PHOTO

The value of merger and acquisition deals with a Middle Eastern and North African involvement hit an eight-year high of $33.9 billion in the second quarter of 2018, a year-on-year increase of 74 percent, according to new data from Thomson Reuters.

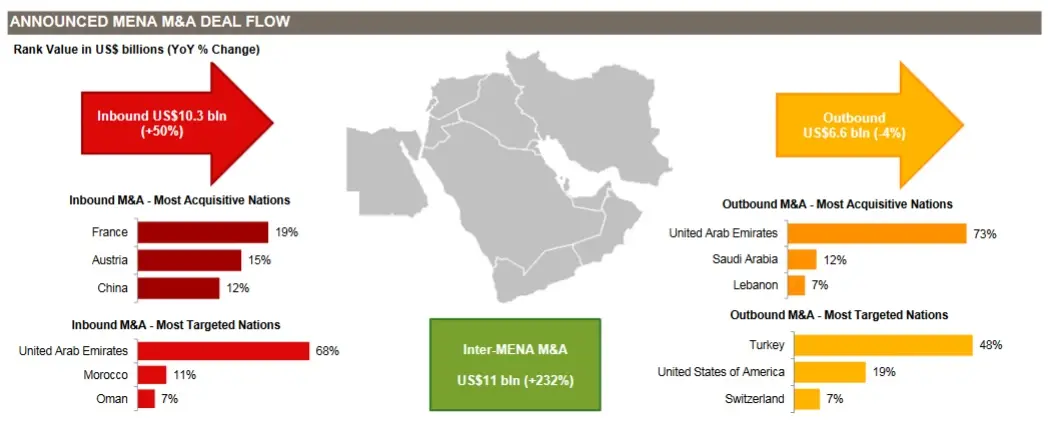

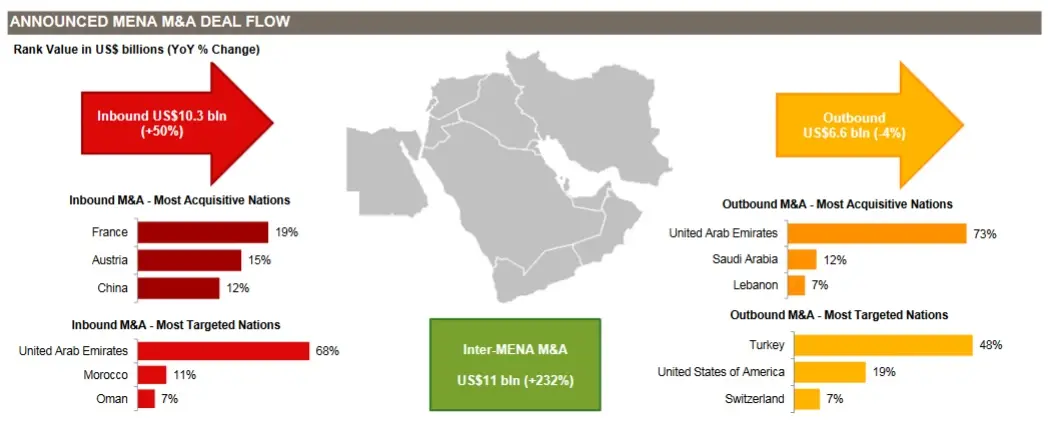

Deals involving a regional company as the target increased by 110 percent year-on-year to $21.3 billion, but deals with regional entities as the acquirer dropped by 4 percent year-on-year to $6.6 billion, a report issued on Tuesday stated.

Inter-MENA deals, however, hit a five-year high of $11.1 billion, up 232 percent. This was driven partly by the $5 billion merger between Saudi British Bank and Alawwal Bank - a deal that creates the kingdom's third-biggest bank.

Both equity and debt capital markets remained fairly buoyant, with fundraising via equity capital markets standing at $3 billion for the first six months of 2018 - up 68 percent year-on-year.

Debt capital markets also remained buoyant, albeit 2 percent lower than the corresponding period last year. Some $59.4 billion worth of debt has been issued during the period, with 28.5 percent of that being raised by Qatar institutions, including an $11.97 billion sovereign issue in April.

The buoyant Middle East market in part reflects global trends. At the end of June, Thomson Reuters Deal Intelligence stated that $2.5 trillion worth of M&A deals had been completed worldwide in the first half of the year - the highest amount since records began in the 1980s, and a 64 percent increase on the same period last year.

However, there are also local drivers. Ossama Kayed, a partner and head of capital markets for KPMG Lower Gulf, said that part of the reason for improved M&A conditions regionally was the recovery in oil prices.

"In 2015, things slowed down and now all of the transactions that were put on hold are seeing movement because this (higher oil prices) is the new norm and the new reality," he told Zawya in a telephone interview on Tuesday evening.

"I'm buoyant for at least the remaining part of 2018 and if this carries on I see no reason that next year also won't be as good."

Zubin Chiba, M&A partner at PwC said that inbound investment was mainly being driven into the region's three biggest markets - Saudi Arabia, the United Arab Emirates and Egypt.

"We view that as a trend that will continue," he told Zawya in a phone interview on Tuesday, adding that investors were attracted to these because they offered either stability or transformative, high-growth prospects.

He added that a loosening of ownership restrictions in the region allowing for outright ownership of businesses in certain sectors or markets was also driving interest.

"M&A continues to be a viable option for entities looking to grow inorganically in the region," Chiba said. "We believe that transactions are still very much executable based on a level of realism between acquirers and vendors."

Zawya is part of the Financial & Risk business of Thomson Reuters.

(Reporting by Michael Fahy; Editing by Shane McGinley)

(michael.fahy@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018