PHOTO

With Iraq continuing to face challenges to an economy beset by low oil prices and an ongoing insurgency in parts of the country, Mena Fund Manager considers the investment opportunities

The macroeconomic headwinds facing the region have hit Iraq particularly hard given the ongoing insurgency in parts of the country. Continued oil price weakness has placed increased pressure on Iraqi finances, while the ongoing security situation has posed a number of challenges for the government in Baghdad.

Highlighting the challenges facing the Iraqi economy, IMF mission chief Christian Josz claimed real GDP growth was likely to reach 1.5% in 2015, compared with 2.3% forecast for the wider Mena region.

"Iraq continues to face a number of challenges. Key among those is the ongoing armed conflict with Islamic State [IS], still straining the country's resources, thus resulting in new waves of internally displaced people, reaching over 4 million in June 2015," he said.

"The other key challenge is the fall in oil prices, causing a large external shock to the balance of payments and the budget revenue, which depends predominantly on oil export receipts."

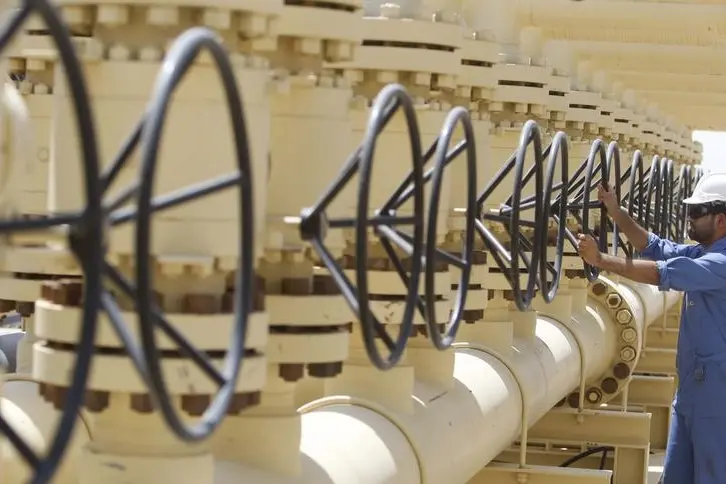

Iraq is one of the world's largest oil producers and has the third largest amount of proven reserves after Saudi Arabia and Iran, data from oil exporter organisation OPEC shows, although production has lagged behind its regional neighbours. Yet, its fiscal breakeven price remains above current market prices at $81 per barrel. Rating agency Fitch recently forecast the price of Brent crude to average $55 per barrel in 2016 and $65 in 2017.

This has forced the Iraqi government to find other funds to support the many spending commitments it faces. It has been compounded by concerns raised over the allocation of US dollars, resulting in a suspension of payments by the Federal Reserve earlier this year, according to reports.

As well as oil, Iraq is rich in other commodities, such as natural gas and phosphates.

However, as concerns have been raised over Chinese growth, commodities producers around the world have come under increased pressure.

Stagnant growth

Returning the Iraqi economy to growth in 2016 will require considerable effort, with many logistical challenges for the Baghdad government to overcome.

"Economic growth has very much diminished recently and is likely to remain stagnant as we move into 2016 and beyond," says Ruth Lux, senior consultant for credit, political and security risk - consulting at London-based JLT Specialty.

"Although we've seen some modest increase in terms of oil exports that is not reflected in the state the domestic economy is in, for two reasons: firstly, the ongoing situation with IS; and then, low global oil prices, which is one of the key contributors to the Iraqi economy."

She adds: "There will be a modest expansion in 2016 of around 2.6% but that is significantly lower than what we have seen two years ago, which was around 7.1% mark."

While efforts to dislodge IS have been recently redoubled, with new support pledged both from within and outside the region, the scale of the problem has exacerbated the issue.

"IS has taken over large swathes of territory in the north-east of the country throughout last year [2014] and this year," says Lux.

"We're seeing a significant difference between the oil rich southern parts of Iraq, predominantly occupied by Shia communities, and a widening gap with the eastern Sunni regions.

"In July, the Iraqi government and World Bank signed a loan agreement for $350m that is earmarked for emergency reconstruction in towns recaptured from IS," she says.

"But for a number of reasons, not least that corruption is deeply embedded in Iraq and the security environment, we are very dubious about how quickly there will be any improvement in those areas. Foreign reserve levels are depleting, they are unlikely to bounce back any time soon and that is despite 10 years of surplus."

A downturn in oil revenues has been compounded by a flight from emerging markets by international investors more recently, as Iraqi authorities have sought to raise capital on public debt markets.

"They tried to go to bond market but their timing was a bit off because at the time rates for emerging markets were starting to go up," says Sherif Salem, portfolio manager at Invest AD. "Many other countries at the time had to find another way, as the rates they were expecting to pay were a lot higher than they had envisioned."

Pay off in the long-term?

The precarious state of the Iraqi economy has impacted on local stocks too. With investors cautious about committing capital to the country, the Iraq stock exchange (ISX) has seen lower volumes and increased volatility recently.

"We've been in the Iraqi market since 2010, up until 2013 we had been averaging mid single digit returns for the fund," says Invest AD's Salem.

"But then, with the deterioration in the geopolitical situation, 2014 and 2015 the market has been declining. Up until the end of September we were down 12.7%."

Salem says it has had to make changes to the fund's portfolio, cutting back risk exposure in the fund and moving more money into cash, despite remaining bullish about some of its holdings.

"The investors on the ISX have seen a continued frail stock market environment where corporate earnings appear to have hit bottom but growth remains scarce," says Henrik Kahm, investment analyst at Stockholm-based FMG and manager of the FMG Iraq Fund. "There is a general shortage of liquidity in the country, leading to lower volumes and amplified volatility on the ISX."

Invest AD's Salem agrees: "Stocks have become more volatile as they tend to move on very little volume.

"We get days where stocks are up 7-8% and a few days later are 7-8% down; the volatility has increased due to the lack of liquidity because there hasn't been the same level of interest from foreign buyers and local sellers are a bit less patient to sell."

Huge potential

Despite the knock-on effects on listed stocks in Iraq from the significant challenges facing the economy, there are reasons for optimism in the coming months and years ahead.

"We expect to see a continued gradual improvement in earnings from the listed companies, supporting the stock market and staging a recovery. The banks and consumer stocks look very attractive," says Kahm. "Several of FMG Iraq Fund´s core holdings in the banking sector have reported stronger earnings but despite the improvement they are still trading near their shares price lows."

"In the consumer segment, telecoms are still struggling with operations but for the long-term investor, there is value to be found in the sector."

"On a micro level, for an outsider looking in, it would come as surprise that there are companies making profits and some improving in terms of operations," says Invest AD's Salem adds.

"Our outlook is that it is sort of a macro story and given what the country has been through over the past 10 years, the lack of a lot of things - such as infrastructure, supply of basic needs - would make a lot of things that we're invested in have huge potential."

Salem says Iraq shares many similarities with other countries in the Mena region, which have made long-term investment in Gulf countries seem attractive.

Indeed, despite the many challenges the country currently faces, Iraq has been a destination for foreign direct investment (FDI) inflows in recent years, as international investors have sought to gain access to its oil sector. Data from the United Nations Conference on Trade and Development reveal gross FDI inflows reached $4.8bn in 2014, down on the $5.1bn recorded in 2013 but still among the highest in the region.

"If you look at Iraq positioning itself as somewhere that is still open for business," explains Lux.

"The National Investment Commission chairman highlighted recently there are at least 900 projects available for joint venture or foreign investment.

"Ranging from oil and natural gas development and mining and moving to other areas such as housing, infrastructure, agriculture, manufacturing, transportation and financial services.

"The commission that in the near term it ought to build 400,000 homes and anticipate needing 3 million homes over next 10 years. But there are huge issues."

The outlook for Iraq's Kurdish region also provides an additional avenue for investors. Overseen by the Kurdish Regional Government, the region has been a broadly stable part of Iraq and made moves towards greater autonomy from Baghdad.

"In the Kurdish region, it's a bit more optimistic," says JLT's Lux. "There is some progress in telecommunications, retail and the oil sector.

"Over the next 10 years, we are likely to see increasing levels of political autonomy, which will enhance the Kurdish region's ability to export oil independently of Baghdad.

"The Kurdish region has a much more favourable environment for investment and a higher growth rate, but I would caveat that by saying IS is at its borders and any high profile attack will significantly impact business confidence," adds Lux.

Yet, while there may be some bright spots for investors considering Iraq, the opportunity has changed significantly in the intervening years since the restoration of democracy.

"There is widespread corruption, no real likelihood of reform of the economy and the ongoing war against IS: we're not really going to see any improvement in the banking sector which will significantly hinder FDI and impact investor confidence," says Lux.

"Furthermore trade between Iraq, Syria and Jordan, which was non-oil related will be subdued in 2016."

"When we started, the view on Iraq was that it was a risky investment but one that could pay off in a big way in the long term. But the level of risk that is perceived has grown a lot since [more recent] developments in Iraq," adds Salem.

© MENA Fund Manager 2015