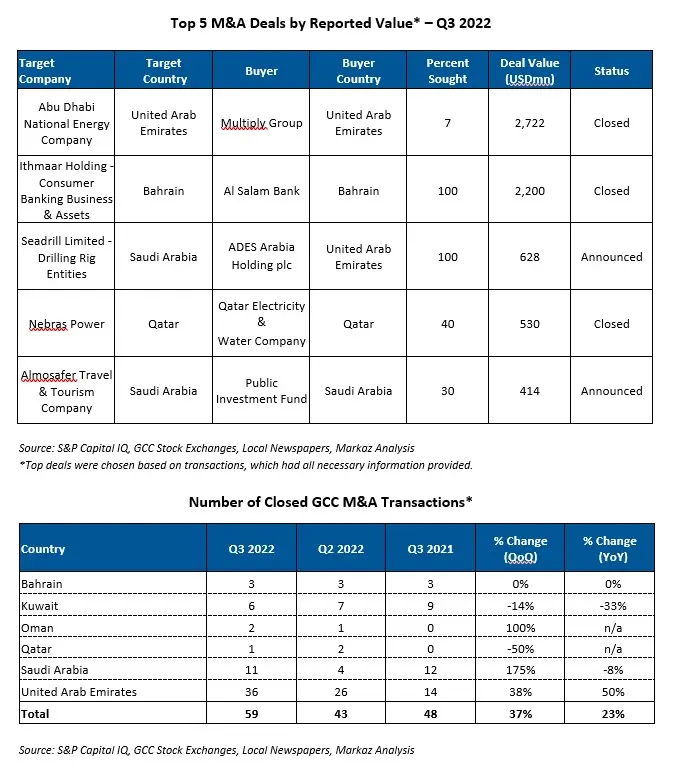

Kuwait: Multiple Group leads the top GCC M&A transactions during Q3 2022 as per a report recently issued by the Investment Banking Department at Kuwait Financial Centre “Markaz”. The report highlights the USD 2.7 billion transaction that was announced by the Emirati company whereby it acquired a 7% stake in Abu Dhabi National Energy Company.

Following this is Al Salam Bank, who recorded the second largest transaction when it sealed its USD 2.2 billion acquisition of Ithmaar Bank’s consumer banking businesses alongside a portfolio of sukuk issued by the Government of Bahrain and the group’s indirect shareholdings in Bank of Bahrain and Kuwait, Solidarity Group Holding, Mastercard Inc. and the Benefit Company. ADES Arabia Holding plc took on the following transaction, penning a binding agreement with Seadrill Limited to acquire the shares of seven of its entities, each of which owns and operates a jack up drilling rig, for a total consideration of USD 628.0 million. The company expects to seal the deal in Q4 2022, upon obtaining regulatory approvals. Moreover, Qatar Electricity & Water Company (Qatar Electricity) finalizes it acquisition of a 40% stake in Nebras Power for a total consideration of USD 530.0 million, upon which it became the sole owner of the company. Qatar Electricity acquired this stake from Qatar Holding L.L.C. through its wholly owned subsidiary, Raslaffan Operating Company W.L.L. Lastly, the Saudi Public Investment Fund signed a non-binding agreement to acquire a 30% stake in Almosafer Travel & Tourism Company from Seera Group Holding for a total consideration of USD 413.8 million, which includes an earn out component amounting to USD 102.8 million. This is based on an enterprise value of USD 998.6 million.

GCC M&A Growth

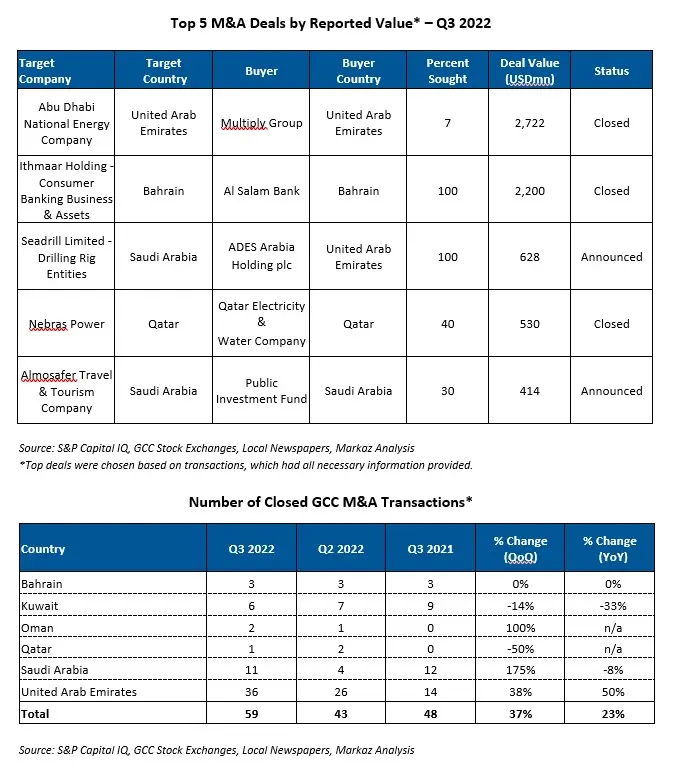

According to Markaz’s report, the GCC market sealed a total of 59 transactions throughout Q3 2022, which implies a growth of 23% year over year. Saudi Arabia recorded the greatest level of growth quarter of quarter, at 175%, while United Arab Emirates recorded the greatest level of growth year over year, at 50%.

Acquirers and Targets

The majority of closed transactions during Q3 2022 and Q3 2021 were carried out by GCC acquirers. Of the total number of transactions that closed during Q3 2022, GCC acquirers accounted for 74% while foreign acquirers accounted for 19%. The remaining 7% represents transactions for which the buyer information was not available. GCC acquirers also dominated the market during Q3 2021 as they accounted for 69% of the total number of closed transactions while foreign acquirers accounted for 27%. Once again, the remaining 4% represents transactions for which the buyer information was not available.

Furthermore, GCC acquirers primarily invested in companies within their local markets and in international markets, and targeted regional companies to a lesser extent. Throughout Q3 2022, GCC acquirers closed a total of 39 transactions within their local markets, compared to 23 transactions in Q2 2022[1]. In addition, GCC acquirers sealed 18 cross-border transactions throughout Q3 2022, relative to 24 cross-border transactions in Q2 2022. It is worth noting that UAE buyers accounted for approximately 44% of the total number of cross-border transactions that closed in Q3 2022, followed by Saudi Arabia and Kuwaiti, who accounted for 33% and 17%, respectively.

Foreign Buyers

The GCC market received a slightly lower level of interest from foreign buyers in Q3 2022 compared to Q2 2022 and Q3 2021. Throughout Q3 2022, foreign buyers closed 11 transactions compared to 15 transactions in Q2 2022 and 13 transactions throughout Q3 2021. The UAE continued to be an attractive contender compared to its GCC constituents which is evident as they accounted for all of the foreign-led transactions that closed throughout the quarter.

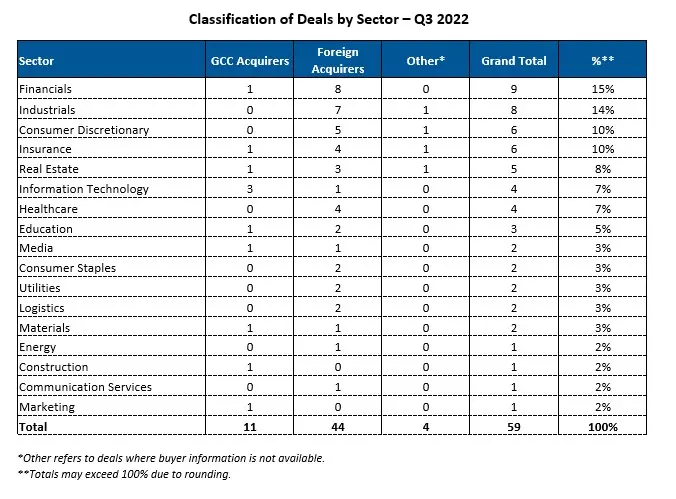

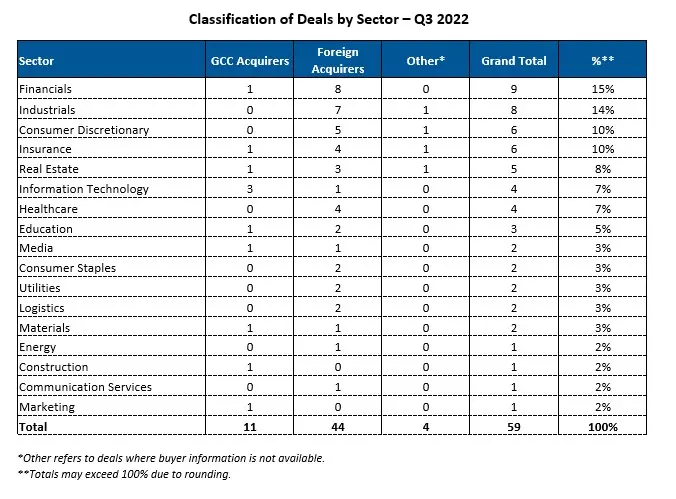

Sectorial View

Moreover, the transactions that closed throughout Q3 2022 targeted companies that operate across various sectors, highlighting another trend that has remained strong throughout the past few quarters. With that being said, the sectors that witnessed the greatest level of activity throughout Q3 2022 were the Financials, Industrials, Consumer Discretionary and Insurance sectors. Collectively, these four sectors accounted for 49% of the transactions that closed throughout the quarter.

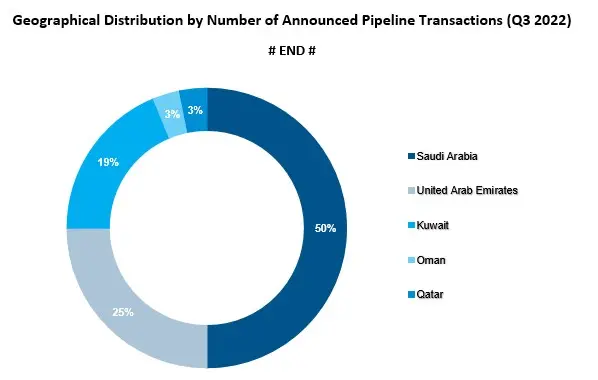

Deals in the Pipeline

By the end of Q3 2022, there was a total of 32 announced transactions in the pipeline, which is relatively stable compared to Q2 2022, which ended with 30 transactions announced. The majority of these transactions involved Saudi targets, who accounted for 50% of the total number of announced deals, followed by United Arab Emirates and Kuwait at 25% and 19%, respectively. The remaining transactions involved Omani and Qatari targets while Bahrain ended the quarter with no transactions in the pipeline. It is worth noting that Saudi Arabia and Kuwait were the only two markets that witnessed growth in its pipeline relative to the previous quarter.

-Ends-

About Kuwait Financial Centre “Markaz”

Management and investment banking institutions in the MENA region with total assets under management of over USD 3.67 billion as of 30 September 2022. Over the years, Markaz has pioneered innovation through developing new concepts resulting in creation of new investment channels. These channels enjoy unique characteristics, and helped Markaz widen investors’ horizons. Examples include Mumtaz (the first domestic mutual fund), MREF (the first real estate investment fund) and Forsa Financial Fund (the first and only options market maker in the GCC since 2005), all conceptualized, established and managed by Markaz. Markaz was listed on the Boursa Kuwait in 1997.

For further information, please contact:

Sondos S. Saad

Media & Communications Department

Kuwait Financial Centre K.P.S.C. "Markaz"

Email: ssaad@markaz.com