PHOTO

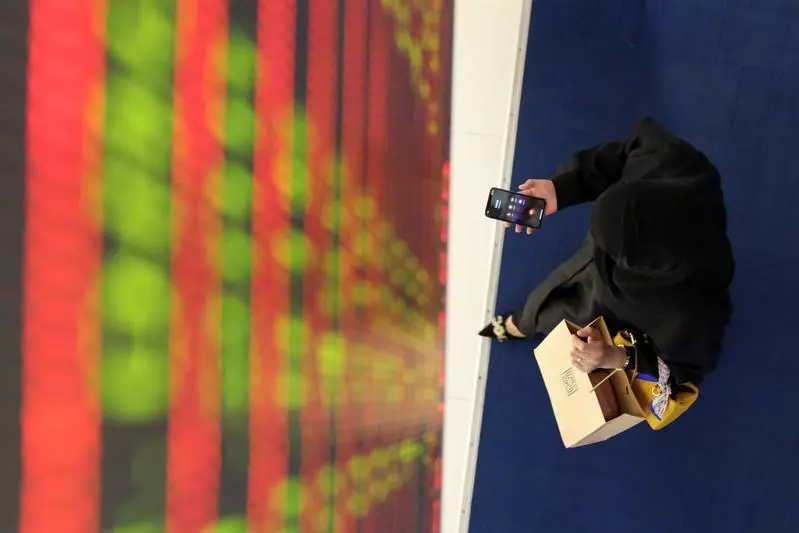

Most stock markets in the Gulf ended higher on Thursday, as worries around the Omicron coronavirus variant eased after a study suggested the strain might be less severe than feared.

The risk of needing to stay in hospital for patients infected with the Omicron variant is 40% to 45% lower than those with the Delta variant, according to research by London's Imperial College published on Wednesday. read more

Saudi Arabia's benchmark index gained 0.6%, with Al Rajhi Bank rising 0.9% and petrochemical maker Saudi Basic Industries Corp finishing 1.4% higher.

Crude prices, a key catalyst for the Gulf's financial markets, were broadly stable.

However, fears over the potential impact on fuel demand from mobility restrictions have receded as the Organization of the Petroleum Exporting Countries, Russia and allies have left the door open to reviewing their plan to add 400,000 barrels per day of supply in January.

Dubai's main share index rose 0.6%, led by a 3.4% leap in top lender Emirates NBD Bank and a 1.1% increase in Emirates Integrated Telecommunications.

The Dubai market remains fundamentally strong and could recover more broadly as soon as more data on Omicron is made available, said Farah Mourad, senior market analyst of XTB MENA.

The Abu Dhabi index snapped four sessions of losses to close 0.4% higher, with telecoms firm Etisalat advancing 1.2%.

But, the Abu Dhabi index posted a weekly loss of 4.8%, its biggest since March 2020.

The Qatari index edged 0.1% higher, supported by a 0.9% gain in the Gulf's biggest lender Qatar National Bank.

Outside the Gulf, Egypt's blue-chip index climbed 1%, with Fawry for Banking Technology and Electronic Payment jumping 2.9%, after it announced plans to establish consumer finance company.

The Central Bank of Egypt said on Thursday it had extended measures to ease the impact of the coronavirus until June 2022.

((Reporting by Ateeq Shariff in Bengaluru; editing by Uttaresh.V))