With growth stalling in the Eurozone, Turkey is increasingly looking at the Middle East for growth.

The country accelerated exports to the Middle East to make up weak demand in its traditional trading partner of the European markets, which is suffering from anemic economy and austerity measures that have drained growth and investments.

Turkey's proximity to MENA and Asia proves a natural advantage in finding replacements for the European markets -- especially for primary products such as apparel, textiles and food -- while maintaining relatively low shipment costs, says the International Monetary Fund (IMF).

"Prior to the 2008 crisis, more than half of Turkish exports were destined for EU-27, with Germany leading the pack, but since then the share has declined to below 40% in the first half 2012, while the share of MENA countries increased from less than 15% to 31%. Exports of gold, food and building materials to Iran and Iraq have been particularly strong."

Turkey has earned respect in the region with a strong stance against Israel and is seen as a model state by many regional governments looking to strike a balance between secular and conservative forces.

The country also recently began a peace process with its Kurdish people that "could have a major impact on the broader Middle East, with three neighboring countries harboring Kurdish populations: Iraq, Iran and Syria," said Philippe Dauba-Pantanacce, analyst at Standard Chartered Bank.

Turkey is also forging closer ties with Kurdistan in the form of greater oil exports and offering a lifeline to the semi-autonomous region, which has been at odds with the central government in Baghdad. The two parties' recent agreement on oil payments would no doubt ease tensions in the region.

"By 2014 - possibly earlier - Iraq should overtake Germany's spot. We conservatively assume that Turkey's exports to Iraq grow on average by 20% annually in the coming years (against the 37% annual average since 2003)," said Dauba-Pantanacce. "This would put Turkey's exports to Iraq at [around] USD 30 billion by the end of the decade or 2.3x the amount of exports to Germany in 2012 and one-fifth of its total exports for that year."

The problem that is Syria

But proximity to the region also has its downside. Turkey has been increasingly concerned about the raging civil war in neighboring Syria.

Turkey has generously opened its borders to 300,000 Syrian refugees, but the International Crisis Group estimates that figure could triple by the end of the year.

"As the Syrian crisis is likely to continue, Ankara needs to open up more to international partners and develop a comprehensive multi-year plan to ensure the sustainability of its response," said Sabine Freizer, Crisis Group's Europe program director.

"Ankara wants to build a sphere of influence, stability and prosperity in the Muslim countries to its south," noted Hugh Pope, Crisis Group's Turkey/Cyprus project director. "A well-planned, non-sectarian policy to care for the large refugee population inside Turkey will allow Ankara to lay the foundation for friendly relations with whatever Syria emerges from the conflict".

Exploring new investment markets

Overall, however, Turkey's engagement with the region is paying off and helping the country find new export markets.

"What is striking about the impressive increase in trade with the Middle East is that it can be attributed to just two countries: the UAE and Iran," said the Standard Chartered Bank analyst.

"In 2011 these two countries represented [around] 5% of Turkey's total exports and 27% of its exports to MENA. In 2012, these figures had risen to 12% and 45%, respectively."

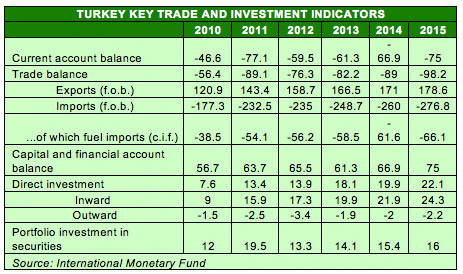

Gulf states are also trying to break European dominance over investments in Turkey. Foreign direct investments from the EU have averaged around USD 9 billion each over the past four years, accounting for 72% of foreign investments.

But Gulf states have been eyeing the country's banking sector for some time.

Saudi Arabia's National Commercial Bank took a majority stake in Turkiye Finans Katilim while National Bank of Kuwait also gained controlling shares in Turkish Bank Ltd of Turkey a few years ago.

Kuwait's Burgan Bank acquired a majority stake in Eurobank Tekfen in 2012. And while Qatar National Bank withdrew from a sale of Turkish lender DenizBank last year, it remains keen on acquiring other Turkish interests.

Gulf interest in Turkey's financial services sector is not surprising, given that Turkish bank have remained strong despite exposure to the ailing European economies.

"Turkish banks have maintained adequate capital buffers, with the CAR at 16.3% (above peer countries)... banking sector leverage remains comfortable at around 8% (Basel III definition) and external roll-over rates have been maintained above 100% despite global financial tensions," said the IMF.

"Profitability, although declining, remains high (return on equity at 16%), non-performing loans are at 2.8% of total assets, and provisioning remains comfortable at 80%."

Turkey and Middle East are natural economic partners and can offer each other access to wider markets.

"Turkey sits at a crucial geographical point between the Middle East and Europe, part of many existing and potential oil and gas routes, and future exit routes for any Levant basin offshore hydrocarbon finds," said the SCB analyst.

Meanwhile, the country is emerging as a strong investment destination for Gulf sovereign wealth funds and government institutions eager to participate in an emerging market economy.

© alifarabia.com 2013