PHOTO

Dubai, United Arab Emirates (AETOSWire): Most experts agree that kickstarting the global economy after the current lockdown due to coronavirus pandemic could be crucial for a future progress. There are more factors, including a deep unemployment, which can cause problems and affect the global economy and markets.

How are stock markets managing right now? In the middle of April, American stocks appeared in highest values since March 2020. A symbol of the growth had been some good news on potential Covid-19 drug being developed by Gilead Sciences, an American biopharmaceutical company. A recently leaked WHO study on Gilead’s Covid-19 drug inefficiency, however signals that markets haven’t won yet. Right after the news spread, shares of the American biopharmaceutical company plunged, and so did all global stock market indexes as well as European indexes.

Some countries have begun to ease lockdown measures and reopened their economies, what suggests that a stock-market bottom had been reached. Yet, according to Alpho broker, it could also mean the so-called “lull before the storm”. Why? Let’s have a look at it in more details.

Due to the pandemic, expenses per individuals grow – the employment rate drops and impact of lockdown on economy of each state is inevitable.

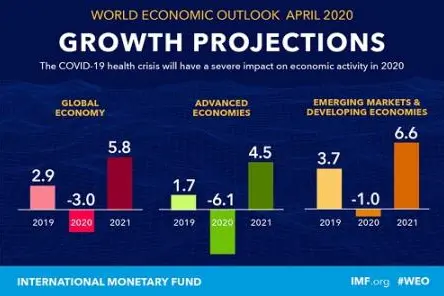

In the latest report published on 6th April 2020, the International Monetary Fund lowered its global growth estimate for 2020 to 3%, and such a scenario would be worse than financial crisis of 2008 and 2009. Moreover, it could trigger further sale on stock markets.

While developed economies are expected to slump in 6,1%, developing markets and economies should drop in 1%.

In addition, a wave of stock market growth after slump in March, could have been just a temporary movement in bearish mood. Mark Jolley, strategist from CCB International Securities, told CNBC that shares value could drop in 15% below last minimum. For example, main stock indexes are currently traded on a higher forward P/E, while profits of companies decline. The forward P/E formula means a ratio between the current price and estimated earnings per share in upcoming 12 months.

That could be a serious reason for nervousness of investors, whose decisions during negative sentiment usually lead to sales.

-Ends-

*Source: AETOSWire

For more information:

Milosh Pham

Chief Analyst

Alpho

+442080689907

support@gulfbrokers.com

Trading is risky and your entire investment may be at risk. TC’s available at https://alpho.com/

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.