PHOTO

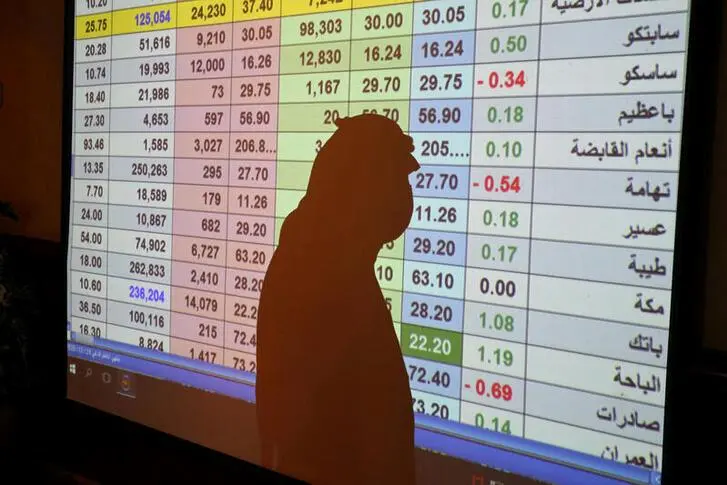

Most major stock markets in the Gulf fell in early trade on Monday, with the Saudi index leading the losses a day after its biggest one-day fall in over a year following drone attacks.

Yemen's Iranian-aligned Houthi movement said on Saturday it had fired 14 drones at several Saudi Arabian cities, including at Saudi Aramco facilities in Jeddah.

Saudi Arabia's benchmark index dropped 1.3%, dragged down by a 1.4% fall in Al Rajhi Bank and a 1.6% decline in the kingdom's largest lender, First Abu Dhabi Bank.

The Saudi-led coalition fighting the Houthi movement said it had detected indications of an imminent danger to navigation and global trade south of the Red Sea, Saudi state media reported early on Monday.

Among other losers, Aramco was down 1%.

The oil giant was also under pressure after India's Reliance Industries Ltd said on Friday it had decided with Aramco to reevaluate Aramco's proposed roughly $15 billion investment in Reliance's oil-to-chemicals (O2C) business.

However, Nayifat Finance Company, a consumer-focused Islamic finance firm, was at 36 riyals per share, 5.7% above its initial public offering price of 34 riyals.

Dubai's main share index slid 1.2%, hit by a 2.7% fall in blue-chip developer Emaar Properties and a 1.5% decrease in sharia-compliant lender Dubai Islamic Bank.

The Qatari index retreated 0.7%, as almost all the stocks on the index were in negative territory, including petrochemical firm Industries Qatar.

Oil prices, a catalyst for the Gulf's financial markets, came off seven-week lows but remained under pressure after Japan said it was weighing releasing oil reserves and as the COVID-19 situation in Europe worsened, raising concerns about both oversupply and weak demand.

(Reporting by Ateeq Shariff in Bengaluru; Editing by Kevin Liffey) ((AteeqUr.Shariff@thomsonreuters.com; +918061822788;))