PHOTO

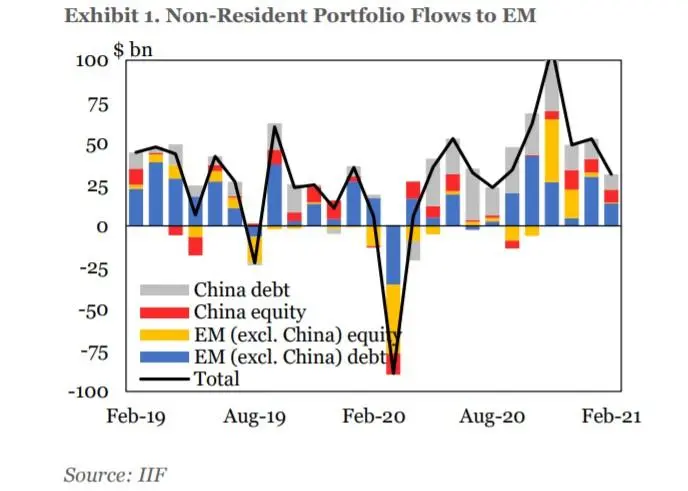

Emerging market (EM) securities attracted around $31.2 billion in February 2021 thanks to the progress in rolling out vaccinations and higher commodity prices, the Institute of International Finance (IIF) said in a new report.

"Nevertheless, rising US rates increase the risk of a taper-tantrum-like episode, which could be detrimental to EM flows, as data for the last week of February has shown," Jonathan Fortun, Economist at IIF said.

Inflows to emerging market equities hit $8.4 billion in February and debt instruments attracted $22.8 billion.

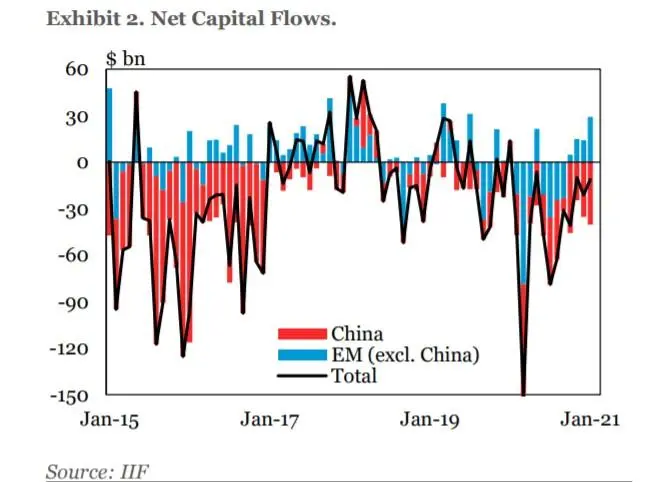

The awakening fears of a reflationary cycle in the US, combined with the asset market rotation have capped the scale of capital inflows to EM and increased downside risk. Some positive support remains, stemming from increasing commodity prices, and constructive BoP dynamics, IFF said in the report.

Despite the recovery in equity flows (x/China) in the last portion of 2020 (with record-breaking combined inflows of $55 billion in November and December), the beginning of 2021 has seen a scaling back in EM equity flows, only $3 billion in inflows during January and February ($0.6bn in February).

However, EM debt saw a strong influx, totaling around $43.2 bn in the first two months of 2021.

"During February, China assets have supported the overall dynamic, our tracker shows an inflow of $9.3 billion to fixed income and $7.8 billion to equities," Fortun said.

IFF witnessed inflows across all regions. EM Asia saw inflows to both debt ($10 billion) and equity ($6.8 billion) Latin America saw the same trend (inflows of $1.2 billion and $7.1 billion for equity and debt respectively). EM Europe and Africa/Middle East accounted for $6.1 billion of inflows.

(Reporting by Seban Scaria; editing by Daniel Luiz)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021