PHOTO

Investors around the globe will be waiting for the outcome of the United States Federal Reserve's (Fed) meeting on Wednesday and the European Central Bank’s (ECB) meeting on Thursday to get more clues on the global economy.

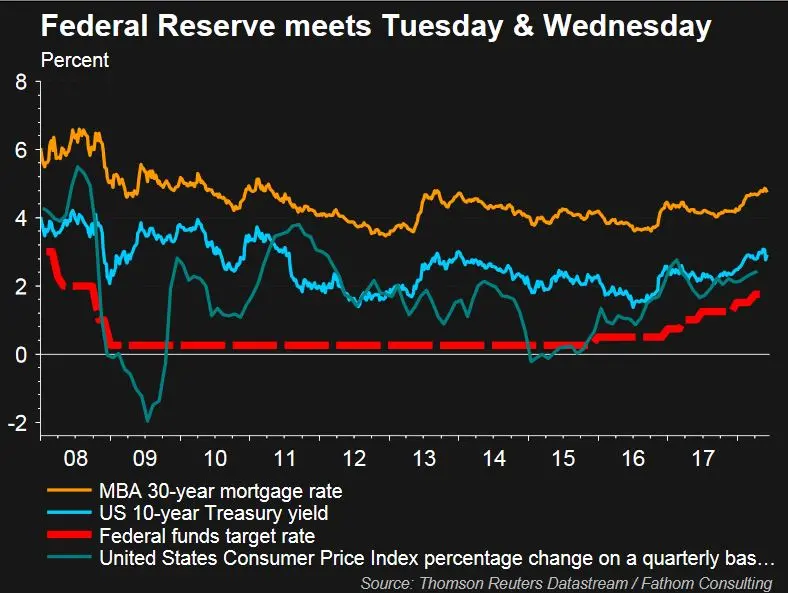

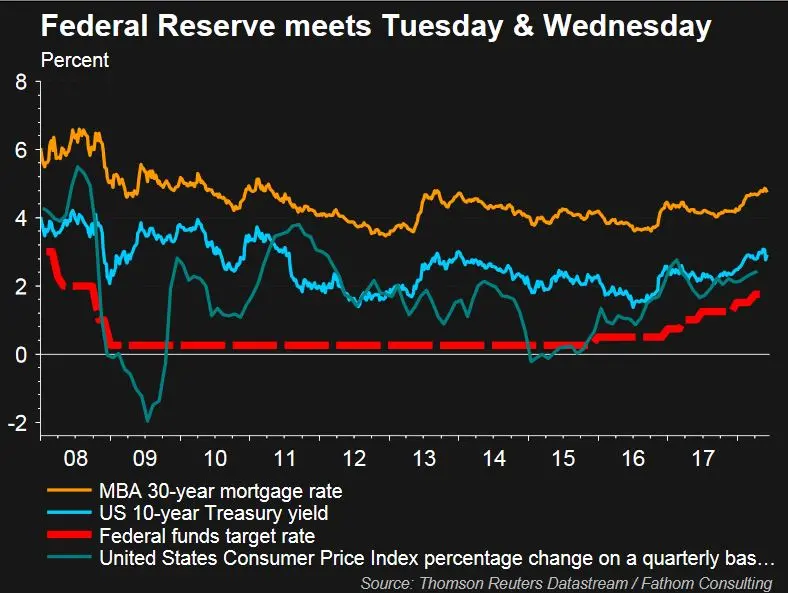

The Fed is likely to raise rates again on Wednesday by 25 basis points to a range of 1.75 percent to 2 percent.

“The domestic risks facing the US economy are arguably tilted to the upside,” ABN Amro economist Bill Diviney told Reuters.

“A significant amount of fiscal stimulus is coming on stream when the economy is by many measures close to full capacity, and growing at an above-potential pace.”

The ECB has already said the 2.55 trillion euro ($2.99 trillion) asset purchase program’s fate will be on the agenda on Thursday but ECB President Mario Draghi must decide whether to declare the end or wait until policymakers next meet in July.

Global markets

Wall Street stocks closed higher on Friday, trading in relatively low volumes ahead of the Fed meeting.

The Dow Jones Industrial Average rose 75.12 points, or 0.3 percent, to 25,316.53, the S&P 500 gained 8.61 points, or 0.31 percent, to 2,778.98 and the Nasdaq Composite added 10.44 points, or 0.14 percent, to 7,645.51.

For the week, the S&P rose 1.62 percent while the Dow added 2.76 percent and the Nasdaq gained 1.21 percent.

Commentary: Many investors expect on Wednesday the U.S. Federal Reserve to raise interest rates for the second time this year and the seventh since December 2015.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Middle East markets

Stock markets in the Middle East were mixed on Thursday.

The Saudi main index fell 0.5 percent as banking shares weighed on the index, with National Commercial Bank, the biggest lender, losing 0.5 percent, and Alinma Bank giving up 1.2 percent in heavy trade.

In Abu Dhabi, the index was up 0.2 percent as real estate developers Aldar Properties rose 1.4 percent and Rak Properties gained 1.5 percent. However, the index gains were held back by Dana Gas which fell 0.9 percent in heavy trade. Emirates Telecom was up 0.6 percent.

Neighbouring Dubai’s index was down 0.5 percent.

In Qatar, the main index fell 0.9 percent, dragged down by Qatar Gas Transport, which dived 4.4 percent in heavy trade and telecommunications firm Ooredoo which lost 2.2 percent.

Egypt's main index was flat to higher as it was held back by telecommunications shares which have been falling on expectations that the government will cut fuel and electricity subsidies in the next financial year. Orascom Telecom fell 1.4 percent and Global Telecom was down 0.7 percent.

Bahrain’s index was down 0.2 percent, Oman’s index rose 0.3 percent and Kuwait’s index added 0.6 percent.

Oil prices

Oil prices fell on Friday on concerns over Chinese demand after data suggested Chinese demand was waning and concerns lingered about growing U.S. output.

JP Morgan cut its 2018 crude forecast for WTI by $3 to $62.20 a barrel. The bank said geopolitical tensions and lingering risks of supply disruptions may push prices higher during the second half 2018, it expects prices will head lower late in the year, and remain capped in 2019.

Brent crude futures settled down 86 cents, or 1.1 percent, at $76.46 a barrel.

U.S. West Texas Intermediate (WTI) crude futures ended 21 cents lower at $65.74 a barrel. For the week, Brent fell 0.5 percent, while U.S. crude slipped 0.3 percent.

Currencies

The dollar recovered on Friday ahead of this week’s Fed meeting. The dollar edged off a three-week low rising against the euro.

Precious metals

Gold prices on Friday were pressured by a recovery in oil prices but were trading firm.

Spot gold inched up 0.1 percent to $1,298.11 per ounce by 1:35 p.m. EDT (1735 GMT), while U.S. gold futures for August delivery settled down 30 cents, or 0.02 percent, at $1,302.70 per ounce.

(Writing Gerard Aoun; Editing by Mily Chakrabarty)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018