PHOTO

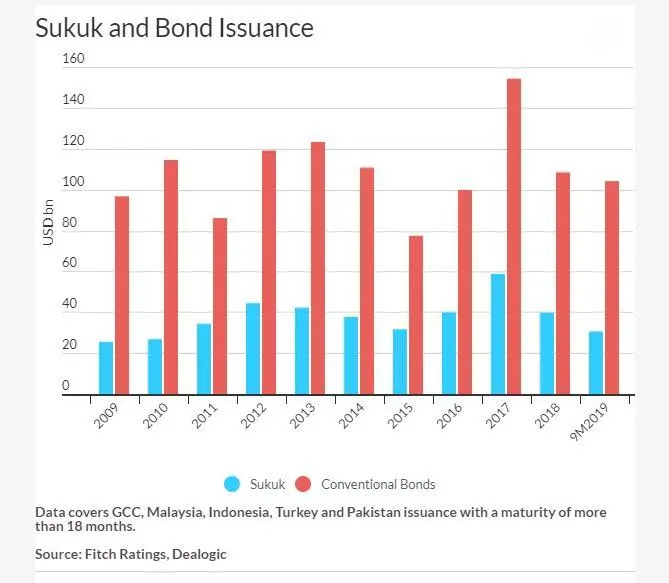

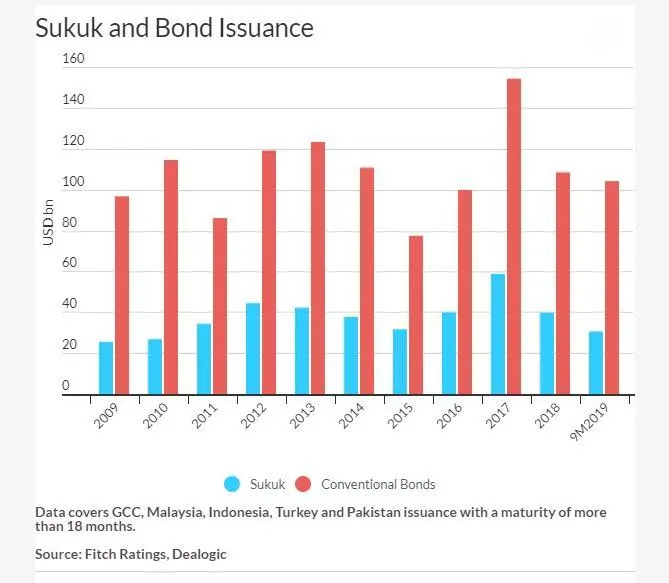

International sukuk issuance from major Islamic finance markets was mainly unchanged in the first nine months of 2019 compared to the same period last year, Fitch Ratings said.

According to the ratings agency, sukuk issuance with a maturity of more than 18 months from the GCC, Malaysia, Indonesia, Turkey and Pakistan totaled $30.6 billion for the period compared to $31.0 billion for the first nine months of 2018.

US dollar issuances from Turkey, Indonesia, Islamic Development Bank Trust Services Limited and First Abu Dhabi Bank alone raised a total of $6.5 billion.

“Moreover, these figures do not capture the recent growth in domestic local-currency issuance, such as Saudi Arabia's riyal-denominated local issuance programme,” Fitch noted.

Saudi Arabia raised 8.834 billion Saudi riyals ($2.36 billion) in September through a local currency-denominated sukuk.

According to Fitch, beyond the GCC, Malaysia has remained the key source of sukuk supply in 2019.

The agency noted that full-year 2019 volumes might be highly influenced by the funding needs and strategies of large individual borrowers, which may come to the market before year-end, and by geopolitical developments.

“GCC debt markets are still relatively developing, and individual sovereign funding decisions can profoundly affect total supply,” Fitch said.

“For example, the Saudi Debt Management Office said earlier this year that it plans a new benchmark international Islamic bond issuance as part of its plans to diversify the financing of its national budget deficit, which could boost the 2019 total if executed before year-end,” it added.

(Reporting by Gerard Aoun; editing by Seban Scaria)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019