North Africa may be on the cusp of a recovery barring a return to major political upheavals. And a pickup in economic activity in the European Union - North Africa's biggest trading partner - could further lift sentiment in the region.

Morocco is expected to emerge as the fastest growing economy in North Africa, rising 3.8% in 2014 and nearly 5% in 2015, as the new consensus government provides more certainty and paves the way for "bolder" economic reforms, according to the Institute of International Finance (IIF) said.

"While North African countries face similar economic and social challenges, they followed different political and economic reform paths," the IIF said in its latest report on the region.

"In Egypt, reforms have stalled and successive governments have focused on immediate political challenges. In contrast, Tunisia and Morocco have recently achieved broad political consensus and embraced sound economic principles."

EGYPT

Field marshal Abdel Fattah al-Sisi has announced his intention to run for president. While some analysts believe it is a step back for democratic forces in Egypt, many investors believe Sisi will focus on the economy and continue to garner support from Saudi Arabia, the UAE and Kuwait.

Gulf funds have improved market sentiment and made it possible for the Egyptian authorities to increase public spending, but private investment remains weak and portfolio inflows remain negligible. The number of tourists is still down sharply.

"GDP growth in the fiscal year ending June 2014 is expected to remain around 2%, far short of what is needed to bring down the high rate of unemployment," the IIF noted. GDP growth may rise 2.3% this year, followed by a more robust 4% recovery in 2015.

Inflation remains high, which may force authorities to tighten monetary policies at the most inopportune time for the economy. Fiscal deficit is expected to widen to 15%, while public debt could reach 98% of GDP, the institute warns.

"Prospects for sustained higher growth beyond the near term hinge on reforms. Egypt needs to rectify serious macroeconomic imbalances as a prelude to tackling deeply embedded structural distortions in the economy."

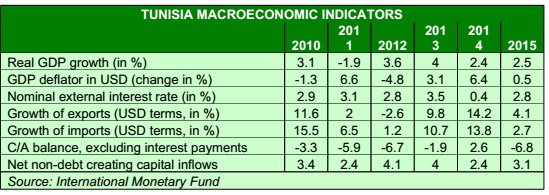

TUNISIA'S TURNAROUND

Further west in Tunisia, the slow return to normalcy should help lift GDP to 3.7% in 2014, from 2.6%. The International Monetary Fund's USD 506 million-standby facility should also help Tunisia push through its political transition.

A new constitution has improved sentiment, although the recapitalization of public sector banks is set to widen the budget deficit to 8.3% of GDP.

Provided the economic program is kept on track, government financing needs for 2014 should be met without great difficulty and total external debt will remain manageable at 58% of GDP in 2014, the IIF said.

"Yet, Tunisia's economic situation remains fragile, with growth insufficient to make a significant dent in unemployment," Christine Lagarde, managing director of the International Monetary Fund, said recently.

"Reducing macroeconomic imbalances, revitalizing investment, and generating more inclusive growth will be prerequisites for ensuring sustainable job creation and fulfilling the legitimate aspirations of the Tunisian people."

BOUTEFLIKA AT THE HELM

The Algerian economy is expected to grow 3% in 2014, as the hydrocarbon's sector picks up. The country's oil production stood at 1.15 million barrels per day in February 2014, compared to 1.21 million bpd in 2012.

The country's own domestic demand for crude oil is eating into its export revenues. In addition, Algeria has been slow to embark on expanding oil and natural gas production, suggesting that the country will likely miss a golden opportunity to become a reliable producer of crude oil and natural gas to Europe, which is looking to move away from Russian hydrocarbon products.

However, public spending is going to be high in 2014 as it is an election year.

On April 17 Algerians will head to the polls to elect a president. Abdelaziz Bouteflika, the 76-year-old president, will run for a fourth time. Most analysts believe he will win; but that would likely suggest that economic, political and social reforms in the country will remain on the backburner.

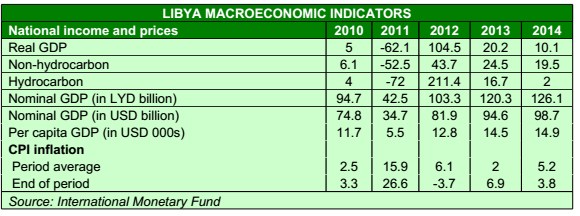

LIBYA IN LIMBO

After the ouster of Muammar Gaddafi, Libya's economy grew 104% as oil production reached pre-civil war levels. But since then, the economy has been beset by political issues, regional disputes and a dramatic reduction in oil output.

"By end-March, Libyan oil production was trimmed to 150,000 bpd from 1.4 million bpd, and although there is little clarity on a political resolution, further outages are limited, and the return of barrels, however staggered or fragile, will continue to pose a downside risk to prices," according to Barclays Capital.

With Libya currently awaiting a new round of elections, probably to be scheduled over the summer, it is clear that any production recovery there would be limited to fields in the Western half of the country, with volumes still averaging below 500,000 bpd.

"The question of any potential resolution with the federalists holding export terminals in the Eastern half with the potential to raise volumes more substantially is on hold for now, probably until Q3, pending the installation of a government after elections with more of a mandate to potentially make a deal," said Greg Priddy, analyst at Eurasia Group.

The feature was produced by alifarabia.com exclusively for zawya.com.

© Zawya 2014