Mozambique's proposed liquefied natural gas project has the lowest upstream capital costs in the world, making the country a highly attractive location for development.

With more than 25 new countries looking to build LNG projects over the next five years, Mozambique is racing to become East Africa's first LNG exporter - with a project slated for start‐up in late 2018-19.

"East Africa has emerged as an important hydrocarbon province in the wake of enormous natural gas discoveries made in Mozambique and Tanzania since 2010," said Royal Bank of Canada Capital Markets said in a new report.

"This abundant resource picture has piqued the interest of Asian LNG buyers who are seeking to diversify their portfolios. Tanzania does not envision LNG exports this decade - but Mozambique could be an LNG exporter by late 2018-19," it added.

Majors such as Exxon Mobil Corp, Chevron Corp, BG Group and Asian national oil companies are scouting various locations around the world such as Mozambique, Australia, the United States and Canada to build LNG export plants. Costs considerations, distance to market and regulatory regimes will all play a crucial role as these companies commit to capital over the next few years

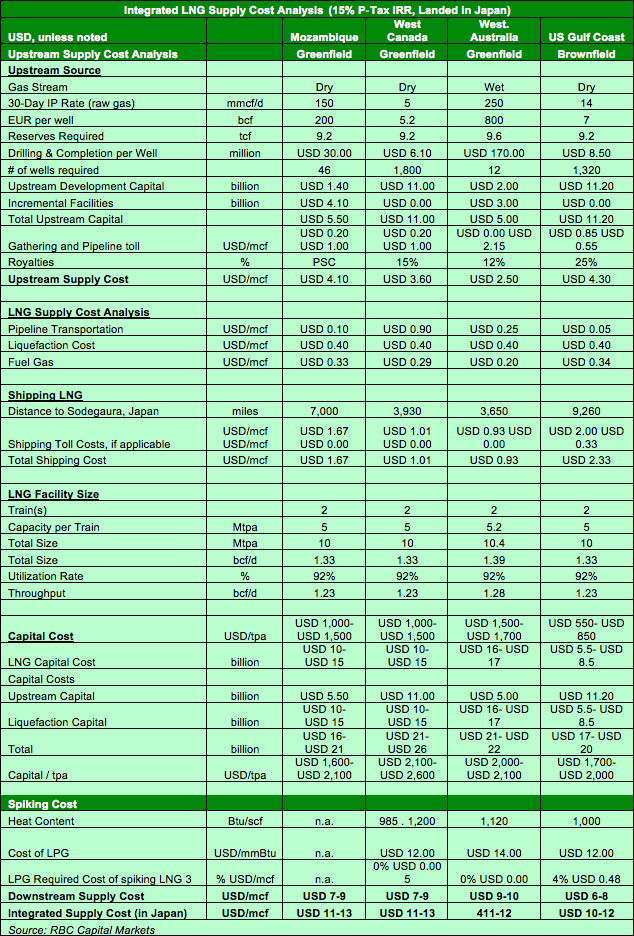

Total initial capital at an offshore, greenfield project in Mozambique would cost between USD 1,600 and USD 2,100 per ton per annum, compared to USD 2,100-USD 2,200 on the U.S. Gulf Coast and USD 2,100-USD 2,600 on the Canadian West Coast, according to the report.

"As a greenfield project, Mozambique's LNG export thrust will need to contend with its remote location, limited infrastructure, and reliance on imports of equipment and skilled labor."

Mozambique is 7,000 miles away from Japan, the world's largest LNG importer. In comparison, projects on the Canadian West Coast are 3,930 miles from Japan and Western Australia projects are 3,650 miles away.

All things considered, the integrated supply cost for a Mozambique project is around USD 11-USD 13 per million cubic feet, similar to projects in Western Canada and Western Australia but cheaper than Eastern Australia.

MOZAMBIQUE'S PROPOSITION

Growth for African LNG exports will come from East Africa, with the development of Mozambique LNG from 2018, according to Sanford Bernstein, a sell-side research house.

"Gas discoveries offshore Mozambique have made up the largest and most regular source of exploration success over the last few years and recoverable resources."

Around 150-200 trillion cubic feet of recoverable gas reserves have been discovered in the Rovuma Basin offshore Mozambique's northeastern coast across two main blocks -- Area 1 and Area 4.

Italy's Eni SA has led Area 1 exploration, while the United States' Anadarko Petroleum Corporation has led the proceedings in Areas 4.

Anadarko, which has a 26.5% stake in the East African assets, has discovered recoverable gas reserves of 45-70 tcf along an area spanning 2.6 million acres.

Meanwhile, Eni has a 50% interest in Area 4, estimated holds more than 85 tcf of gas‐initially‐in‐place.

The companies' success in discovering natural gas has been rewarded by Asian state-owned enterprises that have joined the fray.

Last year, India's Oil & Natural Gas Corporation (ONGC) teamed up with Oil India to buy a 10% stake in Anadarko's Mozambique assets for USD 2.5 billion. ONGC then acquired an additional a 10% stake in the basin for USD 2.6 billion.

But the biggest deal was by China National Petroleum Corporation, which bought a USD 4.2 billion, 20% stake in Eni's East African play.

ACCELERATING APPROVAL

Mozambique recently revamped its petroleum law, which is widely expected to be approved by parliament soon. The law aims to provide a robust legal framework encompassing oil and gas investment, including LNG.

"In cooperation with the Mozambique government, Eni and Anadarko plan to develop the USD 50 billion onshore Mozambique North LNG project," RBC said.

"The companies are progressing discussions with potential LNG buyers in the Asia‐Pacific region, are coordinating upstream gas development in their respective offshore blocks, and are working with the Mozambique government to accelerate project approvals."

The first two trains of the project could cost anywhere between USD 8 billion and 10 billion; the companies' long-term plans include development of 10 trains with total capacity of 50 million tons per annum by 2030, RBC estimates.

Bernstein expects Mozambique to take a little longer to reach that figure.

"Our gas supply model, we assume first LNG from 2020, given the complications inherent in constructing export facilities where there is currently limited gas infrastructure," said Clint Oswald, analyst with Bernstein.

"Furthermore, it will take time for such a large volume of gas to be fully developed. We anticipate 10x 5MTA trains being constructed in total, but it being 2033 before plateau volumes are reached."

TANZANIA'S TRAIN

Mozambique is not the only East African nation eyeing LNG exports. Next-door neighbor Tanzania is also sitting on formidable reserves of natural gas.

Two groups of companies are looking to develop the country's LNG export industry. UK's BG Group (60%), Ophir Energy (20%) and Singapore's Temasek (20%) are developing three blocks in a joint venture, while Norway's Statoil (65%) and ExxonMobil Corp. (35%) are working on another basin. Together, the two groups have discovered around 35 trillion cubic feet of natural gas resources.

RBC estimates the companies can produce two LNG trains, each with a capacity of five million tons per annum. Additional new discoveries might warrant the construction of a third train, the investment bank said.

"Pre‐FEED [front end engineering designs] and FEED work on Tanzania South is expected to continue through 2015, with a final investment decision slated for late 2016 or 2017, and first LNG exports in 2020 at the earliest," RBC said.

"Property is being shortlisted for a major LNG development on the coast, and we expect the BG and Statoil‐led projects to run in parallel."

The feature was produced by www.alifarabia.com exclusively for www.zawya.com.

© Zawya 2014