PHOTO

Dubai, 13 April 2015 - JLL, the world's leading real estate investment and advisory firm, today has released its first quarter (Q1 2015) Dubai Real Estate Market Overview report that assesses the latest trends in the office, residential, retail and hotel sectors.

Craig Plumb, Head of Research at JLL MENA, commented: "The Dubai real estate market continued to experience subdued activity during the first quarter of the year. Residential sale prices saw a marginal decline across both apartments and villas, although rents remained relatively flat. We expect this trend to continue with average sale prices declining by up to 10% during 2015. Sale prices normally move ahead of rents and this appears to be happening in the residential market in Dubai at present. While this is resulting in increased rental yields, this is likely to be a temporary factor with more attractive yields eventually increasing demand and therefore sale prices again. Middle income end-users have assumed an increasingly important role in Dubai's residential market of late, with a number of initiatives underway from both developers and the government that target the affordable housing sector including the launch of two phases of Nshama's Town Square project near the Arabian Ranches and a proposal by the Dubai Municipality to introduce mandatory affordable housing quotas."

He continued: "We anticipate the commercial sector will see a significant increase in supply during the next couple of years, particularly of Grade A office space. Reflecting confidence in the market, the DIFC has announced an AED 200 million expansion plan which will include completing Building 11 of Gate Village in 2017, and ICD Brookfield's USD 1 billion development in DIFC is scheduled to be delivered in 2018. The retail market continues to be constrained by the decrease in spending, restricting overall growth levels. We expect performance of the retail market to remain stagnant throughout 2015, following estimates of a slowdown in retail sales growth figures. The latter is likely to put pressure on retailers and push out some of the small and mid-sized tenants, as they face difficulty achieving targets to meet high rents."

Chiheb Ben Mahmoud, Head of Hospitality at JLL MENA, added: "The hotel sector continued to face competition in the first quarter of the year. The increase in supply on one hand and the perceived softness of the inbound travel market on the other are leading some hotels to review their pricing and revenue management strategies. While occupancy rates remain healthy at 86% and above the MENA average, RevPARs declined 11% to USD 234 over Q1 2014. Visitor trends in the tourism market are changing with the stronger U.S. dollar, which is a detractor for Russian and Eurozone tourists, and evolving consumer habits in emerging markets, which is resulting in higher guests from South Asia, Far East Asia and Africa."

SECTOR SUMMARY HIGHLIGHTS - DUBAI:

Office: Dubai's office market remained relatively stable over the first quarter, with average rents across the commercial business district registering AED 1,880 per sq m and vacancies reaching 23%. Demand for Grade A quality stock continues to be robust, particularly in the DIFC and its surrounding precinct (e.g. Daman Tower), as evident by the rate of leasing activity. In turn, demand for Grade B office space remains weak, exerting downward pressure on asking rents. The first quarter saw the handover of Central Park in DIFC, adding approximately 130,000 sq m of office space and bringing the total gross leasing available (GLA) to 7.7 million sq m as of Q1 2015. In addition to the handover of Central Park, an additional 900,000 sq m of office GLA is expected to enter the market over the next nine months.

Residential: Q1 saw the delivery of approximately 730 residential units across Dubai. An additional 22,000 units are expected to enter the market by the end of 2015, however the delivery of some of the projects may not occur within the specified timeframe. While Dubai's rental market has maintained its overall stability during the first quarter, the REIDIN sales index depicts a marginal decline in prices across both apartments and villas, which comes as the REIDIN rental index shows growth levels dropping to 8% Y-o-Y in February 2015 (from 23% Y-o-Y in Q1 2014). Similarly, the REIDIN sale price index shows a decline in growth levels from 30% to 6% over the same period. This downward trend is expected to continue throughout 2015, as JLL expects prices to drop up to 10% by year end.

Retail: Dubai's retail market remained largely stable during Q1. Despite recording strong annual growth levels, average retail rents registered no quarterly increases. Similarly, vacancy levels remained at 8%, as no major deliveries occurred, except for the handover of 'Box Park' by Meraas, adding almost 5,000 sq m of GLA. The subdued nature of the retail market comes as the industry copes with a drop in the number of visitors from Russia, while the weak euro threatens visitors from the Eurozone. Despite the subdued nature of the retail market, Dubai's Shopping Festival (DSF) 2015 had a major impact on Dubai's retail market. According to statistics issued by Visa, visitors from Saudi Arabia emerged as the top spenders, contributing USD 35 million to the UAE's economy, and representing a 29% Y-o-Y increase.

Hotels: The hotel sector continued to face downward pressure in the first quarter of the year. While occupancy rates only dipped marginally (2% Y-o-Y), average daily rates (ADRs) saw a 9% decrease to USD 272 in the first two months of 2015. JLL anticipates ADR's may soften further in response to the additional 3,600 keys scheduled for delivery over the next nine months. Although Dubai's hotel market welcomed 11.6 million guests in 2014, according to figures released by the Dubai Tourism & Commerce Marketing, the rate of growth declined from the 11% registered in 2013. The decline in tourists from Russia and the Eurozone has been offset by the significant increase in tourist numbers from emerging markets with South Asia, Far East Asia and Africa increasing by 14%, 13% and 11%, respectively.

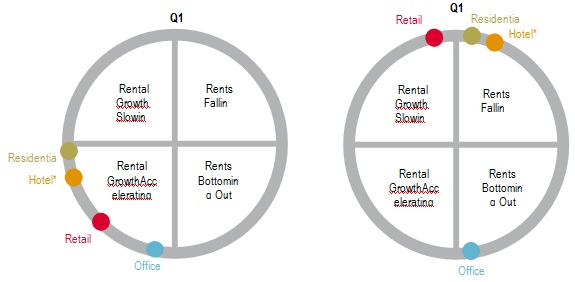

Dubai prime rental clock

This diagram illustrates where JLL estimates each prime market is within its individual rental cycle at the end of the relevant quarter.

*Hotel clock reflects the movement of RevPAR.

Source: JLL

-Ends-

Contact:

Craig Plumb / Kathryn Athreya

Erica Pettit / Vadia Rai

Phone:+971 4 426 6999

+971 4 437 2105 / +971 4 437 2110

Email:craig.plumb@eu.jll.com / kathryn.athreya@eu.jll.com

erica.pettit@fticonsulting.com /vadia.rai@fticonsulting.com

Ref:JLL_Dubai Q1 2015

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. With annual fee revenue of $4.7 billion and gross revenue of $5.4 billion, JLL has more than 230 corporate offices, operates in 80 countries and has a global workforce of approximately 58,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.4 billion square feet, or 316 million square meters, and completed $118 billion in sales, acquisitions and finance transactions in 2014. Its investment management business, LaSalle Investment Management, has $53.6 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.

About JLL MENA

Across the Middle East, North and Sub-Saharan Africa, JLL is a leading player in the real estate market and hospitality services market. The firm has worked in 40 Middle Eastern and African countries and has advised clients on more than US$ 1 trillion worth of real estate, hospitality and infrastructure developments. JLL employs over 200 internationally qualified professionals embracing 30 different nationalities across its offices in Dubai, Abu Dhabi, Riyadh, Jeddah and Cairo. Combined with the neighbouring offices in Casablanca, Istanbul and Johannesburg, the firm employs more than 550 professionals and provides comprehensive services in the wider Middle East and African (MEA) region. For information, please visit our website: www.jll-mena.com

Emaar Square Bldg 1 Office 403 Sheikh Zayed Road │ PO Box 214029 Dubai UAE tel +971 4 426 6999 fax +971 4 365 3260

© Press Release 2015