PHOTO

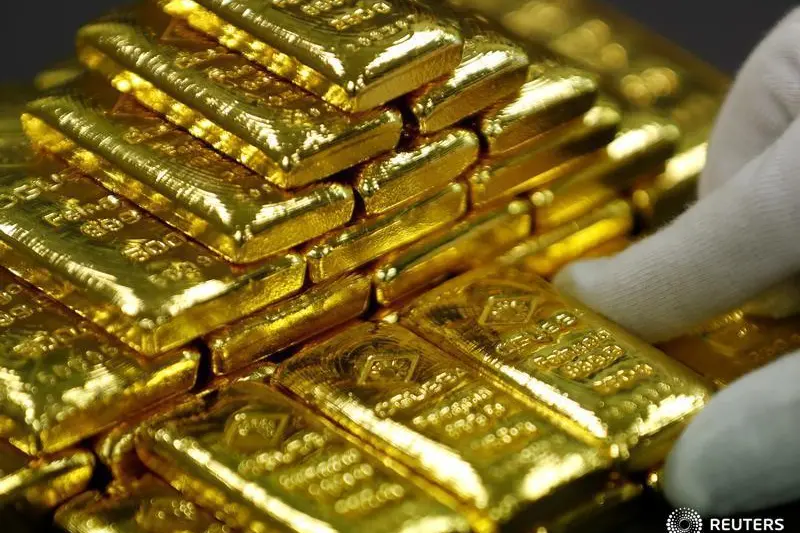

Gold jumped on Friday, poised for its sixth consecutive weekly gain, as a record-breaking rise in coronavirus infections in the United States fueled uncertainly about an economic recovery, while a weaker greenback also added support.

Spot gold rose 0.7% to $1,809.86 per ounce at 11:25 a.m. EDT (1525 GMT) and has gained 0.6% so far this week. U.S. gold futures were up 0.7% at $1,811.90 per ounce.

"Negative real interest rates, ballooning central bank balance sheets, weaker U.S. dollar and still-rising COVID-19 cases are enhancing the safe-haven appeal of the yellow metal," said ANZ commodity strategist Soni Kumari.

"Now, escalating tension between the U.S. and China is another tailwind for the market."

The United States shattered its daily record for coronavirus infections, prompting some states to impose partial lockdowns, while the number of global cases crossed 13.89 million.

Further heightening political tensions, the United States was considering banning travel to the country by all members of the Chinese Communist Party, a person familiar with the matter said on Thursday.

The dollar index eased 0.3% against its rivals.

A sharp rise in stimulus packages globally to shield economies from the fallout of the coronavirus pandemic has driven safe-haven gold prices 19.3% higher so far this year.

While a v-shaped recovery seemed possible, the recovery might now be slower, adding to gold's support due to additional commitments from central banks to add liquidity and add stimulus, said Bart Melek, head of commodity strategies at TD Securities.

U.S. lawmakers return to Washington on Monday to discuss potential new coronavirus aid programs, while investors also eyed a meeting of EU leaders in Brussels about a proposed stimulus to kick-start their COVID-hit economies.

Elsewhere, palladium rose 1.75 % to $2,031.37 per ounce, while platinum rose 1.3% to $834.91 per ounce.

Silver rose 0.8% to $19.32 per ounce and was headed for a sixth straight weekly rise.

(Reporting by Nakul Iyer in Bengaluru; additional reporting by Eileen Soreng and K. Sathya Narayanan; editing by Jonathan Oatis) ((eileen.soreng@thomsonreuters.com; Within U.S. +1 646 223 8780, Outside U.S. +91 80 6749 6131; Reuters Messaging: eileen.soreng.thomsonreuters.com@reuters.net))