PHOTO

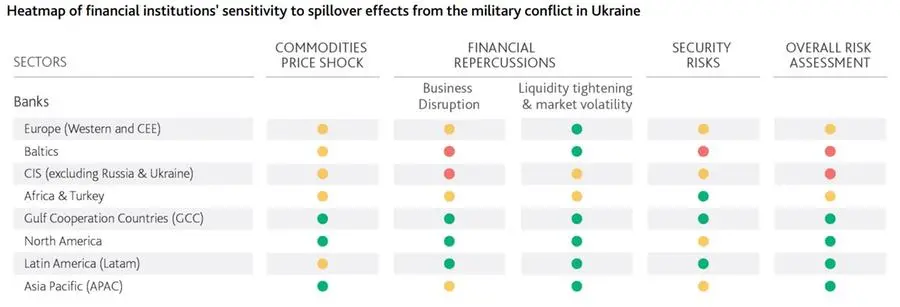

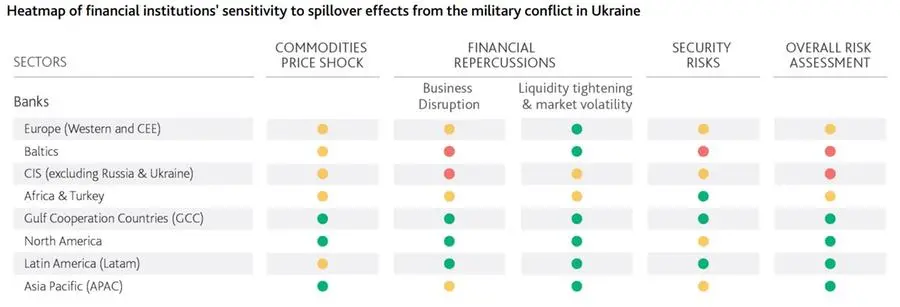

The ongoing Russia-Ukraine military conflict is having widening repercussions for financial institutions across the globe, but banks in the GCC region are among those not facing serious spill over effects, according to a new Moody’s report.

The rating agency said that European, African and Turkish banks, as well as aircraft lessors, non-life insurers, US non-bank residential mortgage lenders and business development companies, are at highest risk under its downside scenarios.

In its report, Moody’s Investors Service described GCC banks’ risk exposure to the military conflict as “low”, with limited impact on credit profiles. Banks in the region were previously forecast to have a stable outlook this year due to the economic recovery and higher oil prices.

“GCC banks’ credit profile is supported by high capital buffers, solid profitability and improving economic conditions,” Moody’s said.

High risk

Banks that are close to the epicentre of the conflict are the ones that are most exposed. These include banks in the Baltics and in the Commonwealth of Independent States (CIS) which are closest to the conflict or closely linked to the Russian economy.

Risk sensitivity: Green (low); yellow (moderate); red (high)

Moody’s also noted that persistently high inflation would increase asset risks of African and Turkish banks and raise the cost of claims and the risk of reserve deficiency for P&C (re)insurers.

A prolonged conflict, coupled with sustained high oil prices, could lead to higher airfares and slow the recovery in air travel. This would then impact the demand for leased aircraft, thus affecting businesses in the aircraft leasing sector.

“Weaker macroeconomic conditions would amplify these effects. Aircraft lease rates had already declined during the COVID-19 pandemic but have since materially strengthened, particularly for narrow-body aircraft, as airlines restore capacity to meet rising travel demand,” Moody’s said.

(Reporting by Cleofe Maceda; editing Seban Scaria )