In a world of falling real estate yields, African markets stand out as a haven of high yields, according to analysis published in Knight Frank’s inaugural Africa Horizons report.

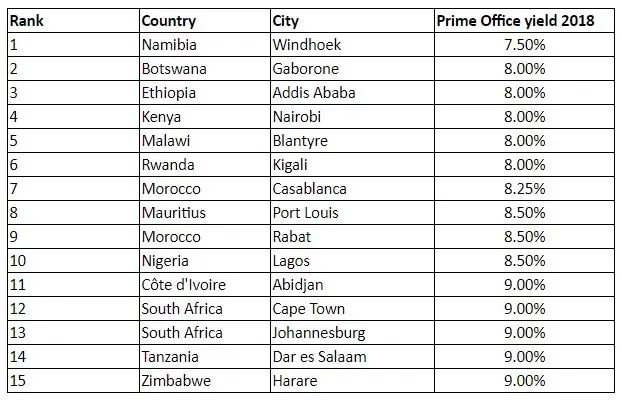

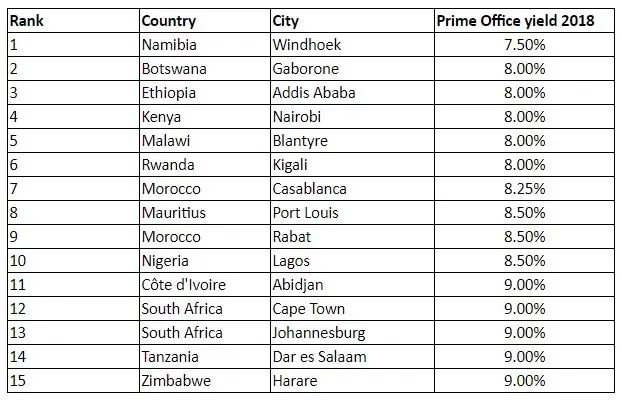

The report shows that of the 35 office markets covered, yields remained stable in 16 locations in the two years to 2018 and rose in six, while 13 markets recorded declines. Yields in key African locations remain higher than Europe and Asia Pacific, even in the most expensive locations, creating a value play for patient investors. Yields of 7.50%-8.00% for leading African cities look attractive compared to 3.00%-4.50% for major Western European cities.

Economic growth in Africa is forecast accelerate to 4% in 2019, according to the African Development Bank, with East Africa continuing to see the strongest growth at 6% due to diversification. This economic strength has meant that inward business investment has continued apace with more than 700 separate inward investment projects in 2017, with half originating from companies domiciled in the US, UK, France, China or Germany. Contrary to popular belief, the dominant source of inward investment was not China but rather the US with 130 projects in 2017.

Investment has also extended beyond the historical focus of infrastructure as international businesses bring services and products to markets that are experiencing globally unrivalled rates for population growth, urbanisation and consumer market expansion.

Peter Welborn, head of Africa, Knight Frank: “bilateral trade between the two regions has increased more than nine fold over the last two decades and as at 2018 stands at over US$65 billion. The UAE has been a key contributor to this growth, with bilateral trade growing almost 4,000% over the same period. Currently the UAE accounts for over 50% of the Middle East’s trade with the African continent.”

Kuwait, Qatar, Saudi Arabia are all involved in significant agricultural, port and telecom investments across Africa but the UAE is leading the way and is the ninth largest investor in Africa with 19 FDI projects in 2017, creating an estimated 74,000 jobs.

Dubai has become an interesting model for many African nations, some are putting in place very advantageous financial and regulatory incentives, similar to the Dubai model, trying to leverage advantages they have at a regional level to make themselves more attractive to FDI.

Rise in Wealth

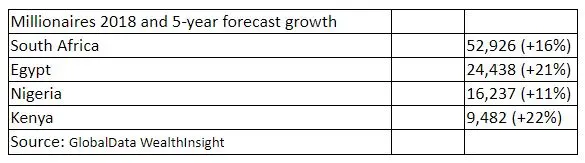

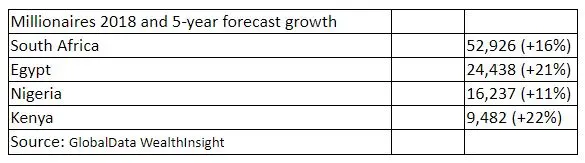

The number of Ultra-High-Net-Worth* individuals is set to grow by 20% over the next five years, with millionaires increasing by 22% in Kenya, 21% in Egypt, 16% in South Africa and 11% in Nigeria.

The rise of the middle class shows that, by 2023, almost 50% of African Households will have an annual income of over US$5,000. An increase of almost 50% from 2018. This will result in greater consumerism, more sophisticated patterns of spending and more private investment, particularly as stronger growth is predicted for higher income bands. Not only will this affect the retail sector, a growing number of Africans will be able to invest in their children’s future, resulting in higher school and university enrolment.

In addition, the percentage of the continent’s population living in urban areas is set to rise from 43% to 58% by 2048.This increased urbanisation will drive demand for office, education, hotels, healthcare and residential stock in key cities.

For further information, please contact:

Alice Mitchell, head of corporate communications, Knight Frank, +44 (0)20 7861 1738,alice.mitchell@knightfrank.com

Nicola Milton, Head of Marketing Middle East, Nicola.milton@me.knightfrank.com, +971 56 6116368

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank has more than 18,000 people operating from 523 offices across 60 territories. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit knightfrank.com.

*UHNWI – a person with US$30 million in net assets.

© Press Release 2019Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.