PHOTO

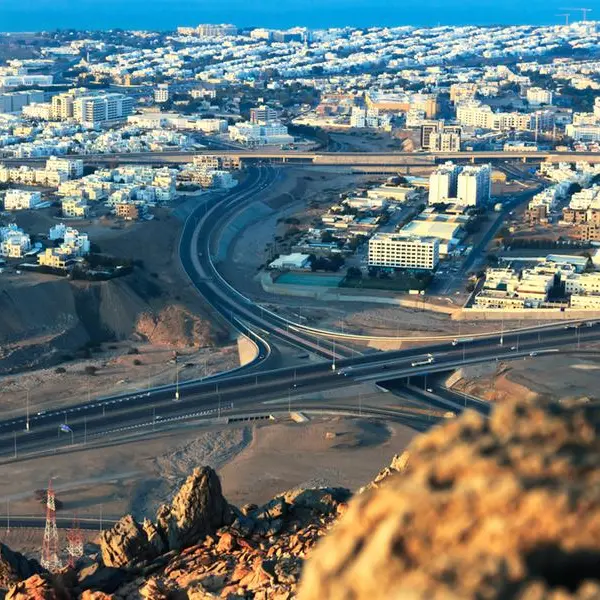

ABU DHABI: The Federal Tax Authority (FTA) has stressed the need for taxpayers to abide by accurate, emirate-specific Value Added Tax (VAT) reporting requirements in relation to e-Commerce.

The Authority noted that recent updates to the VAT legislation in the UAE, specifically around the reporting in the VAT returns of e-commerce supplies, result in additional obligations for a number of persons when preparing their VAT returns.

The FTA emphasised that businesses must carefully assess whether they fall under the new reporting obligations, noting that failure to comply – or compliance with the updated reporting when not required – may result in mistakes and expose companies to potential penalties.

The FTA explained that starting from 1st July 2023, and in the VAT return for the first tax period starting on or after that date, “qualifying registrants” are required to report supplies made through e-commerce in box 1 of their VAT Return, based on the Emirate in which the supply of goods or services is received by the customer. They are also required to retain the relevant supporting evidence. If a taxpayer is not a qualifying registrant or if a supply is not an e-commerce supply, then, generally, the taxable business must report its supplies in the Emirate where its fixed establishment related to the supplies made is located.

The Authority called upon the taxpayers to review the relevant legislation and the clarifications provided by the FTA prior to their next VAT return submission process, to determine if:

1. They have made e-commerce supplies in the calendar year ending on 31st December, 2022

2. The value of these e-commerce supplies made in the previous calendar year exceeded AED100 million.

The Federal Tax Authority noted that in order to assist taxpayers in preparing a correct VAt return, the FTA’s Tax administrations system (“EmaraTax”) will request taxpayers to respond to a set of 2 questions to confirm if they are indeed qualifying registrants with respect to the new e-commerce supplies reporting requirement. This double-check will aid taxpayers to submit a correct VAT reporting, avoiding any later corrections or penalties.