PHOTO

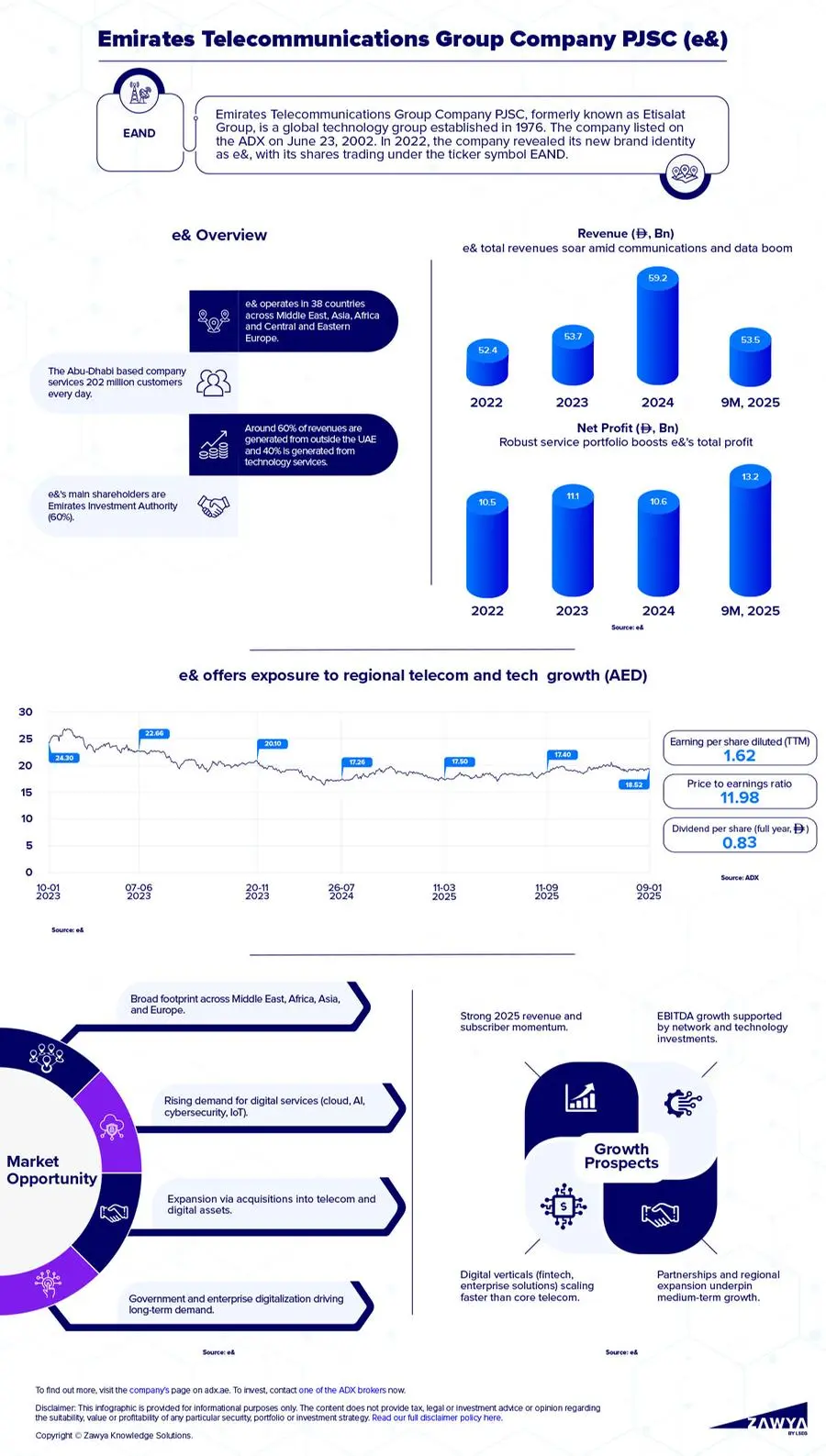

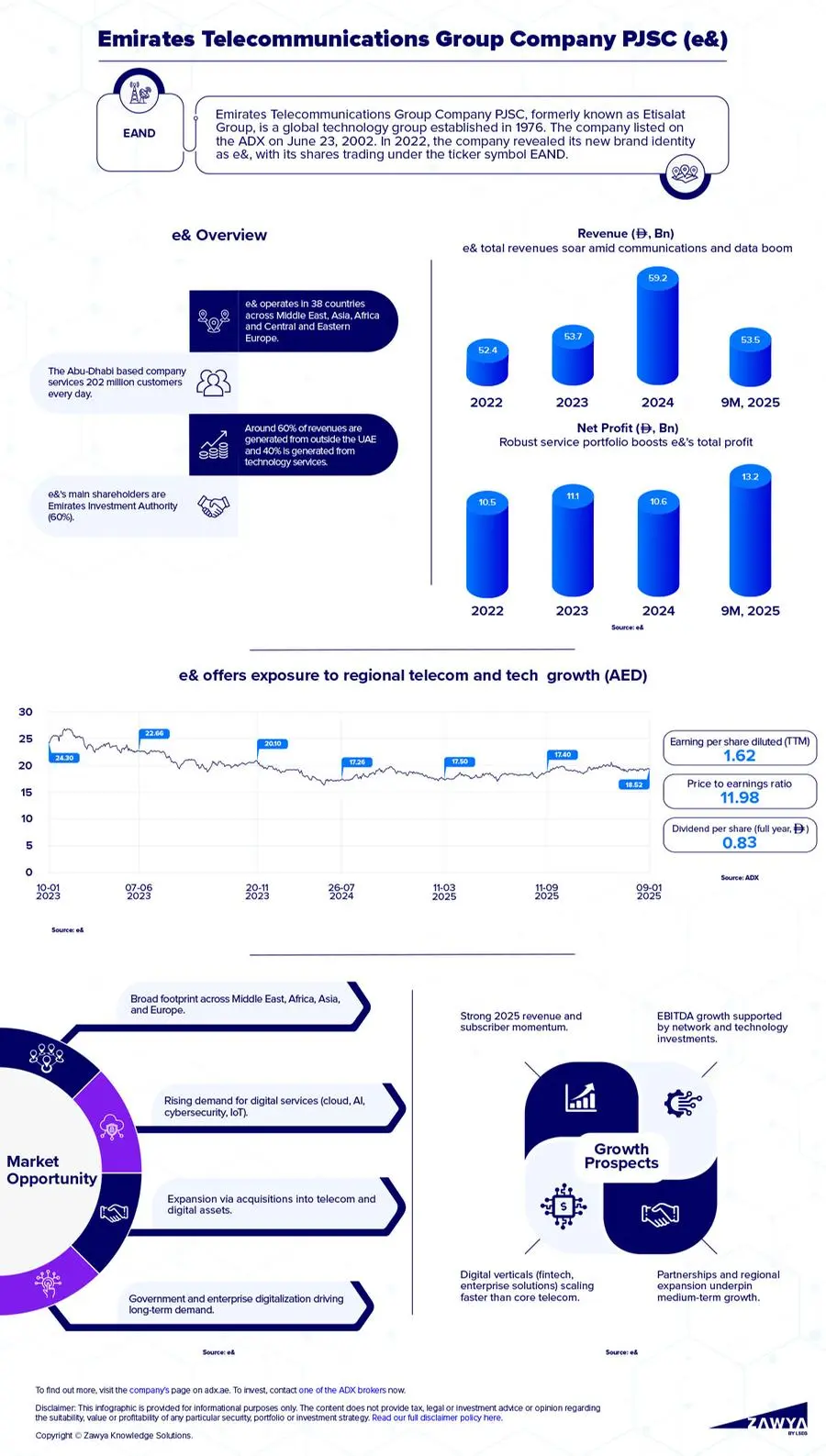

Emirates Telecommunications Group Company PJSC, rebranded as e& (formerly Etisalat Group), is a publicly listed telecommunications and technology conglomerate headquartered in Abu Dhabi. The company operates across the Middle East, Africa, Asia, and Central and Eastern Europe, delivering connectivity and digital services to a diversified subscriber base of more than 200 million.

e&’s business model integrates traditional telecommunications services – mobile, fixed broadband, and wholesale connectivity – with expanding digital verticals spanning enterprise IT solutions, cloud computing and data centre services, cybersecurity, fintech, and consumer digital lifestyle offerings. The conglomerate has transformed from a regional telecommunications company (telco) into a broader global technology group, positioning itself as a digital ecosystem player. It targets growth in technology-enabled segments across several emerging countries, including Saudi Arabia, Egypt, Hungary, and Pakistan, in addition to its home market, the UAE.

The company enjoys highly diversified revenue sources anchored in both legacy telecom operations and emerging digital services. Its pursuit of strategic acquisitions, international expansion, and investments in next-generation network infrastructure has made it one of the region’s most innovative and transformative organisations.

Click here to download infographic

STRATEGIC GROWTH DRIVERS

A key strategic driver for e& is the expansion of its international telecommunications footprint. As of 2025, the group has presence in 38 countries, contributing to a notable rise in overall subscribers. During the third quarter of 2025, another significant milestone was achieved with the aggregate subscriber base exceeding 202 million, reflecting a 14% year-over-year growth, driven both by organic additions and external consolidation effects. Given its coverage universe’s aggregated population of 1.1 billion, there appears to be plenty of headroom for organic growth.

The incorporation and scaling of e& PPF Telecom Group – a strategic joint venture operating in Eastern Europe (Bulgaria, Hungary, Slovakia, and Serbia) – also substantially broadened its European presence and diversified its geographic and revenue exposure.

Beyond core telecom operations, e& continues to scale its digital and enterprise verticals. These units include cloud services, cybersecurity, managed services, fintech platforms (through e& life), and digital ecosystem offerings tailored to both consumer and business segments. Over the past year, e& life has nearly doubled its revenue, driven by fintech and digital lifestyle services, underscoring the traction in new growth segments.

The enterprise segment also delivered steady growth, with cloud services and managed digital services contributing to a gradual diversification of revenue streams. Integrations such as acquisitions in cloud and enterprise IT services are intended to expand its high-margin service offerings.

e& has been continuously investing in next-generation technologies, including advanced 5G and optical fibre networks, which enable higher data throughput and broader service capabilities. As of the third quarter of 2025, the telco’s capital expenditure (excluding spectrum and licensing fees) reached AED 3 billion, supporting network densification and future readiness.

These network enhancements not only improve service quality in existing markets, but also lay the groundwork for new revenue streams linked to enterprise digital transformation, private network deployments, and Internet of Things (IoT) solutions, underpinning its corporate digital strategies.

INVESTMENT OUTLOOK

The company’s financial performance over the past decade has been robust, reflecting telecom growth in the region and rising demand for data, mobile services, communications, and social media.

Consistent earnings before interest, taxation, depreciation and amortisation (EBITDA) growth supports the view that e&’s fiscal fundamentals remain intact despite ongoing investments and integration activities. Net profit has also seen a strong year-to-year increase, driven by both operational expansion and consolidation synergies.

e&’s capital allocation strategy prioritises both growth investment and shareholder return, evidenced by a progressive dividend policy introduced in 2024. During that year, the group also declared a dividend per share of 83 fils, with plans for incremental increases through 2026.

Robust free cash flow and a manageable net debt profile (Net Debt/EBITDA ~1.11x as of Q3 2025) provide the financial flexibility to continue funding network expansion, strategic acquisitions, and digital vertical scaling without materially compromising its balance sheet strength.

e& operates in multiple emerging and frontier markets, which could expose it to currency volatility, regulatory shifts, and economic cycles that can affect revenue stability and margin performance. Consolidation effects also introduce integration risk and near-term cost increases.

As competition in both telecom and digital services intensifies globally, margins in new digital segments may lag core telecom operations until scale is achieved. Additionally, capital requirements for continuous infrastructure upgrades remain significant, and prudent allocation will be necessary to balance growth and returns.

e& represents a strategically diversified telecom and technology group with a broad global footprint, a growing subscriber base, and expanding digital revenue streams.