PHOTO

Capital markets are off to a strong start in 2018, matching the optimism found in our recent Deal Makers Sentiment Survey. Matthew Toole, Director, Deals Intelligence, Thomson Reuters, recently spoke with IFR (International Financing Review) Assistant Editors Anthony Hughes and Davide Scigliuzzo about developments so far this year.

- Equity capital markets continue to do well in 2018, with technology seen as one of the most attractive IPO sectors.

- In U.S. leverage, the proportion of high yield issuance to loans is the lowest since the global financial crisis, with the latter driven by appetite for floating rate instruments.

- The capital markets performance is in line with the Thomson Reuters Deal Makers Sentiment Survey, which showed broad optimism about M&A prospects in 2018.

Looking back in 2017

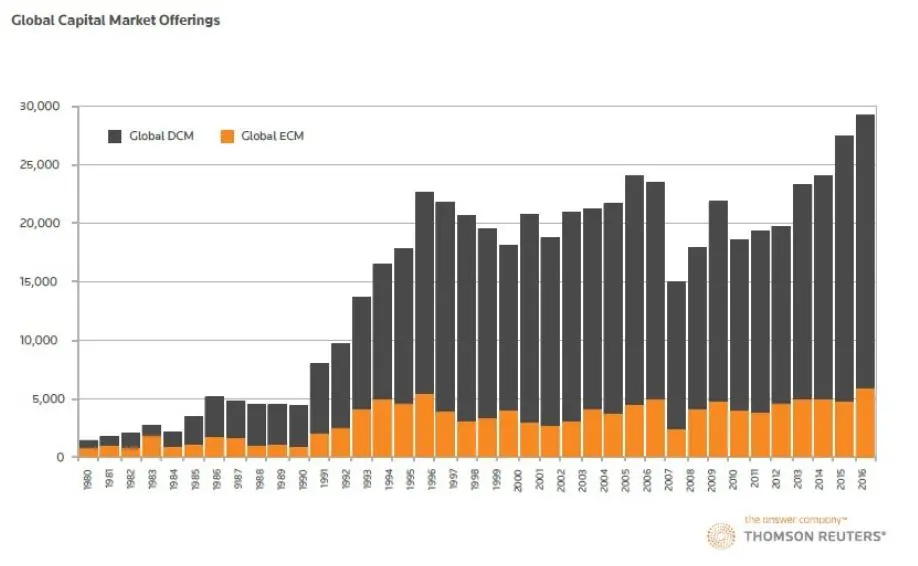

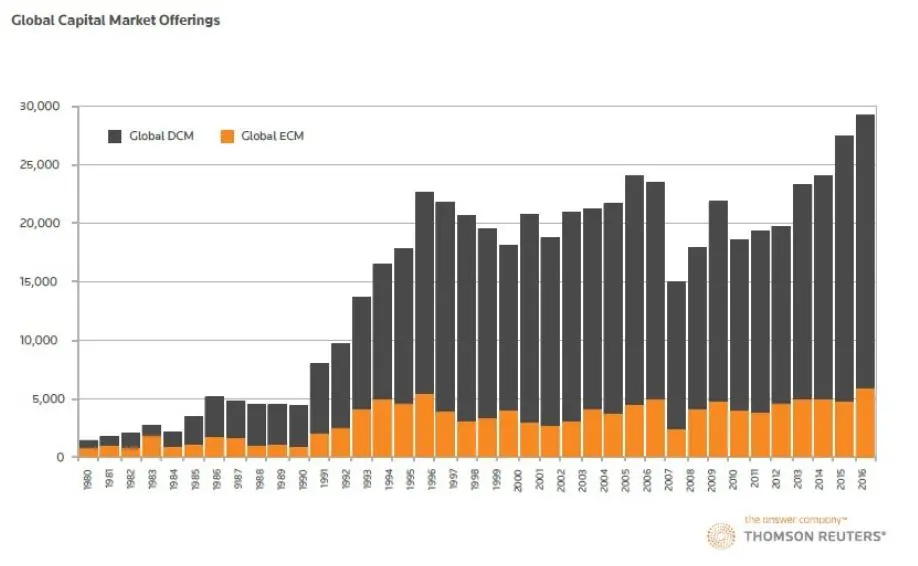

Global capital markets were robust across all the main products in 2017 (M&A, debt capital markets, equity capital markets and syndicated loans), as measured by investment banking fees, which hit an all-time record of more than US$1 billion.

Around three-quarters of investment banking fees were from capital market activity, with last year seeing strong levels of M&A and a resurgence in global IPOs, as well as a recovery in high yield.

The Americas, driven by the U.S., continue to be the major contributor to fees, with Europe and Asia coming close to parity in recent years. This follows an increase in capital market activity from Chinese companies in both debt and equity issuance, as well as a surge in outbound M&A activity since 2016. As a result, Asia-Pacific investment banking fees are now rivaling Europe for the first time.