Virtually all of Kuwait's key macroeconomic indicators are pointing upwards. But political wranglings could rein in growth once again.

After a period of extended economic and political lethargy, Kuwait's key macroeconomic indicators are looking increasingly positive.

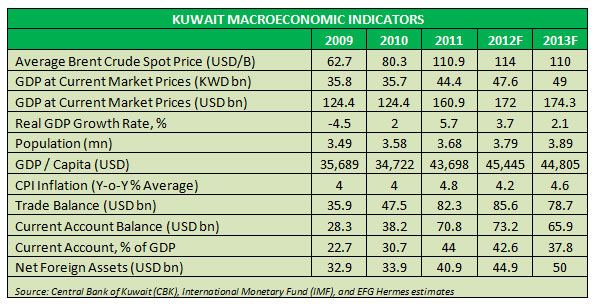

Most analysts have raised Kuwait's GDP forecasts as the country pumps oil at full throttle, but the non-oil hydrocarbon economy is also expected to tick along nicely.

"We increase our 2012 real non-oil GDP growth outlook to 4.0%, up from 3.7%, on the back of 25.0% public sector wage increases, approved in end of March, albeit still down from 4.6% in 2011 estimate," EFG Hermes' analysts Monica Malik, Mohamed Abu Basha and Mohamed Al Hajj wrote in a recent report.

Barclays Capital is even more bullish, calling for a 4.7% non-oil growth for the country this year. The bank has also raised hydrocarbon growth as well to 5.4% as well, on the back of high oil prices.

Kuwait raised crude production from its average 2.3 million barrels per day to three million bpd in the year, helping the country post an income of USD96.8-billion for the fiscal year, double the budgeted figure for the year -- and the highest ever on record.

However, spending was a victim of political wranglings and investor nervousness. Ministry of Finance data shows that the country spent a mere USD39-billion in the first nine months compared to the USD70-billion earmarked in the budget.

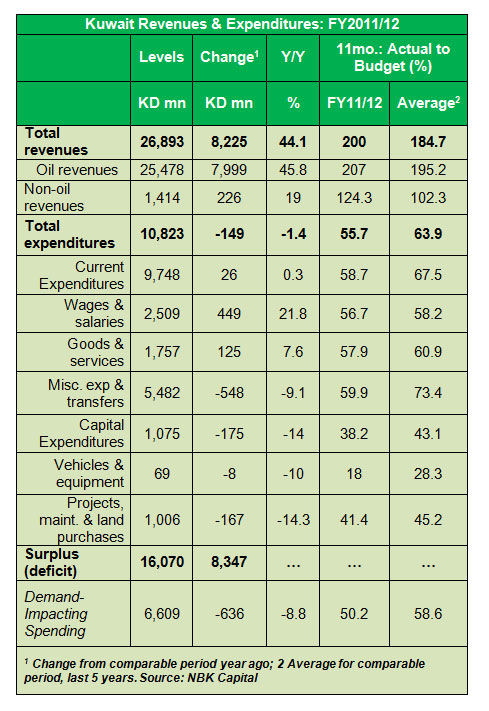

Here's last year's spending breakdown:

* Total government spending reached KD10.8 billion in the first 11 months, a slight contraction of 1% compared to the same period in the previous year.

"Admittedly, this was skewed by the impact of the Amiri grant -without which spending would have increased 10% year-on-year. Nevertheless, the underlying spending pace is still disappointing," wrote Bassel Zinaty, Assistant Economist at NBK Capital.

Current spending remained unchanged as a KD449-million rise in wages was offset by a decrease in expenditures and transfers.

* Capital spending fared the worst, falling 14% year-on-year, reaching KD1 billion. "Spending in this category is still lagging at 38% of budget, compared to a 43% historic average. The capital-spending pace was projected to pickup, as this is the second year of the development plan and more projects should have materialized."

Going forward, spending is going to be a crucial catalyst for growth and there are indications that the authorities are finally moving on that front.

The government approved a 12.5% increase in pensions and a KWD50 per month pay rise for expatriates in a bid to raise private consumption.

"We now forecast a 9% increase in government spending in FY2012/13 (Apr-Mar) following the 25% general pay increase, up from our earlier estimate of 5% in FY2011/12," said EFG-Hermes analysts. "The approval of the wage increase implies that the budget is likely to be revised up to accommodate the pay rises."

The new FY2012-13 draft budget, which is still not passed, presumes a wage increase higher than the 7% rise in public sector salaries and is expected to add KWD600 million to the annual budget.

FOREIGN TRADE RISING

Kuwait's massive jump in oil production also led to a record trade surplus of KD21.6-billion in 2011, up from KD 12.8 billion from the previous year and equivalent to 47% of GDP.

"Non-oil exports also rose to record levels in 2011, at KD 1.9 billion, up 23% y/y. Most of the increase came from petrochemical exports, which also benefited from higher oil prices," said Aysha Adnan Al-Bahar, assistant economist at NBK Capital. "The non-oil sector's contribution to exports remains small at 7%."

Imports grew 11% and are expected to grow faster when the economy picks-up.

"This might require faster growth in the non-consumer sector, which accounts for more than half of all imports but which remains sluggish. While stronger import growth might reduce the trade surplus, it is good news for the overall economy as it signals improving business activity."

EMPLOYMENT GREW AT 6%

Kuwait's population also grew at a fast pace last year, rising 3.2% to reach 3.69 million, as expatriates continued to leave higher-risk regional countries and found employment in Kuwait.

The indigenous population rose by 2.9% but was eclipsed by the 3.3% rise in expatriate population, as 80,000 foreigners landed in the country.

Kuwait's total employment grew 6% in both the public and private sectors last year, according to NBK Capital data. Kuwait's total labour force grew by 3.2% in 2011 to reach 2.18 million.

"Growth among Kuwaiti nationals was strong, exceeding 6% year-on-year. For expatriates, the numbers were up in both the public and private sectors, though they fell for domestic workers. Growth for expat workers was slower at 3.4%."

POLITICAL CONCERNS

The country continues to be locked into a political deadlock, however. Kuwait recently referred an USD800-million deal with Royal Dutch Shell to the judiciary, while another MP has questioned a 300,000-barrels-per-day deal with China for 10 years.

Regardless of the merits of the cases, the incidents suggest the lack of a robust framework to conduct deals that are above board.

Kuwait's Islamic parties-led parliament has established a number of enquiries into issues ranging from corruption to torture, and analysts expect tensions between parliament and the government to remain high.

In early May, the current prime minister Sheikh Jaber Mubarak Al-Sabah was questioned regarding the money transfers by his predecessor Sheikh Nasser Mohammad al-Ahmad al-Sabah - both are members of the ruling Al-Sabah family.

Members of parliament have accused the former Prime Minister of transferring public funds to his private bank accounts abroad through the Central Bank of Kuwait.

Sheikh Nasser has also been fighting other corruption charges and resigned in November leading to the dissolution of parliament and fresh elections that ushered opposition groups into power.

"The biggest bone of contention is that of corruption... We believe this will be the primary battleground between parliamentarians and the cabinet going forward," wrote Citibank analyst Farouk Soussa.

In the current environment, Citibank sees little chance of progress on the legislative agenda, which bodes poorly for implementation of the economic development plan.

"Despite their clear parliamentary majority, opposition demands will likely be frustrated by the executive veto over legislation, and thus we would expect that parliament will exercise its right to censure and fire ministers as a tool to maintain pressure on government," said Mr. Soussa.

"In short, we would expect more of the same, as far as Kuwaiti politics are concerned, with political squabbling taking precedence over national economic policy."

The conflict has delayed implementation of the USD104-billion project, which is the cornerstone of Kuwait's diversification plan.

But there are signs of growth. Projects such as the USD7-billion metro development are moving along, while the municipal council recently approved the development of a free zone in the south of the country.

The Minister of Public Works also announced 320 infrastructure projects worth USD12.6-billion for the current fiscal year. This included a USD1.8-billion independent water and power project at Al Zour with a capacity of 1,500MW.

Construction companies are also lining up to bid for a USD2.5-billion terminal at the Kuwait International Airport.

Consumer confidence has also improved on the back of rising wages and consumer spending is expected to remain robust in 2012 though come down from their current elevated levels.

"Spending should continue to receive support from relatively healthy confidence levels and a private sector recovery," said NBK Capital. "The new pay hikes for Kuwaiti employees are also likely to provide an additional boost to consumers' spending power."

Credit to the private sector, which had grown by an anaemic 2.6% year-on-year by November, has started to pick up. Latest data from the Central Bank shows that credit grew strongly in March to a robust KD158-million, after KD242 million recorded in February - much higher than the 2011 levels.

The trade sector was the biggest beneficiary of credit growth, accounting for KD60-million, while services, telecoms and transportation attracted KD93-million.

"Demand for credit from the corporate sector is weak, and growth has mainly been in the consumer credit area, still a relatively small part of bank portfolios," said Mr. Soussa.

"The slowdown in credit growth is also in part due to the collapse of Kuwait's investment company industry, which had been a great source of demand for credit prior to 2008. There is still a great deal of uncertainty regarding the future of the investment companies, and the fallout to the banking sector has been somewhat limited by the timely passage of the Financial Stability Law, which provides government guarantees and other support."

Kuwait's IFA's annual results in an indicator of the pain many investment companies continue to go through. The investment company's losses widened to 14% during 2011 to USD74.55-million.

Meanwhile, Kuwait's National Investment Corporation is also planning a USD7-bilion restructuring its investment portfolio due to the evolving regional and global markets. Like IFA, the company suffered a loss of USD98.21 million last year. Gulf Investment House and KAMCO have also posted losses last year in a sign that the financial sector remains the economy's weak link.

CONCLUSION

Kuwait has seen four governments come and go in six years, and the political frustration led many Kuwaitis to take to the streets, even though they don't suffer from the same issues as their embattled Egyptians and Syrian counterparts.

For now, parliament and government are both trying to find a way to get along as there is a clear realization that the country needs to raise its game and speed up some of its key projects, especially in energy and infrastructure. Kuwaitis are hoping the parliament-government relationship lasts long enough this time around for Kuwait to make a robust recovery.

© alifarabia.com 2012