Saudi Arabia has responded to the Kingdom's education problems with a decision to invest a mammoth SAR81.5-billion (USD21.7-billion) in the sector.

The developments are ambitious and suggest the government's seriousness in improving education access for and raise the standards.

Some of the highlights of the new phase of education development announced by the Saudi education minister Dr. Khalid bin Mohammed Al-Anqari include:

- 18 university cities and academy complexes for male and female students in Jazan, Hail, Jouf, Tabuk, Najran, Northern Borders, Baha, Shaqra, Majmaah, Taibah, Qassim, Taif and Kharj

- King Abdullah bin Abdulaziz City for Female Students at Imam Muhammad bin Saud Islamic University, Female Students City at King Saud University and Female Students City at Umm Al-Qura University,

- 161 infrastructure and support projects

- 167 colleges for male students

- 161 colleges for female students

- 11,000 housing units for faculty members

- 100 housing units for students accommodating 50,000 students

- 3,800-bed 12 university hospitals in Jazan, Jouf, Hail, Baha, Taif, Taibah, Tabuk and Northern Borders, Najran, Rabigh, Kharj and Qassim

While Saudi Arabia has earmarked USD130-billion for various infrastructure and real estate projects in response to the Arab Spring last year, the investment in education signifies King Abdullah Bin Abdulaziz Al Saud's efforts to reform the country's education system, and send a strong signal that he is keen to modernise the curriculum.

What's even more heartening is the near-equal focus on women's education, which is a major step by Saudi standards, given its reputation regarding women's rights and equal access to education and other social freedoms.

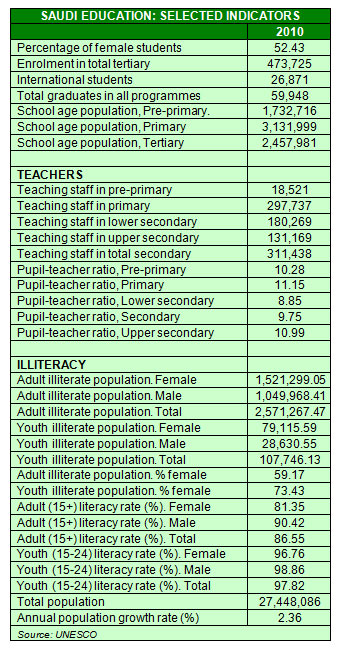

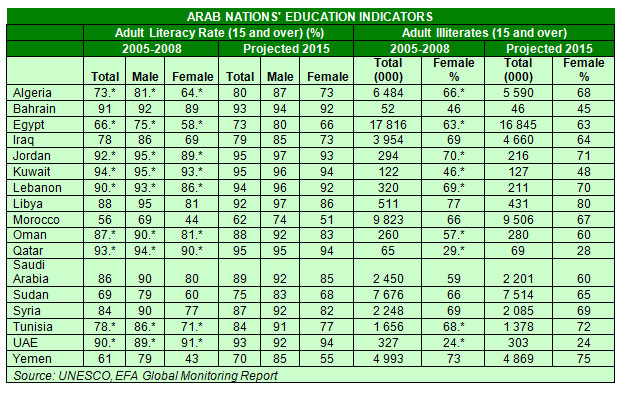

UNESCO statistics on Saudi Arabia show that literacy among women is 81% compared to 90% among Saudi males. That may not seem too bad given the country's conservative culture, but there are 1.5 million illiterate Saudi women, and a little over a million illiterate Saudi men.

In 2010, around 80,000 young Saudi women were illiterate while 28,000 Saudi men were uneducated, UNESCO data shows. In all, 503,000 Saudi children are out of school.

Indeed, Saudi Arabia's tertiary enrolment ratios are much lower than expected of a G20 nation. The poor enrolment statistics show that significant investment in education infrastructure is required for Saudi Arabia to maintain current standards of living.

The latest edition of the World Economic Forum's Global Competitiveness Report ranks Saudi Arabia as the 21st most competitive economy overall, but 74th in the health and primary education areas.

"[Saudi Arabia's] health and education do not meet the standards of countries at similar income levels," noted the World Economic Forum in the report. "While some progress is visible in health outcomes as well as in the assessment of the quality of education, improvements are taking place from a low level. As a result, the country continues to occupy low ranks in the health and primary education (74th) and higher education and training (51st) pillars.

"Both these areas, in addition to a more efficient labour market (66th), are of high importance to Saudi Arabia given the growing numbers of its young people who will enter the labour market over the next years."

But change is afoot.

Improving the quality of education and including the kingdom's youthful population in the fast-growing economy has been a top priority for the government. Saudi Arabia's budget dedicated to education spending has more than doubled in size since 2005. The kingdom spent USD40 billion on education in 2011; up from USD36.7 billion in year 2010. In the last budget, the Kingdom's government designated 25.9% of its total annual budget for education and training purposes.

Concern over whether the education system is arming students with relevant technical skills for the workforce is paramount since only one out of every 10 employees working for a Saudi private sector company is a Saudi citizen.

This scenario must be drastically reversed if the private sector can shoulder the burden of future job creation to meet the needs of the 66% of Saudis below the age of 30 in 2009. Of the country's indigenous population of 18.5 million, 47% are 18 years old or younger.

The Saudi government has targeted the creation of five million jobs by 2030 to appeal to the workforce, with the private sector creating three million of the jobs. The government has also pledged to halve unemployment from 11% (officially) to around 5.5% by 2014.

Saudi Arabia, which is easily the largest education market in MENA, spends 5.6% of its GDP, which is higher than the world average of 4.4% and the North American average of 5.1%, according to Al Masah Capital research report.

"In its Ninth Five-Year Plan (2009-14), Saudi Arabia dedicated USD195 billion to human resource development." Al Masah said. "This includes building several new facilities (25 technology colleges, 28 technical institutes, and 50 industrial training institutes); providing USD240 million in grants for research projects each year; establishing 10 research centers and 15 university technological innovation centers in association with King Abdullah City for Science and Technology (KACST); and building at least eight technology incubators at KACST and other universities."

PRIVATE ENTERPRISE

Private higher education enrolment in Saudi Arabia has grown at 33% per annum making it one of the fastest growing private education segments worldwide, notes The Parthenon Group, an advisory firm.

"Between 2007 and 2011 revenue has grown by over 40% per annum and is estimated at USD300 million. Half of all private higher education revenue comes from medical courses, where enrolment is growing at 45% per annum. Similar to India, China and Malaysia, the majority of private higher education enrolment in the KSA can be found in undergraduate courses."

The growth is driven by three key factors, notes The Parthenon Group:

Focus on employability: Over 80% of enrolments in private universities and colleges are found in courses that produce highly employable graduates, such as medicine, management and commerce, IT and engineering. By contrast, over 50% of students in public universities are enrolled in disciplines like humanities, sciences, etc.

Demand for quality English education: Private higher education institutes offer better quality English language instruction than public universities. Private universities hire more expatriate teachers with better English language capabilities (37% of all teachers) than in public universities (5% of all teachers).

Alternative for expatriate students: Public universities do not enroll expatriate students in Saudi Arabia. Saudi private universities offer these students an alternative for pursuing higher education in Saudi Arabia. 25% of students enrolled in Saudi private universities are expatriates.

The development of private sector education is crucial for many reasons. Currently, private sector education makes up 2% of all education enrolment, and the Saudi government has set a target for the private sector to achieve a 30% share of total enrolments.

Private sector participation will raise standards as it will bring in professional educational institutes to run schools and bring their international experience and practices to the Kingdom.

Rising competition between various educational institutes, academies and universities will also raise curriculum standards and improve student experience, leading to innovations in education, research and new teaching aids that would enhance the education systems

It will also improve teaching standards and allow teachers to get much-needed training to bring in best practices into the Kingdom's education system. It will also raise wages for staff, and attract many people to the teaching profession - which remains a hard-to-find skillset in Saudi Arabia.

"The MENA region has 17 students for every one teacher (a pupil-teacher ratio of 17:1) compared to the world average of 24:1," says Al Masah Capital. "Yet, the knowledge level and skill set among students in the MENA region is far lower compared to the counterparts in the developed countries. One key reason for this is the poor quality of teachers in the MENA region."

Anecdotal evidence suggests the Kingdom is worse given the restrictions in teaching and a curriculum that may be outdated and dependent on archaic teaching methods with untrained teachers.

The rise of private sector participation would also attract the attention of private equity players who have been eager participants in the education sector.

Zawya Private Equity monitor data shows 2008 was great year for education investment with private equity player piling USD37-million in six deals. Since then, PE players have invested in six made education-related deals, for undisclosed sums of money.

Given the USD21-billion on offer, expect many PE player to eye the education sector in search of new opportunities.

CONCLUSION

Perhaps for a country like Saudi Arabia the easy part is to fork out funds for the education sector. USD21-billion is enough to make a serious dent on the education front, and it is likely that the bricks and mortars of schools, colleges and universities will be built pretty quickly, adding to the construction boom already under way.

But the real test will be finding a curriculum that melds Saudi Arabia's unique culture with modern educational programme that move away from rote memorization and arms students with skillsets required by businesses. It could also pit hardliners within the establishment against reformers who are looking to improve women's access to education and greater social freedoms.

The massive investment will also, paradoxically, bring fresh, qualified labour force from both genders putting even more pressure on the economy which has been unable to match robust economic growth with equal feverish growth in job creation.

Regardless of the logistical challenges, reform appears to be finally in the air in the Kingdom.

© alifarabia.com 2012