PHOTO

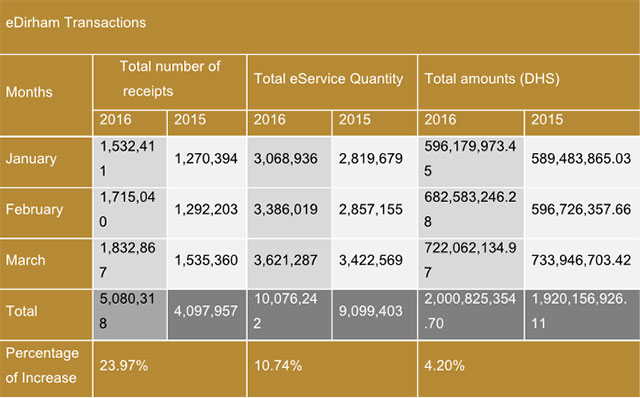

Revenue collected through the smart system increases by 4.2% in Q1 2016 over Q1 2015

10.1 million UAE federal government service transactions registered in Q1 2016

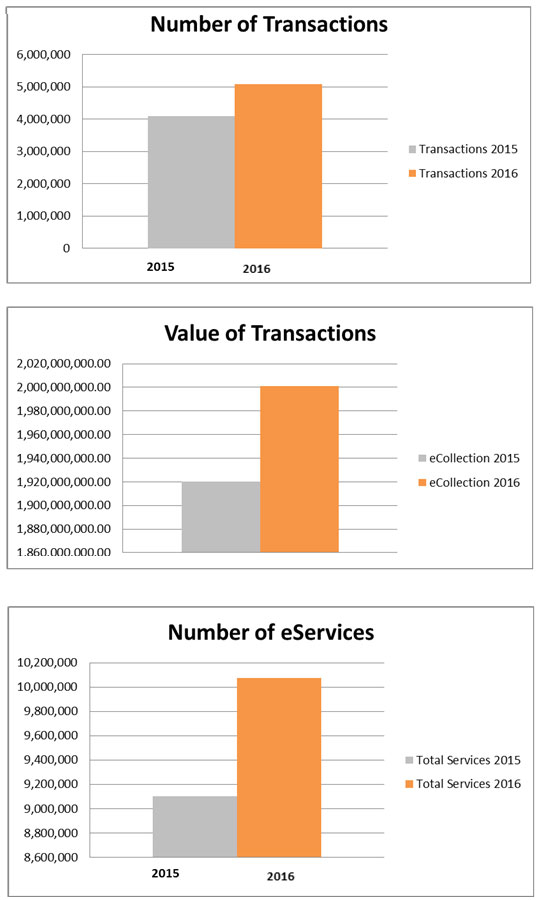

Abu Dhabi - The Ministry of Finance (MoF) announced that the federal government revenue collected through e-Dirham reached more than AED2 billion in Q1 2016, up 4.2 per cent from AED1.92 billion in Q1 2015.

The number of service transactions done through e-Dirham during the first quarter of 2016 rose 10.7 per cent to yield nearly 10.1 million as compared to 9.1 million transactions during the same period in 2015.

HE Saeed Rashid Al Yateem, Assistant Undersecretary of Resources and Budget Sector, Ministry of Finance, said: "The figures point to the growing popularity of the e-Dirham system. It is now becoming the preferred mode of payment of individuals, corporate houses, and institutions."

The total payment receipts through the e-Dirham system increased by 24 per cent for the first three months of 2016, nearly 5.1 million receipts in Q1 2016 compared to about 4.1 million receipts in Q1 2015. The number of sold e-Dirham 'Al Haslah' prepaid cards reached 2 million by the end of March 2016.

"e-Dirham is the initiative of the federal government in the financial sector. The Ministry of Finance is keen to promote and upgrade the e-Dirham system to fulfil its vision and strategic goals in enhancing the efficiency of the government's services and collections. e-Dirham helped the digital economy grow and aided the move towards smart governance," HE Al Yateem added.

"The UAE federal government, ministries and local authorities have been promoting electronic payment gateways. These efforts have shown highly positive results. The total e-collection of the ministries, authorities and federal government entities crossed AED 8.2 billion for 36.14 million government transactions last year," HE Al Yateem added.

In partnership with the National Bank of Abu Dhabi, the e-Dirham system has been in existence for 15 years now and its second generation (G2) services started in 2011. The e-Dirham user base and number of payment transactions have expanded rapidly over the years. Offerings have included 'Al Haslah' prepaid cards, e-wallet, point-of-sale transactions, and e-Dirham self-service kiosks.

This year, MoF has started a media campaign to promote the brand and bring its many advantages to the notice of more potential customers. The campaign raises awareness not only on e-Dirham as a smart and secure substitute for cash, but also on the digitisation of financial transactions for public services.

Saif Ali Al Shehhi, Senior Managing Director, UAE Government and VVIP Clients, National Bank of Abu Dhabi, said: "The figures on e-Dirham usage for the first quarter of 2016 reflect the success of the system, which is being patronised by more clients. That trend is gaining ground day by day because of the system's convenience, efficiency, and its latest payment technologies. Since the G2 launch, 110 million e-services worth nearly AED24 billion have been transacted through e-Dirham."

"e-Dirham minimises people's reliance on cash and increases their control over expenses. This could also mean efficiency of revenue collection for companies," Al Shehhi added.

-End-

About e-Dirham

The e-Dirham system is an initiative launched by the UAE Ministry of Finance in 2001, to provide an official electronic payment platform for collection of revenues and service fees of government and semi-government institutions. e-Dirham is a cashless payment system that adopts efficient, secure, state-of-the-art and world-class technologies; the first step in creating an e-government in the UAE.

Since its launch, e-Dirham continues to innovate with upgrades needed to meet the aspirations and requirements of its customers, both government institutions and individuals. In 2011, e-Dirham launched its second generation avatar, in collaboration with its banking partner, the National Bank of Abu Dhabi (NBAD). This enhanced the capabilities of the system by benefiting from NBAD's pioneering experience in electronic payment and revenue collection.

e-Dirham is now characterised by its compatibility with global networks and methods of payment. The system's flexible platforms easily integrate with e-government services, offering scalable and unlimited options to merge with the latest payment service applications. In line with the UAE's move towards Smart Government, e-Dirham systems support the latest mobile applications, offering the e-wallet feature and payment through various other channels.

The variety of choices and channels include the 'Al Haslah' pre-paid cards, ATM/CDM machines, POS terminals, e-commerce payment systems over the Internet and through smartphones, as well as self-service e-kiosks.

For more information, please contact:

Mary Khamasmieh/ Mirna Hammoud / Mira Assaf

Weber Shandwick

Phone: +971 50 2731753/ + 971 56 3710116 / +971 50 3123518

Fax: + 971 2 449 4833

Email: mkhamasmieh@webershandwick.com mhammoud@webershandwick.com ; massaf@webershandwick.com

© Press Release 2016