PHOTO

61 percent of surveyed respondents expect substantial increase in compliance investment while 66 percent have embraced innovative compliance technology

SOUTH AFRICA – Refinitiv today released its Financial crime in Sub-Saharan Africa Report 2020, which highlights several noteworthy compliance trends.

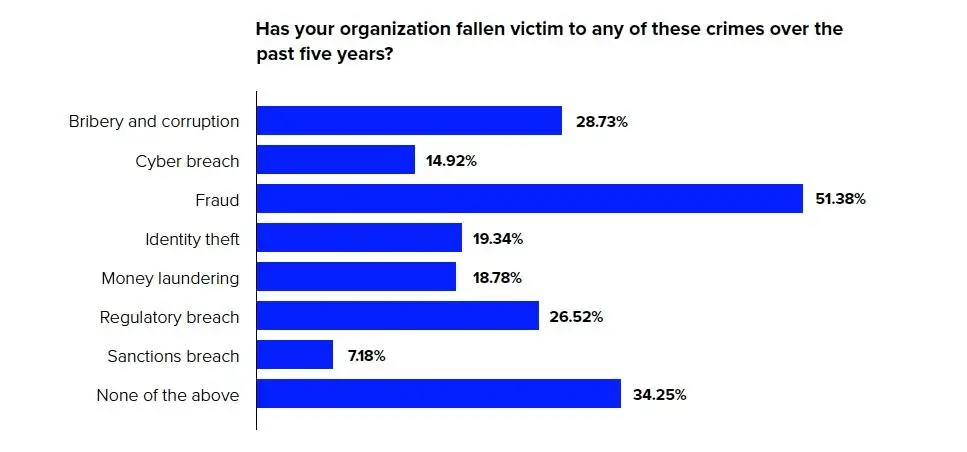

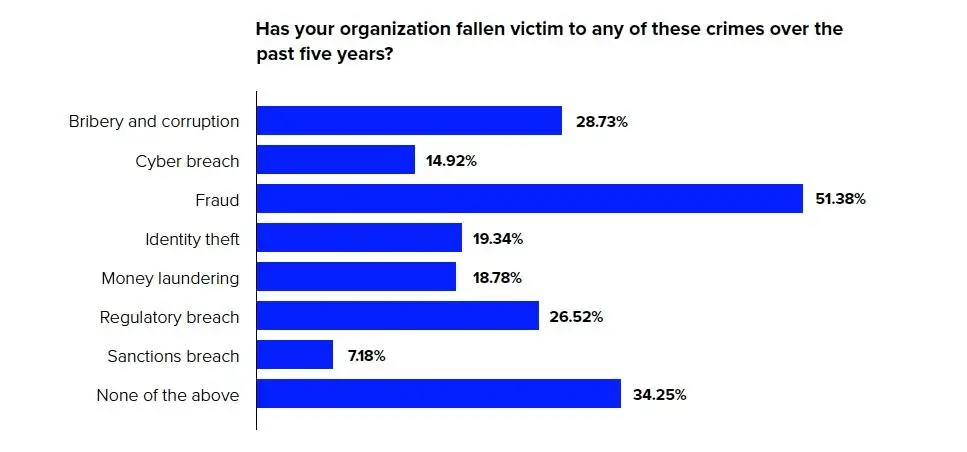

Responses show a high level of awareness of financial crime and a desire to upgrade compliance systems. The survey highlights that the crime threat continues to evolve, with techniques used by organised crime groups and fraudsters becoming more diverse and sophisticated.

According to the findings this year, more than 28 percent of respondents recognise that driving internal behaviour change within their companies is their primary challenge, 61 percent expect a substantial increase in their compliance investment, 74 percent have a Know Your Customer (KYC) program, while 66 percent embraced innovative compliance technology.

Only 43 percent indicate they have a sanctions program despite the growth in regulatory risk, especially in the area of ‘green crime’. Sub-Saharan Africa is home to a diverse range of wildlife and plants, as well as natural resources, and this has increasingly become the target of organised crime. We note that there is a robust regulatory response to green crime, thus increasing regulatory risk. The European Union has included environmental crime as a predicate offence under the 6th EU Anti-Money Laundering Directive (6AMLD); and the Financial Action Task Force (FATF) priorities for 2020 will focus on illegal wildlife trade.

Sub-Saharan Africa based organisations should be especially vigilant, and it is encouraging to see that organizations are striving to meet the regulatory challenge. “Africa is at the forefront of embracing mobile technology and is host to more than half the world’s mobile money services. With this increased mobile access comes the threat of identity theft and money-laundering. In response, digital identity technologies, including those of Refinitiv, are quickly evolving to meet this need and as our survey reports, a quarter of respondents have already adopted digital identity solutions,” said Nadim Najjar, Managing Director, Middle East and Africa, Refinitiv.

“The shift towards digitalization is a theme that comes through very clearly in our report. The pace of this transformation is likely to have accelerated in response to Covid-19 and it is unlikely to diminish once we exit the pandemic,” he added.

Najjar concluded that forward-thinking compliance functions will be focussed on how they can best make the transition towards digital channels and tools, while ensuring the needs of their business and customer base are accounted for and their regulatory requirements are fully addressed.

Please click here to obtain a copy of the report.

About Refinitiv

Refinitiv is one of the world’s largest providers of financial markets data and infrastructure, serving over 40,000 institutions in over 190 countries. It provides leading data and insights, trading platforms, and open data and technology platforms that connect a thriving global financial markets community - driving performance in trading, investment, wealth management, regulatory compliance, market data management, enterprise risk and fighting financial crime.

CONTACTS

Tarek Fleihan

Corporate Communications

Middle East, Africa, Central & Eastern Europe

Refinitiv

Office +97144536527

Mobile +971562162575

tarek.fleihan@refinitiv.com

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.