PHOTO

Abu Dhabi, July 24, 2016

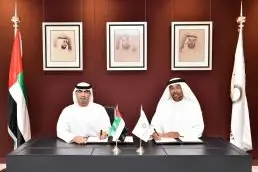

Abu Dhabi Securities Market (ADX) and Abu Dhabi Global Market (ADGM) have entered into an agreement to foster bilateral cooperation. The Memorandum of Understanding was signed at ADGM Office on XXX 2016 by His Excellency Hamad Abdullah Al Shamsi, Chairman of ADX, and His Excellency Ahmed Al Sayegh, Chairman of ADGM. The ceremony was well attended by senior officials from both organisations.

The agreement supports ADX's commitment to the growth of the financial services sector in the Emirate of Abu Dhabi and the development of a sustainable financial environment under the auspices of Abu Dhabi Vision 2030. The MoU establishes a framework that strengthens the bilateral cooperation between ADX and ADGM. It reinforces ADX's ongoing efforts to collaborate with financial centres in the region and globally.

With the MoU, ADX and ADGM can jointly explore and develop financial products and services that will further boost the economic growth and investment sector of Abu Dhabi. Both entities will set up a working group to develop strategic objectives and cooperation initiatives. The MoU will also enable both organisations to work on key areas such as provision and exchange of expertise, financial markets assistance and cooperation, training and others.

His Excellency Hamad Abdullah Al Shamsi, Chairman, ADX, said: "We look forward through this MoU to create new opportunities to promote further cooperation and synergy between the two markets and in various fields. We hope this agreement will contribute to strengthening the level of coordination between us which will benefit our joint activities and contribute to the economic growth in the Emirate of Abu Dhabi."

He added: "ADX is committed to achieving the vision of the Abu Dhabi government by strengthening the capital market, developing a system for asset and wealth management, channelling financial surpluses in the financial sector towards investing in the core sectors, and activating non-traditional financing methods. Economic diversification alongside focusing on non-oil sectors is one of the main long-term goals of Abu Dhabi Economic Vision 2030."

His Excellency Ahmed Al Sayegh, Chairman, ADGM said: "The MoU is a strategic and symbolic extension of our close relationship with Abu Dhabi Securities Exchange. ADX has been an important contributing partner since the inception of ADGM and continues to be a significant stakeholder in the development of Abu Dhabi as an international economic hub. This collaboration allows both teams to work closely in establishing the objective of an exchange in ADGM. In addition, we will explore and develop a wider range of financial products and service offerings that can be available to, and traded by, both local and global market participants and investors in ADGM."

He added: "United by the mission of furthering Abu Dhabi's economic and financial growth, ADGM will continue to work closely with stakeholders to develop the ecosystem, support local institutions to become regional and global champions, and welcome international institutions to anchor themselves in Abu Dhabi. As an international financial centre, we are committed to provide a sustainable business and financial eco-system that will continually draw leading companies and healthy investments into our marketplace and support financial and non-financial entities in Abu Dhabi and the UAE to thrive."

-Ends-

About Abu Dhabi Securities Market (ADX)

The Abu Dhabi Securities Exchange (ADX) was established on November 15 of the year 2000 by Local Law No. (3) Of 2000, the provisions of which vest the market with a legal entity of autonomous status, independent finance and management. The Law also provides ADX with the necessary supervisory and executive powers to exercise its functions.

These functions are:

ADX is a market for trading securities; including shares issued by public joint stock companies, bonds issued by governments or corporations, exchange traded funds, and any other financial instruments approved by the UAE Securities and Commodities Authority (SCA).

At the end of 2015, ADX had 71 listed securities with a market capitalization of AED 447 billion (USD 122 billion). Those securities include 66 public joint stock companies, 2 private joint stock companies, 1 Exchange Traded Fund (ETF), 1 Abu Dhabi Government

Fund, and 1 convertible bond. ADX listed companies are allocated in nine sectors; Banking, Real Estate, Consumer Staples, Investment and Financial Services, Industrial, Telecommunication, Services, Energy, and the Insurance sector.

ADX allows for investors to trade through any of the registered brokerages at the exchange through advanced electronic automated services. ADX has also signed a number of agreements with major financial institutions to provide for custody services, including renowned international corporations; namely the National Bank of Abu Dhabi (NBAD), HSBC, Standard Chartered, Deutsche Bank and Citi Banking Group.

ADX goals are in line with Abu Dhabi Government Economic Vision 2030. The 2030 economic plan plays a vital role in ADX strategy since it places the financial market in the context of economic and social development. The development would be through diverting savings towards investment in the various economic sectors and developing the financial infrastructure of Abu Dhabi to transform the emirate into one of the leading finance and services center in the region.

In 2014, ADX was upgraded to 'Emerging Market' status by both MSCI index (Morgan Stanley Capital International) and S&P Dow Jones, thus greatly increasing the likelihood of inward global investment flows. ADX was already classified as an Emerging Market by FTSE in 2009 and in 2011 by S&P and Russell Investments.

In 2015, ADX won the Most Innovative Exchange GCC 2015 Award. The award, given by Capital Finance International, celebrates achievement, innovation from an international perspective, recognizing organizations with innovative technology products backed by strong management, excellent service standards and sound business models. Capital Finance International is a leading print journal and online resource reporting on business, economics, and finance.

For more information, please contact:

Adel Al Dhaheri

Manager of Corp.Comm. & Digital Mktg Relations

Abu Dhabi Securities Exchange

Telephone No: +971 (2) 612 8716

Fax No: +971 (2) 612 8728

Mobile No: +97150 622 12 66

E-mail address: adelm@adx.ae

Wafa Al Marzooqi

Marketing Officer

Abu Dhabi Securities Exchange

Email: almarzooqiw@adx.ae

Telephone: 02-6128746

About Abu Dhabi Global Market

Abu Dhabi Global Market (ADGM), an international financial centre in the capital city of the United Arab Emirates, was established by Federal Decree in 2013 and opened for business on 21st October 2015.

In line with the Abu Dhabi's Economic Vision, ADGM is a natural extension of Abu Dhabi's role as a reliable and responsible member of the global financial community. Strategically situated in the heart of one of the world's largest sovereign wealth funds, ADGM plays a pivotal role in positioning Abu Dhabi as a global centre for business and finance that connects the growing economies of the Middle East, Africa and South Asia.

ADGM's three independent authorities, the Registration Authority, the Financial Services Regulatory Authority and ADGM Courts, enable registered companies to conduct business in a zero-percent tax environment and operate with confidence within an international regulatory framework with its own independent judicial system and legislative infrastructure based on the Common Law.

Established as a broad based financial centre, ADGM's foundation is anchored on three of Abu Dhabi's strategic strengths - private banking, wealth management and asset management and will continually expand its financial services in response to the needs of its businesses and marketplace.

Abu Dhabi Global Market is located on Al Maryah Island, a 114-hectare development that is home to world-class business and lifestyle facilities such as the Rosewood and Four Seasons Hotels and Residences, the first ever specialty Cleveland Clinic Hospital outside of USA, luxury retail at the Galleria Mall, and grade-A offices spaces to meet Abu Dhabi's long-term development and economic needs. All these complement ADGM's international financial centre position as a vibrant destination in the capital city in Abu Dhabi. For more details of ADGM, please visit www.adgm.com

For further enquiries, please contact:

ADX Communications Team

Joan Lew, Senior Manager, Communications

Email: joan.lew@adgm.com, Telephone: +971 2 333 8858

Online: www.adgm.com

© Press Release 2016