PHOTO

Key Findings:

· 35% of Respondents from All Nationalities Save for Retirement

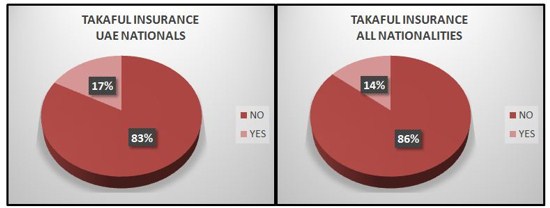

· 17% of UAE Nationals have Takaful Insurance

Dubai, UAE: National Bonds Corporation (National Bonds), the leading sharia-compliant savings and investments' company in the UAE, has announced the latest results of its ongoing financial health check survey.

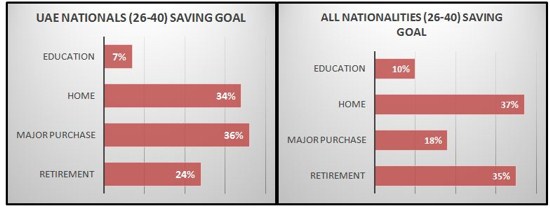

Findings indicate that 36% of UAE nationals save for a major purchase, while 34% save to buy a house and 24% save for retirement. However, only 7% save for their children's education. As for other nationalities, 37% save to buy a house and 35% for retirement while 18% save for a major purchase and only 10% save for education.

Designed by financial advisers at National Bonds, the financial health check was launched in February 2014 as an online tool to help customers assess their financial status and take corrective action towards achieving a more resilient financial future. To date, the survey has received responses from more than 1,000 customers across cultures and nationalities. The respondents fall within the 26-40 age group.

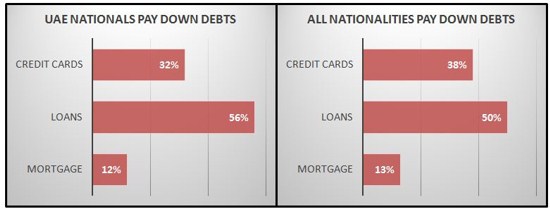

In additional findings from the survey, 56% of UAE nationals said they make monthly payments towards personal loans, 32% are settling credit card debts, while as few as 12% are paying off mortgages. As for other nationalities in the UAE, the survey found 50% of the respondents are paying off personal loans, while 38% make credit card payments, and only 13% are settling mortgages.

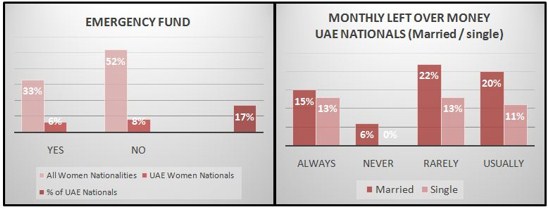

The financial health check results also indicate that 20% of UAE nationals among the respondents usually save monthly, as opposed to only 11% of single UAE nationals.

In yet another interesting outcome, 52% of UAE women from all nationalities don't have an emergency fund, while 6% of female UAE nationals do. Additionally, 17% of UAE national respondents said they have takaful insurance, and 14% of respondents from all nationalities said they do.

Commenting on the results, Mohammed Qasim Al Ali, CEO, National Bonds Corporation, said: "Five months since our last financial health check, we are observing a major shift in our savers' financial behavior. We are happy to note that saving for retirement and homes is gaining precedence among customers of all nationalities. However, debts due to personal loans and credit cards remain the biggest challenge. We at National Bonds are well aware that bad habits die hard. This is why we offer a comprehensive financial planning strategy that helps customers achieve a balance between their needs and wants, their budgets and liabilities."

Highlighting the low numbers of savers with takaful insurance across all nationalities including UAE nationals, Al Ali explained: "The significance of takaful does not only lie in being a means of protection against an uncertain future incurred through job and income loss. It serves as an expression of social and Islamic culture - reflecting its inherent values such as cooperation, solidarity and partnership even while ensuring a safe and sustainable future for all segments of society without discrimination."

Takaful can also be a key to resolving the problems relating to Emiratization policies in the private sector, where the advantages are less compared to the public sector. Thus, takaful is an effective alternative that provides financial security to the employee and his family. Takaful insurance is also expected to be one of the main drivers for financing development and ensuring stability of the financial sector.

The CEO of National Bonds also highlighted the debts paid by the majority of savers against personal loans and credit cards and said: "Despite the increased awareness today about the importance of savings and the burden of debt, the credit card culture continues to weigh heavily on many people draining their income and severely impacting their financial security and the future of their children. The issue of debt is more related to habit than need if we consider the high income levels of individuals and consumption trends in society. This habit is reinforced by excessive consumption associated with earlier economic phases, but the same habits may not be appropriate for the upcoming economic phase if recession and its related challenges continue to adversely impact the global economy."

Al Ali added: "The solution to any problem lies in understanding its various dimensions. Doing so helps us develop sound plans to resolve the problem. National Bonds is keen to elaborate the scope of its products and programs to cater to the needs of customers who seek advice on debt restructuring, wealth management, budgeting and financial planning. We always take into account market changes and trends to design the best options for investment with the least risks, in addition to promoting our regular saving schemes and incentives for safe investment."

National Bonds has created a number of innovative tools to encourage regular saving among bondholders. Of these, the new myPlan Rewards Program launched in August 2015 with the aim of encouraging customers to commit to a monthly savings plan is gaining popularity among bondholders that are mindful of the challenges they might face in the future.

A financial plan that does it all says National Bonds

Your financial plan should cover more than just your investments. It should also include advice on retirement, taxes, insurance Takaful, cash flow and debt management.

Retirement

Where will your retirement income come from? Your personal savings will have to make up the difference. Think about what age you'd like to retire at and how much you'll need annually to live comfortably once the house is paid off and the kids are gone. Then have an adviser determine how much you should be saving monthly and how your portfolio should be invested to make sure you retire with the nest egg that you'll need.

Insurance Takaful

Examine what your workplace benefit plan offers and then have your adviser review all your insurance policies--disability, life, auto and home--to make sure that your coverage is adequate. If you need extra coverage, make a note of it so you can include that in your financial plan.

Cash flow

Determine how much you spend and save right now by maintaining a journal. The result may surprise you. If you're spending more than you make, your net worth could be decreasing every year. "Successfully managing cash flow is your key to financial control, it will give you an awareness that has more long-term value than anything you can invest in, buy or sell.

Debt management

Comb your budget to see if you can find extra savings to put towards your payments. And make sure to have a plan, such as paying off high interest rate debt first. Also consider renegotiating your mortgage or cutting out one major expense completely--like travel--to pay your debt off quicker. Do what you can to increase your income, cut your expenses, and start cutting your debt. That will give you the best risk-free return on the bottom line.

Keep track of your spending. At least once a month, check your credit card spend and other records to review what you've purchased. Then, ask yourself if it makes sense to reallocate some of this spending to an emergency savings account.

Are you looking for an effective way to establish a budget? Beginning on the first day of a new month, get a receipt for everything you purchase. Stack and review receipts at the end of the month, and you will clearly be able to see where your money is going. A good way to go would be to pay yourself first. This can be done through setting up a systematic saving plan and parking some funds into this plan. The remaining money will be good to cover your expenses. Unfortunately, most people wait and only save what is left over instead of paying themselves first.

-Ends-

About National Bonds Corporation PJSC

National Bonds, licensed and regulated by the UAE Central Bank, is a Sharia'a compliant saving scheme that provides UAE nationals, UAE residents and non-residents with a credible and safe savings opportunity. Minors can also own National Bonds, provided the bonds are purchased by the parent/guardian. Each bond costs AED10, with a minimum purchase option of AED100. National Bonds Corporation PJSC announced an annual return up to 4% for 2014. The scheme has distributed an annualized rate of return of 57% since inception, which is a combined average of annual returns and prizes distributed till 2014. National Bonds is a unique savings scheme with a diversified client base of more than 800,000 customers, offering:

· Opportunity to win more than 40,000 prizes every month. These prizes include monthly and quarterly awards distributed to UAE nationals and residents in separate categories. The quarterly prize offers two participants the chance to win a million dirham award every first Sunday of the quarter. The monthly awards give two bondholders the chance to win two BMW cars, AED10,000 to two women bondholders, and AED 10,000 to two minor bondholders. In addition, regular savers have the chance to win 15 awards worth AED10,000 every month. The monthly prizes also include 40,000 give away cash awards valued at AED50 each. The awards are allocated to 4,000 women bondholders, 4,000 minor bondholders, 8,000 regular savers, and 24,000 awards for all individual bondholders.

· Savings with National Bonds can be redeemed easily after an initial 30-day holding period by calling 600522279 or for instant cash redemptions up to AED10,000 per day through visiting selective branches of Al Ansari Exchange and UAE Exchange houses across the UAE.

· National Bonds does not charge any subscription fee for the purchase of bonds. One can open an account for free and redeem bonds at any time without paying a penalty.

· The National Bonds Employee Saving Program offers government and private sector employees an opportunity to save a portion of their salary on a monthly basis and also be entitled to all benefits and rewards offered by National Bonds.

· National Bonds can be purchased from nearly 1,700 outlets across the UAE, including The Sukuk Express through MBME - The Cube machines, Emirates Post offices, exchange houses and banks.

· National Bonds can also be purchased online at www.nationalbonds.ae

For more information please call:

Ghada El Khoury

APCO Worldwide

Tel: +971 4 375 5247

Mob: +971 55 804 5317

gelkhoury@apcoworldwide.com

© Press Release 2016