PHOTO

There are more than 1,000 funds domiciled in the Middle East and North Africa region, with Saudi Arabia accounting to close to 250 funds.

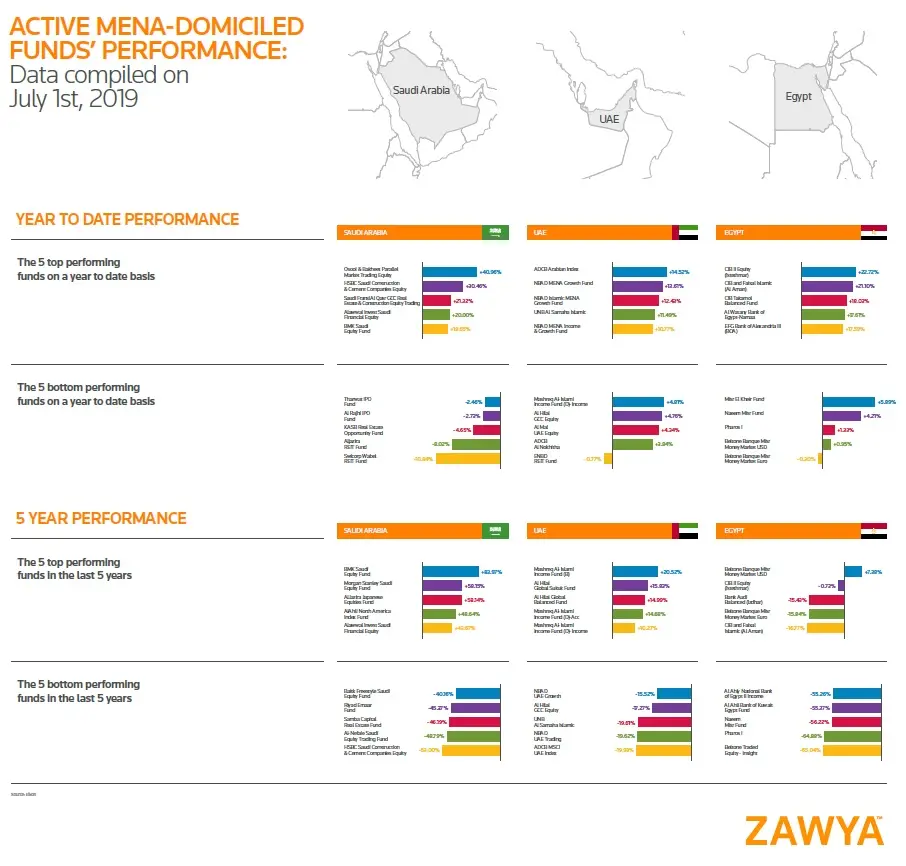

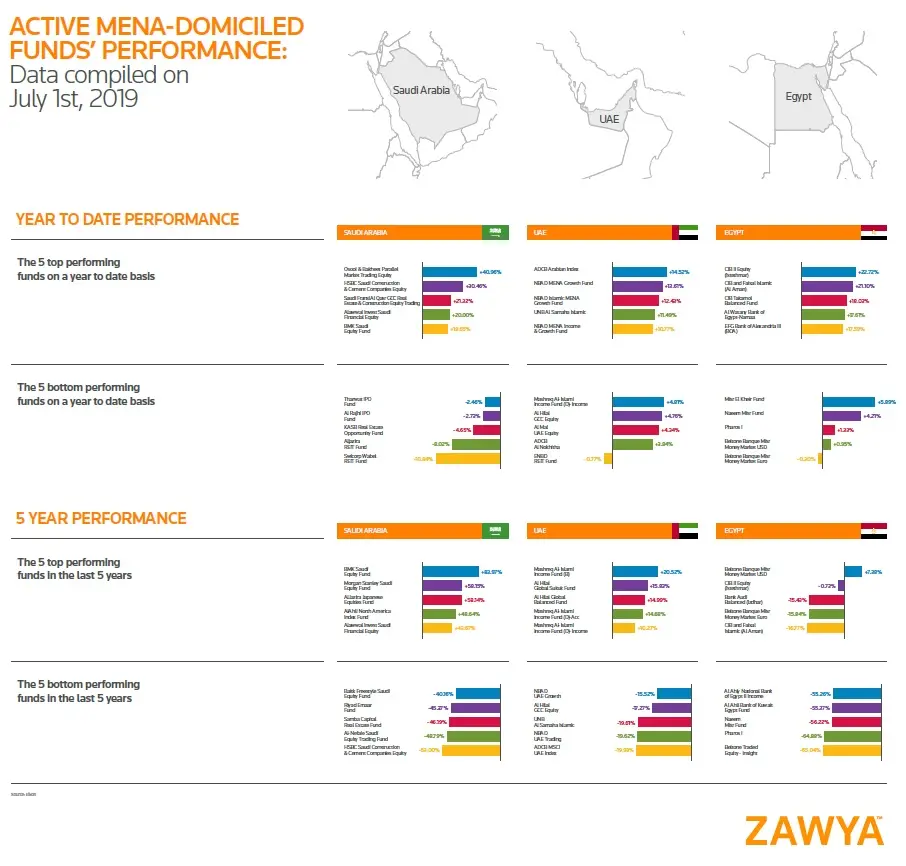

Zawya has compiled data on the best and worst performing funds in the UAE, Saudi Arabia and Egypt in the first half of 2019 and the past five years.

Click on the image above to open a high-resolution PDF version in a new tab.

Sharing his views on MENA funds, Raghu Mandagolathur, head of research at Kuwait Financial Centre (Markaz) told Zawya: “Assets managed under funds that are domiciled in Saudi Arabia alone account for 80.8% of the total assets under management (AUM) in GCC region, followed by Kuwait with 13.6%.”

According to Mandagolathur, the inclusion into the MSCI emerging market indices “is likely to result in large inflow of funds particularly by passive investors. The major inflows will be directed towards Saudi Arabia and Kuwait. The total AUM of funds domiciled in GCC countries has increased by 14.8% as of July 2019 to USD 35.8bn compared to Oct-2018 levels,” he added.

“There has been an addition of 12 new mutual funds since Nov-2018, out of which 11 were in Saudi Arabia and one in Kuwait. The total AUM of these mutual funds as of June-2019 was over USD 58mn. The major growth in AUM however came from the increase in investments through the existing funds,” Mandagolathur said.

“In percentage terms, the global mutual fund AUM to world’s GDP is over 15%, while in GCC the total mutual fund AUM to its GDP is less than 2%,” he ended.

(Writing by Gerard Aoun, editing by Seban Scaria)

(Gerard.aoun@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019