PHOTO

- Middle East and North Africa syndicated loan issuance exceeded bond issuance in 2018

- Refinancing activity more than doubled in 2018

- Sovereigns dominated the bond issuance landscape, accounting for 61.5%

Dubai: Debtwire, the provider of high value news, data and analysis on global debt markets, has released research showing that Middle East & North Africa (MENA) syndicated loan issuance in 2018 outpaced bonds at USD 133 billion compared to USD 89.5 billion. The largest bond issued in 2018 was by the Government of Qatar, at USD 12 billion, and the largest syndicated loan was a USD 16 billion refinancing by the Government of Saudi Arabia, according to data from Debtwire Par.

Elias Lambrianos, CEEMEA Deputy Editor at Debtwire, commented:

“Loan volumes were boosted by opportunistic refinancing activity, and several mega deals such as Saudi Arabia’s USD 16 billion club loan and its sovereign wealth fund, the Public Investment Fund’s USD 11 billion syndicated facility. The withdrawal of bond plans by several issuers during the fourth quarter also paved the way for loans to surpass bonds in 2018. In 2019, the perennially active MENA region could be the great hope for debt capital market bankers, although most remain cautious.”

The Gulf Cooperation Council (GCC) dominated MENA loans and bonds volume in 2018 with 81% and 91%, respectively. However, North Africa loan volume more than doubled from 2017, squeezing out market share from GCC and ‘Others’ (comprising Iraq and Iran). This was the result of an increase by 10 deals in Egyptian loan activity, adding USD 16 billion to the region and 91.5% to North African activity. Despite bond market volumes decreasing in the region by 28% year on year, North Africa’s market share was relatively stable from 2017, at 8%.

Across the region, the most prolific borrower type for bonds was sovereigns, contributing USD 55 billion, or 61.5%. This represented a 33.2% decrease on a year-on-year basis. Corporates accounted for a quarter of loan market issuance at USD 33.6 billion, or 25.3%, representing a 32% increase compared to 2017. Saudi Arabian sovereign issuance occupied a substantial portion of total loan and bond market activity, contributing 30.8% and 37% respectively.

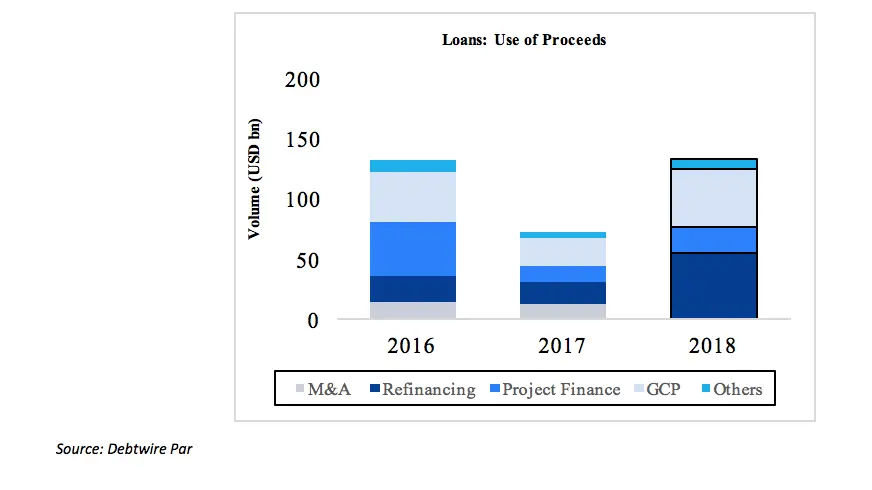

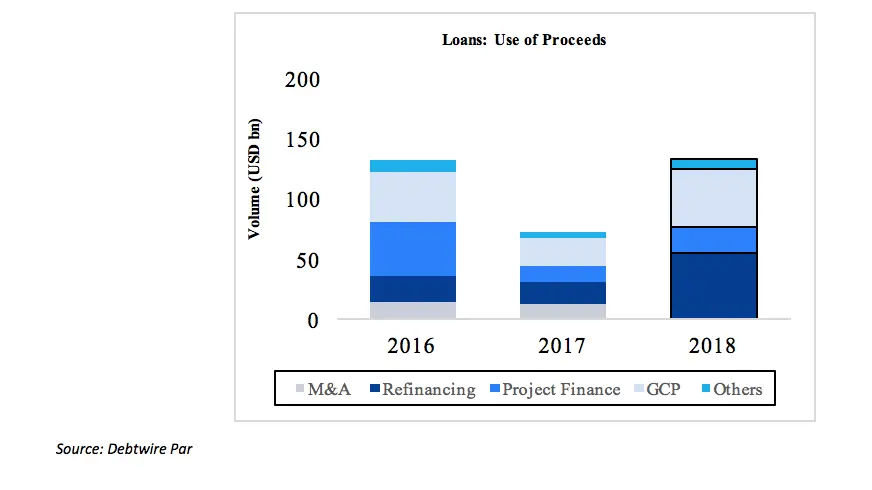

From 2016 to 2018, use of proceeds for M&A, project finance and general corporate purposes (GCP) have jumped significantly. Refinancing activity more than doubled in 2018 to total USD 55 billion, which was predominantly made up of USD 36 billion from Saudi Arabia and the United Arab Emirates (UAE). General corporate and refinancing dominated use of proceeds in 2018, with Saudi Arabia, United Arab Emirates (UAE) and Qatar collectively accounting for 75.5% share of issuance. The third most significant use of proceeds in the region, following refinancing and GCP, was project finance. In 2018, it represented a significant portion of issuance in Egypt, the UAE and Oman, accounting for 37%, 20% and 20% respectively.

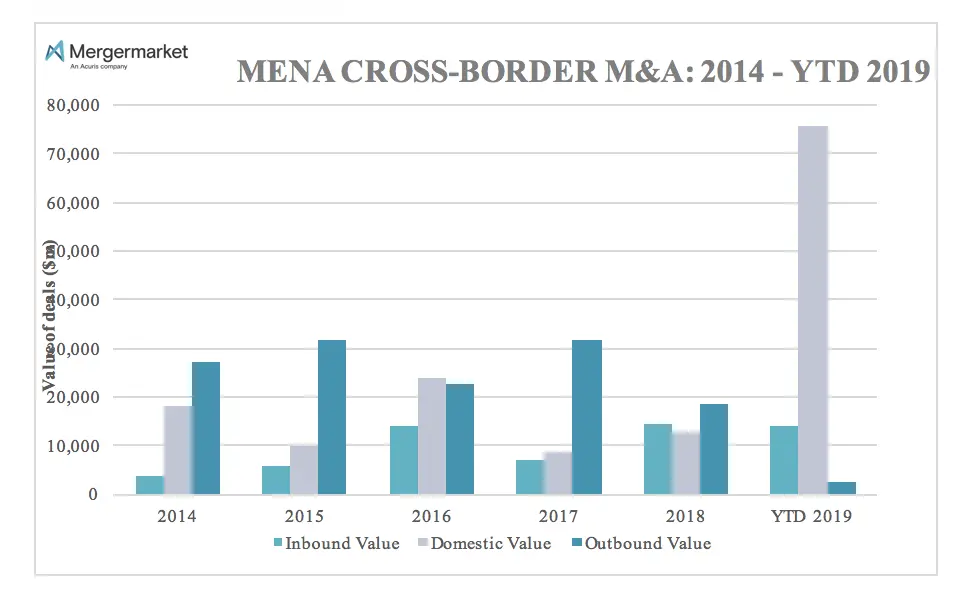

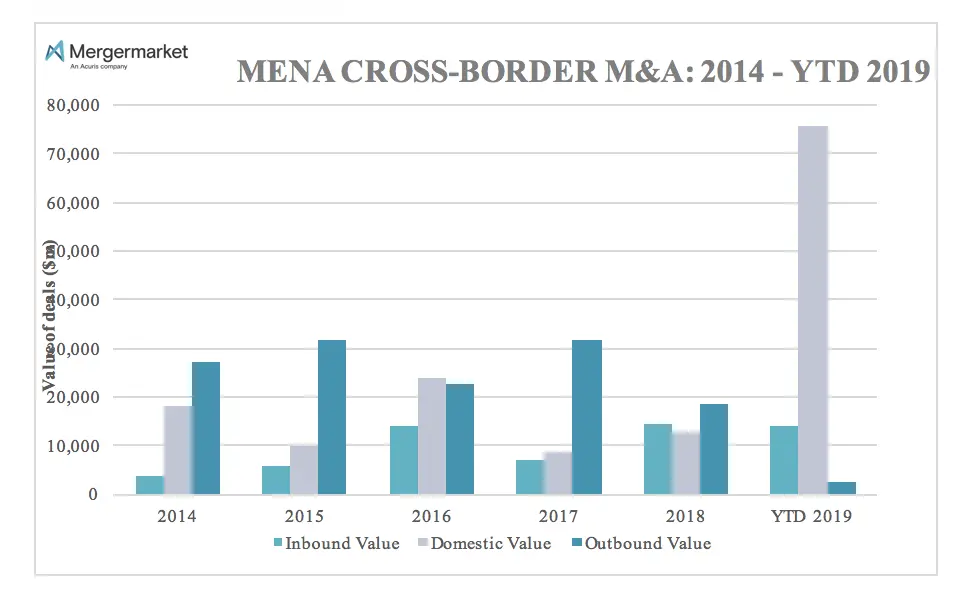

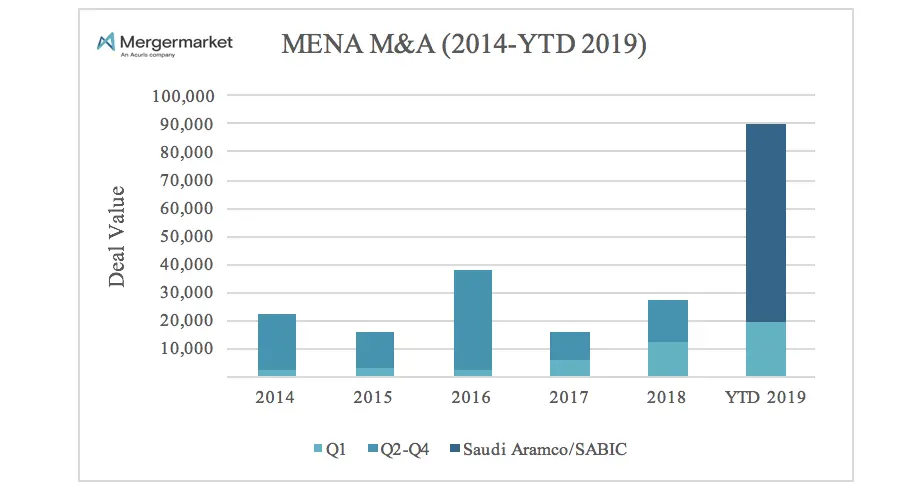

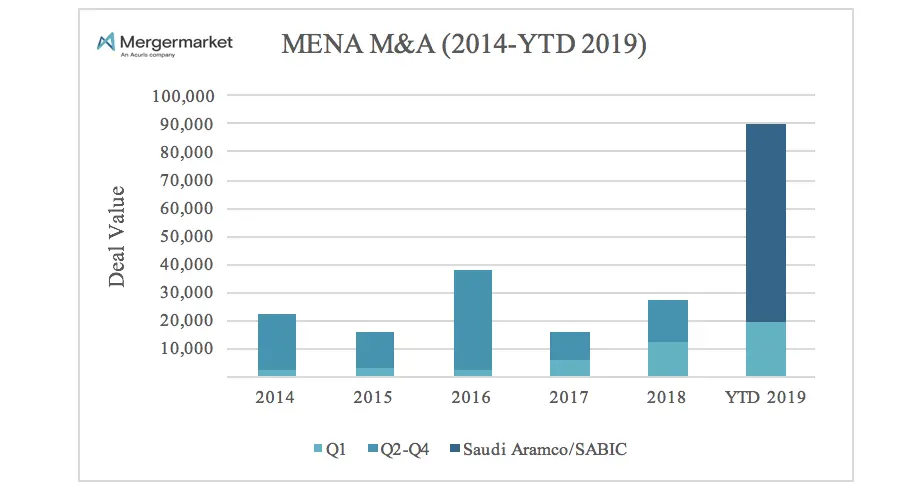

Debtwire’s sister company, Mergermarket, will host the 2019 edition of its MENA Mergers Forum in Dubai on 10th April 2019. The event will take place in partnership with EY, Baker McKenzie, Cleary Gottlieb, Intralinks and Instinctif Partners, and will be attended by corporate development and M&A teams, private equity professionals, business owners, investment bankers, financial advisors, lawyers and transaction services professionals.

Media enquiries

Diana Estupinan

Instinctif Partners

E: diana.estupinan@instinctif.com

T: +971 (0) 4369 9353

Ioiana Luncheon

PR Manager, EMEA

Acuris

E: ioiana.luncheon@acuris.com

T: +44 (0)20 3741 1391

About Debtwire

Part of the Acuris family, Debtwire provides high value news, data and analysis on debt markets worldwide. We are the only intelligence service that reports and researches on debt situations before they break in the market. Our solutions span real time news, in-depth credit analysis, data, covenant research, specialist coverage of structured finance and municipal bond markets. For more information visit https://www.debtwire.com/info/

About Debtwire Par

Part of the Acuris family, Debtwire Par transforms the way financial professionals gain insight into the global performing credit markets. Debtwire Par tracks more than $15 trillion worth of global deals and counting, including current and closed deals as well as retired debt. It invested in a highly experienced team of experts, assembled from across the industry, and innovative technology for wide-ranging, yet in-depth coverage at all times. For more information visit https://try.debtwire.com/primary-issuance/

About MENA Mergers 2019

MENA Mergers 2019 will include will focus on the main deal drivers in the MENA M&A market and look ahead to the key investment trends likely to be seen during the coming year. Panels, presentations and case studies will be given by representatives of the Middle East’s leading corporates, investment banks, private equity funds and financial and legal advisory firms. The event will be attended by corporate development and M&A teams, private equity professionals and business owners, investment bankers, financial advisors, lawyers and transaction services professionals. Mergermarket will host MENA Mergers at Jumeirah Emirates Towers, Dubai, on 10th April, in strategic partnership with EY, Baker McKenzie, Cleary Gottlieb, Intralinks and Instinctif Partners. The forum will be followed by Mergermarket’s third annual Middle East M&A Awards, celebrating excellence in M&A legal and financial advisory in the region. For more information: https://events.mergermarket.com/dubai

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.