PHOTO

- Al-Dakhil: This is a strategic step towards reshaping the customer’s digital banking experience.

- The revamped platform represents a turning point in customer engagement with banking services.

- We strongly believe that real innovation stems from understanding customers’ needs and providing solutions beyond their expectations.

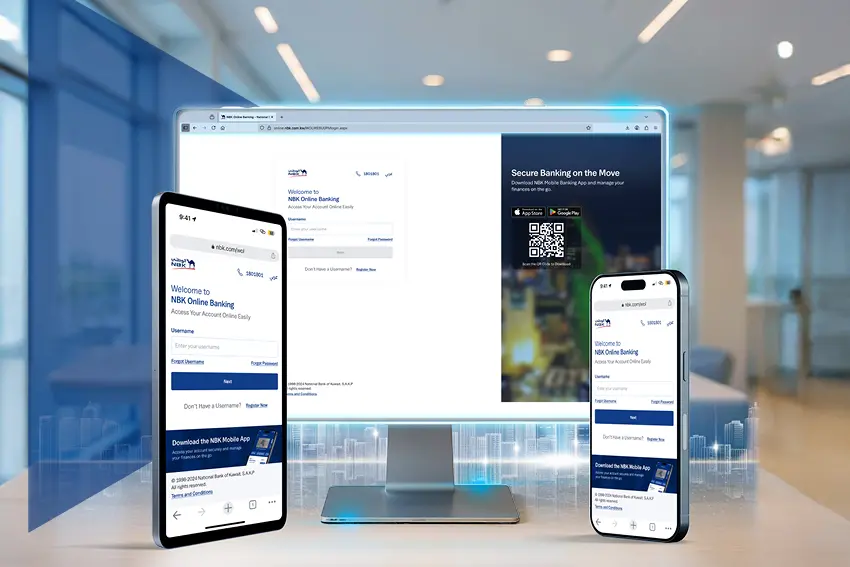

In a step that reflects its commitment to prioritizing customer experience and meeting their expectation with innovative solutions, National Bank of Kuwait announced the complete revamp of its online banking platform, allowing customers to enjoy a more engaging, efficient, and flexible experience as they manage their finances anywhere and at any time.

The revamped platform features a modern, intuitive design and provides an effortless and smart experience through its new user interface, enhanced dashboard, and faster transactions, reflecting NBK’s customer-centric approach to innovation and digital transformation.

The revamped platform features a remarkable modern design and provides an effortless and smart experience with its new user interface, enhanced dashboard, and faster transactions, which reflect NBK’s customer-centered innovative and digital transformative approach.

NBK’s upgraded online platform enables customers to easily navigate through the available banking services, which have been largely enhanced to ensure fast access to the desired service.

These distinguished features include:

Evolutionary Digital Experience: Fresh and responsive interface, delivering a smoother digital banking experience that adapts seamlessly across devices like Laptops, Tabs and Mobile, operating systems, and browsers. The enhanced User Interface provides a familiar, yet richer User Experience aligned with our award-winning NBK Mobile app.

Easier Navigation: The new platform smartly lists an easy-to-use actions that allow customers to have instant access to services with fewer clicks, thanks to the “quick actions” section that group all your relevant and favorite actions.

Enhanced Efficiency: All accounts and products are now consolidated in one centralized dashboard, providing a comprehensive view of your banking relationships. Intelligent menu navigation enables customers to apply for new products, transfer funds to new and existing beneficiaries, pay bills and manage account settings- all from a single, organized interface.

Futuristic Architecture: The platform is powered by next-generation web architecture designed for future of digital banking. Embedded with state-of art security measures, customers can bank with confidence, while enjoying unparalleled speed and responsiveness.

On this occasion, Mr. Mohammad Al-Dakhil, AVP – Head of Digital Banking Channels at NBK, commented: “By revamping our online banking platform, NBK has taken a step towards reshaping customer digital banking experience with a smarter interface, quicker performance, and a design that prioritizes ease of use”.

Al-Dakhil also added: “At NBK, we believe that real innovation stems from understanding customers’ needs and providing solutions beyond their expectations. This is why we were keen to make this platform a true reflection of NBK’s digital transformation vision, as it will enable them to confidently and flexibly manage their finances whether on computers or mobile devices”.

Furthermore, Al-Dakhil highlighted that NBK’s revamped online banking platform represents a turning point in customer engagement with banking services, reaffirming the bank’s leadership in innovation and digital transformation, in addition to its commitment to giving customers the best services possible.

The revamp is part of NBK’s strategy of providing comprehensive customer-centered digital solutions that can keep up with the fast-paced banking sector developments and provide a smart banking environment where customers manage their finances with top flexibility and confidence.

Thanks to its continuous digital investments, NBK is committed to providing world-class banking services that meet the diverse needs of customers and their different lifestyles.