PHOTO

Mergers & Acquisitions (M&A) that had any MENA involvement totaled $109.1 billion throughout 2021, a 57 percent increase from last year and the third year where any MENA involvement M&A volumes surpassed $100 billion, according to newly released Refinitiv data.

A total of 1,141 deals was recorded in 2021, a 40 percent increase from 2020 and the highest annual total since records began in 1980.

M&A involving a MENA target reached $72.9 billion, making it the second-highest total since records began in 1980 and the strongest year of the number of deals with 863 deals in 2021.

Inbound M&A reached record levels with $45.4 billion of M&A activity in 2021, up 88 percent and the highest level since records began in 1980, according to Refinitiv data.

On the other hand, outbound M&A totaled $30.2 billion in 2021, up 198 percent from 2020 and a six-year high. The largest M&A deal in the MENA region of 2021 was Aramco Gas Pipelines Co in a deal worth $15.5 billion lease and leaseback agreement for its gas pipeline network.

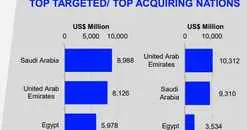

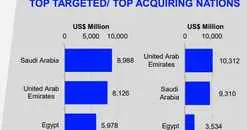

Saudi Arabia was the most targeted nation with $27.3 billion in M&A activity, equivalent to half of target M&A recorded in the region.

Energy and Power was the most active sector with $38.8 billion in deal activity, representing a 189 percent increase from last year.

In terms of bank participation, JP Morgan topped the M&A league table with any MENA involvement in 2021 with $43.3 billion in related activity or a 40 percent share of the market.

Goldman Sachs came second with a 37 percent share of the market, Refinitiv data showed.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2022