PHOTO

Recent reforms introduced in Saudi Arabia to attract more investment will help to drive long-term growth in the kingdom, but Saudi nationals and expat residents are likely to face short-term pain in terms of higher costs, according to Jeddah-based asset manager Alkhabeer Capital.

The firm said in a report published on Thursday that economic reforms which have taken place over the past 12 months, including the introduction of value-added tax (VAT) and the curtailing of subsidies on fuel and electricity, will drive inflation in the kingdom to 5.2 percent this year, which is higher than the International Monetary Fund's 5 percent forecast set out in January this year, but lower than the Saudi government's 5.7 percent prediction.

The firm warned that a sharp increase in prices "could adversely affect the purchasing power of people, forcing many low-to-middle-income households to tighten their purse strings".

It said that small businesses, in particular, face short-term challenges as a result of cost increases they are unable to pass on to customers, and at the same time are facing higher costs as a Saudisation drive leads to more levies being imposed on expatriate workers. The new levies are forcing many foreign workers to send families home, which could lead to a rise in remittances and less spending within Saudi Arabia.

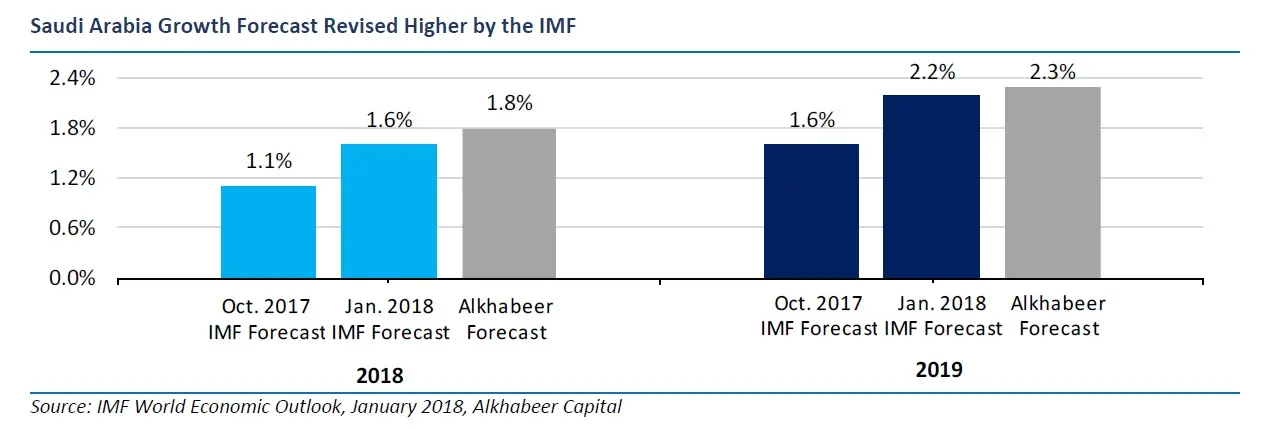

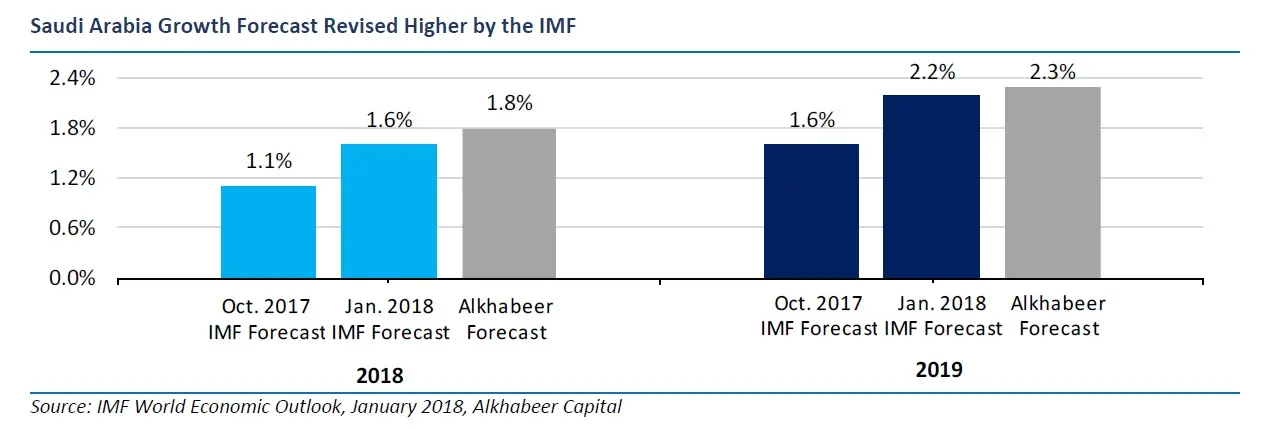

Despite this, the firm's report predicts gross domestic product (GDP) growth of 1.8 percent in the kingdom this year, which is higher than the IMF's 1.6 percent forecast in January (revised last week to 1.7 percent), and growth of 2.3 percent (revised IMF forecast: 1.9 percent) for 2019. The Saudi government's forecast is for growth of 2.7 percent this year, on the back of a 3.7 percent increase in non-oil GDP.

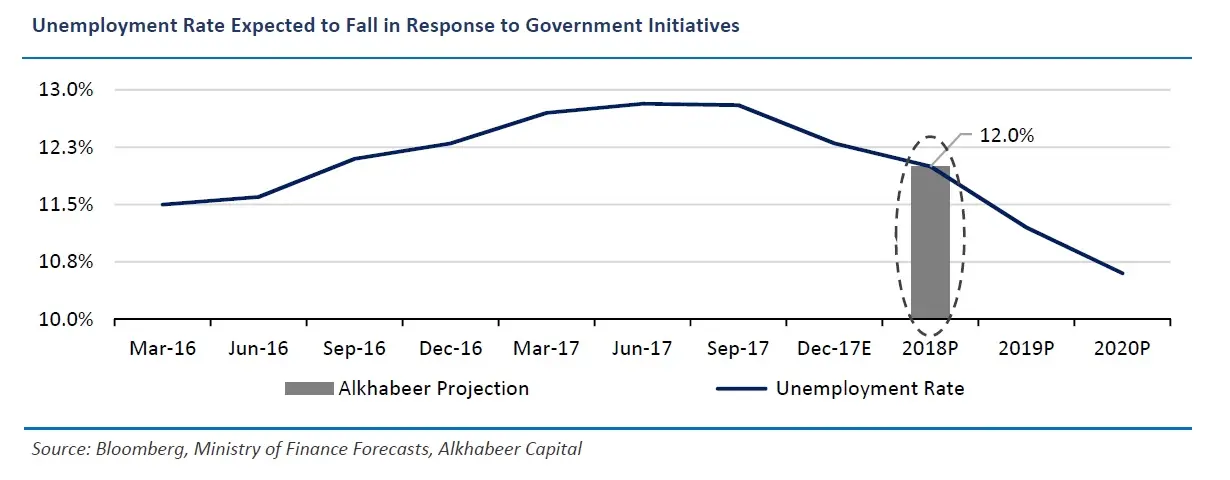

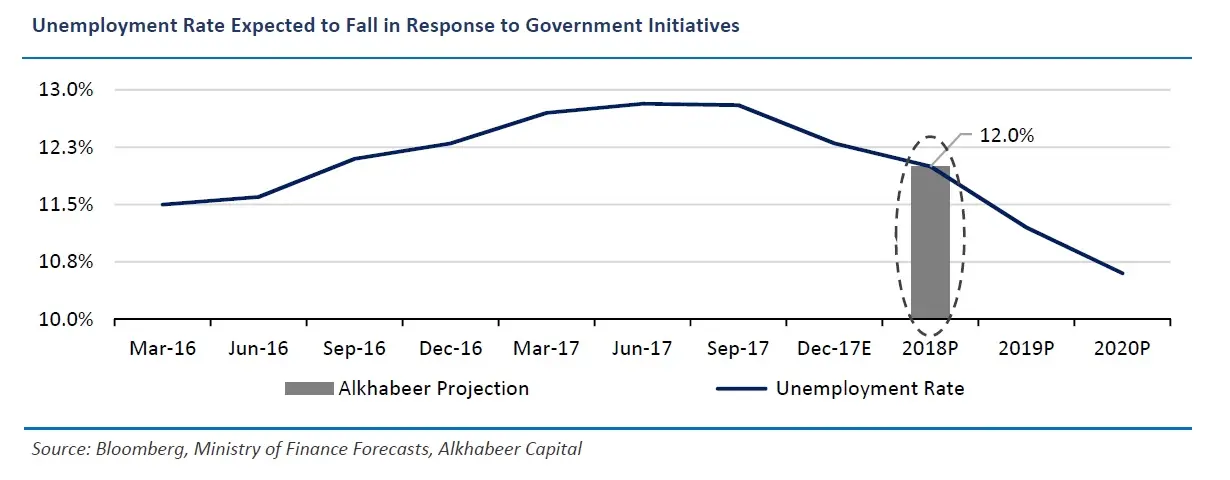

Alkhabeer Capital's report also said that reforms are having an impact on unemployment rates among Saudi nationals. It predicted that the unemployment rate is likely to fall to 12 percent this year, and to continue to decline to below 10.8 percent within the next two years.

In an emailed response to questions from Zawya, Alkhabeer Capital's CEO, Ahmed Saud Ghouth, said that employment rates are likely to increase because of growth in the non-oil sector, the extension of the kingdom's nationalisation programme, the employment of only locals in certain sectors and the expected increase in job creation in the burgeoning tourism and entertainment industries.

The company, which specialises in alternative asset investment, also pointed to capital market reforms as driving investment.

It argued that the anti-corruption drive launched late last year, which saw many prominent businesspeople and public figures placed under custody at the Ritz Carlton Hotel in Riyadh, would "go a long way in boosting investor confidence and further draw foreign investors to its shores", adding that the potential inclusion of Saudi Arabia's stock market into index compiler MSCI's emerging markets portfolio could lead to an inflow of of 140 billion Saudi riyals worth of funds

Ghouth said in response to Zawya's questions that the government "seems to be keen in changing the international perception about Saudi Arabia and success in the anti-corruption drive will encourage the government to initiate more steps towards social reforms and transparency".

"This is an important factor for international investors and fund managers while investing in a country and will go a long way in boosting confidence among foreign investors," he said in the emailed response to Zawya.

Alkhabeer Capital said that following Saudi Aramco's IPO, MSCI and FTSE Russell could re-weight indexes to account for the listing, bringing the total inflow of capitial to 250 billion riyals.

It also argued that the development of the NOMU parallel market had made it easier for foreign investors to participate in Saudi Arabia's capital markets, and would also, over time, provide an exit route for private equity investments, which it expects to increase in the kingdom.

It cites the Public Investment Fund's role in investing in major global funds run by Blackstone and Softbank, as well as its creation of specialist investment companies to invest in areas such as entertainment as a catalyst for the sector. It also said that "KKR, Citigroup, Goldman Sachs and Credit Suisse are among a growing band of western investment banks and private equity firms expanding in the Kingdom", the report said.

Shakeel Sarwar, head of equities asset management at Bahrain-based investment bank SICO, said on Sunday that although investment flows from passive funds will only start from March 2019 when the Saudi market becomes part of FTSE Russell's Secondary Emerging Market Index, active funds have already begun benchmarking the Tadawul index.

He said in a press release that inflow from active funds into Saudi Arabia could reach $15-$30 billion, with $2.5 billion already being allocated so far this year as the index has increased in value by 15 percent.

“We expect an approximately 25 percent market return in 2018 and 2019," Sarwar said.

Finally, Alkhabeer Capital argued that government intervention in the real estate sector - introducing the white land tax, partnering with the private sector to provide 59 billion worth of housing finance and a drive to encourage the development of more affordable homes - could help to spur home ownership levels from 50-60 percent in 2020 to 70 percent by 2030.

However, it warned that an expected decline in the expatriate population following the introduction of new levies could lead to downward pressure on both rents and occupancy levels in the short-term.

Further reading:

- Crackdown concern: Saudi corruption purge could lead to greater investor caution - report

- Saudi 2020 and the plan to attract tourists - will it work?

- The missing million: Saudi women face grim realities in jobs market

- Saudi ministry urged to cancel expat levy

- Index inclusion promises Saudi a pre-Aramco bump

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018