ltd. China's position as an assembly hub for electronic devices makes it the biggest consumer of semiconductors. The U.S. semiconductor industry relies on China for about a quarter of its revenue.

SOYBEANS AND WHISKEY: Jack Daniel's maker Brown-Forman Corp slipped about 1 percent before recovering after whiskey was singled out as the only spirit on which China planned to impose more tariffs. U.S. meat processor Tyson Foods Inc, meat exporter Hormel Foods Corp and Sanderson Farms Inc all rose on the prospect of a drop in prices of feedstock soybean following higher Chinese tariffs on U.S. exports.

Further reading:

Trump threatens more China tariffs, Beijing ready to hit back

China's state media urges U.S. industry to rally against Trump tariff threat

China forex reserves rise slightly as U.S. dollar weakness continues

Wall Street ends down 2% as U.S.-China trade fears intensify

Panic! Don't panic! Navigating the trade talk proves dicey

Trump administration mulls stiffer rules for imported cars

(Writing by Shane McGinley; Editing by Mily Chakrabarty)

(shane.mcginley@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018