PHOTO

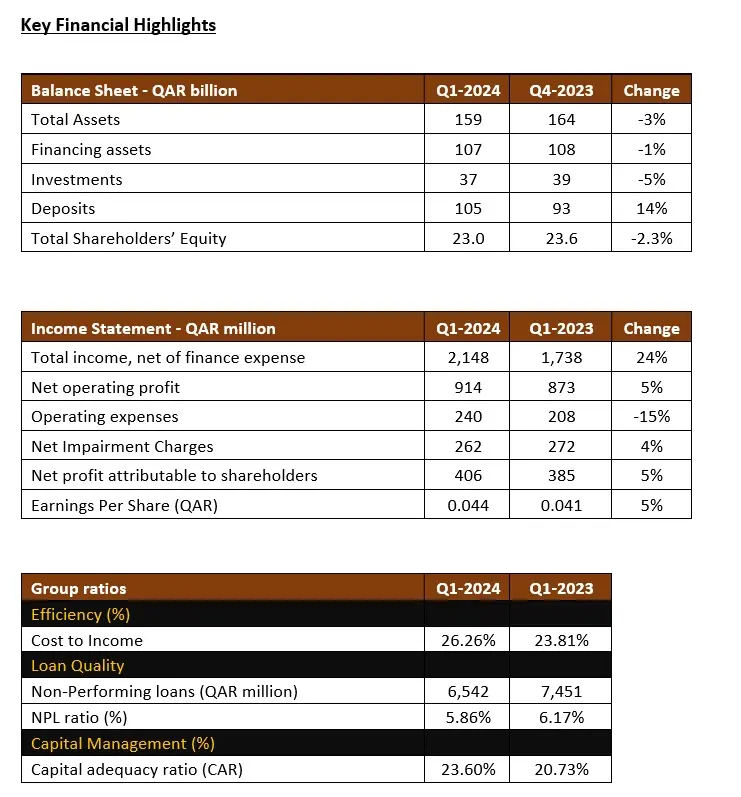

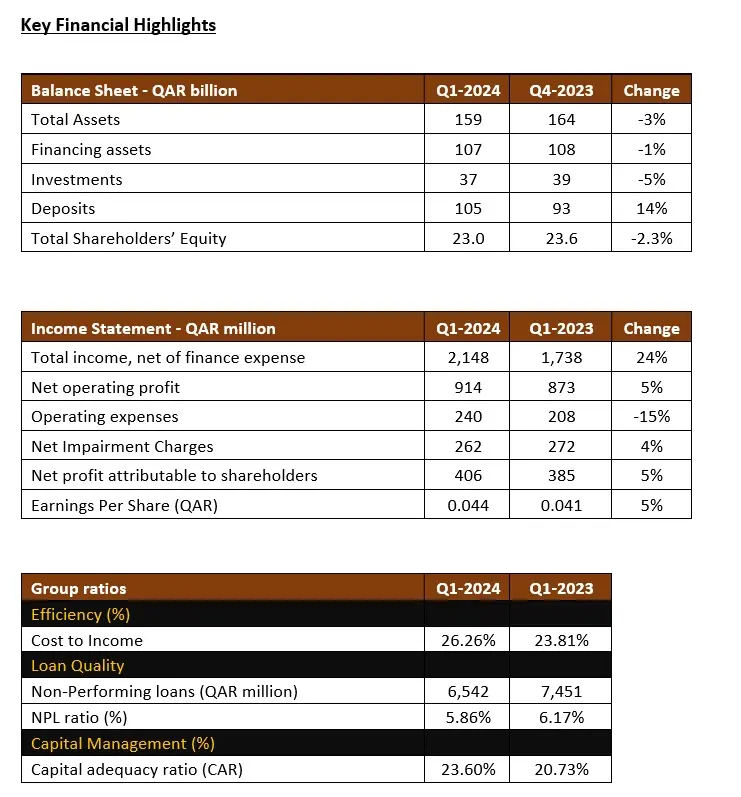

- Total Income net of Finance expense reached QAR 2.15 billion, compared to QAR 1.74 billion for Q1 2023;

- Net financing assets closed at QAR 107.0 billion and Deposits at QAR 105.3 billion

- Cost to Income (efficiency) ratio 26.26%

- The Capital Adequacy ratio stood at 23.60%

Doha: Masraf Al Rayan Q.P.S.C today released its consolidated financial statements for the three-month period ended 31 March 2024 with a Net Profit attributable to the equity holders of the bank of QAR 406 million.

His Excellency Sheikh Mohammed Bin Hamad Bin Qassim Al Thani, Chairman of the Board stated:

“We have delivered a solid performance across our operations in Qatar and overseas. Our total income (net of Finance expenses) and net operating income rose by 24%, and 5% respectively compared to Q1-2023.

During this quarter, we have finalized our new medium-term strategy, that aims to improve our banking services and maximize our shareholders’ value.

Commenting on Q1 financial performance, Fahad Bin Abdulla Al Khalifa, Group Chief Executive Officer said:

“We are pleased to announce Q1-2024 net profit of QAR 406 million, which is up by 5.5% compared to the first quarter last year. Our overall key financial indicators remain strong; the bank’s financing portfolio stood at QAR 107 billion, total assets at QAR 159 billion, and capital adequacy robust at 23.60%. Our efficiency ratio is healthy at 26.26%, and we continue to improve it across all functions of the business.

He added, “Our primary focus is delivering an increased value to our shareholders, by improving our technological services and providing seamless customer experience, while preserving prudent risk management.”

-Ends-

For further information please visit our investor relations page on our website https://www.alrayan.com or contact our Investor Relations team at IR@alrayan.com